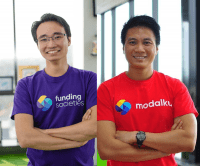

Fintech: Digital Finance Platform Funding Societies Raises $7.5m for SE Asia SMEs

Funding Societies (Modalku), a unified small and medium enterprises (SME) digital finance platform in Southeast Asia, has announced raising $7.5 million in debt from Norfund, Development Financial Institution (DFI) operated by the Norwegian government. DFIs have played a significant role in impact investments in Southeast… Read More

Read more in: Fintech, Asia | Tagged asia, fintech, funding-societies, modalku, msmes, singapore