Harmoney Update: Exceeds Loan Origination Prospectus Forecasts For Six Months to December 2020; New Zealand Loan Origination Increased by 44% to NZ$89 Million

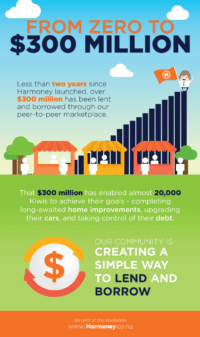

Australasia’s peer-to-peer lending marketplace Harmoney announced this week it has exceeded its loan origination forecasts for the six months to 31 December 2020 (on an unaudited basis), delivering total loan originations of NZ$194m for the period, 2% ahead of Prospectus forecasts. The marketplace also revealed… Read More

Read more in: Investment Platforms and Marketplaces | Tagged australia, harmoney, loan origination, new zealand, online lender, online lending