“This report analyzes various approaches for modifying the definition of an accredited investor. I encourage investors, companies and other market participants to provide comments as public input will be very valuable as the Commission considers the definition.”

The SEC staff submitted their recommendations to the Commission, listed below. They ask the Commission to consider any one or more of their suggestions:

The SEC staff submitted their recommendations to the Commission, listed below. They ask the Commission to consider any one or more of their suggestions:

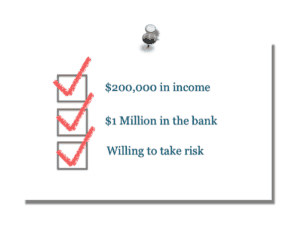

- The Commission should revise the financial thresholds requirements for natural persons to qualify as accredited investors and the list-based approach for entities to qualify as accredited investors. The Commission could consider the following approaches to address concerns with how the current definition identifies accredited investor natural persons and entities:

- Leave the current income and net worth thresholds in place, subject to investment limitations.

- Create new, additional inflation-adjusted income and net worth thresholds that are not subject to investment limitations.

- Index all financial thresholds for inflation on a going-forward basis.

- Permit spousal equivalents to pool their finances for purposes of qualifying as accredited investors.

- Revise the definition as it applies to entities by replacing the $5 million assets test with a $5 million investments test and including all entities rather than specifically enumerated types of entities.

- Grandfather issuers’ existing investors that are accredited investors under the current definition with respect to future offerings of their securities.

- The Commission should revise the accredited investor definition to allow individuals to qualify as accredited investors based on other measures of sophistication. The Commission could consider the following approaches to identify individuals who could qualify as accredited investors based on criteria other than income and net worth:

- Permit individuals with a minimum amount of investments to qualify as accredited investors.

- Permit individuals with certain professional credentials to qualify as accredited investors.

- Permit individuals with experience investing in exempt offerings to qualify as accredited investors.

- Permit knowledgeable employees of private funds to qualify as accredited investors for investments in their employer’s funds.

- Permit individuals who pass an accredited investor examination to qualify as accredited investors.

It is important to note the SEC staff recommends a path for accreditation that should consider sophistication. Initially, the objective of the mandated review was viewed as a step to make it more difficult for individual investors to qualify. But the tides of opinion have shifted as more and more policy-makers are waking up to the fact that the current definition has disenfranchised a generation of investors thus denying them the choice to invest in private placements. While the hard-line economic rule makes the definition easy to manage, it currently places absolutely no relevance on education, sophistication or professional experience. While anyone may blow their paycheck at the roulette table in Vegas, these same people were denied access to invest in UBER when it was posted on AngelList. Wonders never cease.

It is important to note the SEC staff recommends a path for accreditation that should consider sophistication. Initially, the objective of the mandated review was viewed as a step to make it more difficult for individual investors to qualify. But the tides of opinion have shifted as more and more policy-makers are waking up to the fact that the current definition has disenfranchised a generation of investors thus denying them the choice to invest in private placements. While the hard-line economic rule makes the definition easy to manage, it currently places absolutely no relevance on education, sophistication or professional experience. While anyone may blow their paycheck at the roulette table in Vegas, these same people were denied access to invest in UBER when it was posted on AngelList. Wonders never cease.

The misdirected “wisdom” of elected officials can be profound. Young securities attorneys, many doctors, and even Commissioners of the SEC – have been denied access to some of the most lucrative investments ever. As more and more companies have been pushed to remain private for as long as possible the current definition of an accredited investor has exacerbated the wealth gap: A pressing social issue in the US. Of course, the counter argument is that these investments tend to be risky and many early stage companies (only a small segment of private placements) have a higher rate of failure putting individual’s capital at risk. So then the government must decide where you invest your money?

The misdirected “wisdom” of elected officials can be profound. Young securities attorneys, many doctors, and even Commissioners of the SEC – have been denied access to some of the most lucrative investments ever. As more and more companies have been pushed to remain private for as long as possible the current definition of an accredited investor has exacerbated the wealth gap: A pressing social issue in the US. Of course, the counter argument is that these investments tend to be risky and many early stage companies (only a small segment of private placements) have a higher rate of failure putting individual’s capital at risk. So then the government must decide where you invest your money?

The review now stands as an opportunity to right this wrong and give access to a wider audience that possess the sophistication to evaluate if an investment opportunity meets their investment objections. The private placement market is enormous – far larger than annual IPOs. In 2014 Reg D placements topped $1.3 trillion. Hopefully, the SEC will stand up and fix the shortcomings of the current rules. Or maybe the Congress will act first. Paradoxically there still remain a few policy types that want to make the barriers more challenging but these people are quickly falling under the loony category.

The report is embedded below. You may submit your comments to the SEC here.

[scribd id=293684573 key=key-Zylu2lsmZUlJVBxojagU mode=scroll]