Pan-European peer to peer lending platform Bondora has become the first online lender in Europe to open its API to the public. The program interface is available to both retail and institutional P2P/ marketplace investors. This update to their lending ecosystem should facilitate investor access and help to grow the online lender. The API is similar to what already occurs with platforms like Lending Club and Prosper in the US.

“Being open with data and allowing people to research and build services on top of it will ensure the necessary transparency to make the entire financial eco-system more sustainable”, says CEO of Bondora, Pärtel Tomberg. “Through Bondora open API we want to offer the same possibility [similar to access to US online lenders] to our investors and service providers in Europe.”

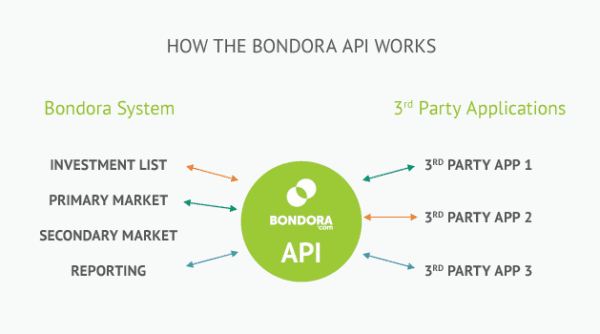

Bondora API is an interface that provides information and exposes Bondora’s functionality for other services and applications. Investors may benefit from the API by having access to data and services that cater to their individual wishes and by getting the ability to bid on specific loans that fit their personal investment strategy.

Bondora states it has embraced open data in order to develop the first marketplace connecting borrowers and lenders all across Europe through personal loans. The transaction ledger, including all loan applications, issued loans and payments, is public and available to download for anyone. Bondora explaines it can now fulfill the needs and wishes of different investor segments without having to compromise. Passive investors may also use the simple web site while more active investors may build services for their personal needs.

Bondora states it has embraced open data in order to develop the first marketplace connecting borrowers and lenders all across Europe through personal loans. The transaction ledger, including all loan applications, issued loans and payments, is public and available to download for anyone. Bondora explaines it can now fulfill the needs and wishes of different investor segments without having to compromise. Passive investors may also use the simple web site while more active investors may build services for their personal needs.

“We hope that all other platforms as well as credit institutions will follow suit and make their data and APIs publicly available. Our data needs to be open and available to everyone as it helps others to better manage counter-party risks and understand a financial service provider’s financial health. Overall this will reduce the inherent risks of the entire financial system”, says Tomberg.

Bondora, based in Estonia but providing loans in multiple European countries, has delivered a net annualized return of 18% to its investors.