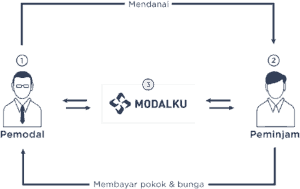

Bank Sinarmas, a Jakarta based financial institution, has formed a partnership with recently launched peer to peer lender Modalku to more easily provide access to capital to SMEs joining a global trend of traditional finance partnering with innovative Fintech firms. The partnership with Sinarmas Bank also means that Modalku is leading the fintech industry towards better regulation, first with the partnership with OJK and now, with Sinarmas Bank;

Reynold Wijaya, CEO and Co-founder of Modalku, welcomed the new agreement;

Reynold Wijaya, CEO and Co-founder of Modalku, welcomed the new agreement;

“We are very excited to partner with Sinarmas Bank as we both have a similar vision to create a new-age financial world for Indonesia and simultaneously support growth of SMEs in Indonesia.”

Freenyan Liwang, President Director of Sinarmas Bank and Soejanto Soetjijo, Director of Retail Banking, explained the arrangement was part of its mission to help and develop smaller companies in Indonesia. The first step in the partnership will see Sinarmas becoming the escrow agent to manage and monitor all funds flowing via the online lender. The initiative was also described as part of a broader initiative to develop a more strategic digital approach and evolve in the changing world of finance. Sinarmas Bank believes Modalku will become a strategic partner to serve SMEs online and together maximize synergies to enable SMEs to become a stronger backbone for the Indonesian economy.

Dr. Hendrikus Passagi, Senior Executive Research, Department of Strategic Policy Development, Financial Services Authority (OJK), said it was important to establish an environment of assurance for investors and borrowers on the platform;

“Trust and consumer protection are the most important issues in the financial industry. As such, peer-to-peer lenders need to earn the full trust of lenders. Lenders will need to believe and see the proof that their funds are distributed to the SMEs directly. It is therefore very important for a lending platform to use an escrow service from a banking institution to ensure transparency and traceability of funds. Similarly, the authorities should be able to conduct checks on the escrow account at any time to ensure zero misappropriation of funds or fraud at the detriment to the lenders.”

Indonesia is viewed with great economic potential. Observers see Indonesia growing to become a top ten economy by 2025. To accomplish this objective more investments are needed for smaller companies

Indonesia is viewed with great economic potential. Observers see Indonesia growing to become a top ten economy by 2025. To accomplish this objective more investments are needed for smaller companies

“We want to be part of that solution as a leader of digital financial initiatives and cement our continuous support to SMEs for a better Indonesia, ” said Freenyan Liwang.