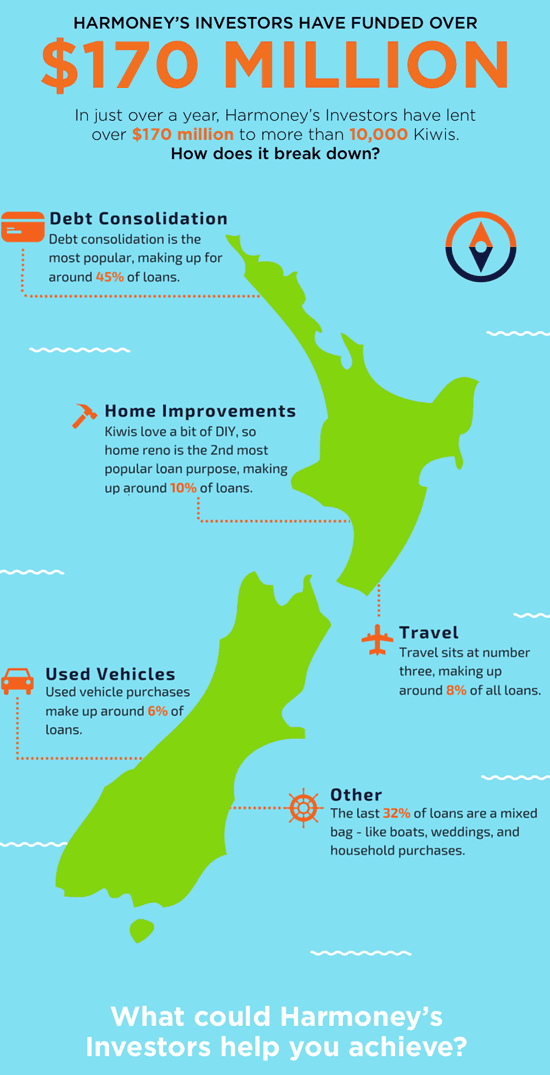

In a bit over one year (they launched in September of 2014), Harmoney, a peer to peer lending platform based in New Zealand, has funded over £170 million to more than 10,000 Kiwis. Realised annual returns on all loans on the platform have topped 12%. And how does the peer to peer lending break down?

In a bit over one year (they launched in September of 2014), Harmoney, a peer to peer lending platform based in New Zealand, has funded over £170 million to more than 10,000 Kiwis. Realised annual returns on all loans on the platform have topped 12%. And how does the peer to peer lending break down?

Harmoney has cooked up a some data points, including an infographic, outlining the platforms success to date.

- 45% of consumers are using Harmoney for Debt Consolidation

- 10% is for Home Improvement

- 9% is for travel

- 6% for used Vehicles

- 32% for everything else

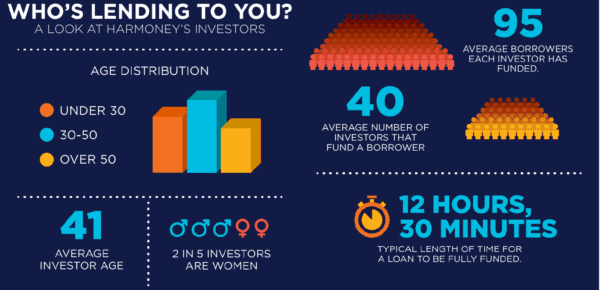

As to Who is doing the lending?

- Average borrower has 40 investors

- Length of time to fund a loan averages 12 hours and 30 minutes

- 2 in 5 investors are women

- Average age of a lender is 41 years old

- Interest paid to investors is over $10 million

Other interesting date points include:

- 22% of investors are retail types. The rest comes from institutional funds

- BUT retail is growing as almost 40% of loans were funded by small investors in July

- A good number of borrowers return to borrower again (about 1 out of 5)

- The rate of loan default is topping expectations with actual rates beating predicted results

You may view all of the Harmoney data here. On to 2016.