Despite a recent slowdown in the marketplace lending sector, a report authored by Wharton FinTech and Richards Kibbe & Orbe states that institutional investors remain optimistic. This optimism has been matched by increasing investment.

Despite a recent slowdown in the marketplace lending sector, a report authored by Wharton FinTech and Richards Kibbe & Orbe states that institutional investors remain optimistic. This optimism has been matched by increasing investment.

The report based on a survey of 300 institutional investors states that while slowing growth may be generating some concerns, these concerns are not shared by actual investors. This is the second year RKO and Wharton FinTech have published their survey and they have some interesting insight to share.

According to the data provided by the research;

- Optimism about the industry’s future is also growing: more than 80% indicated high or medium levels of optimism for continued growth of marketplace lending, compared to 71% last year.

- 50% of respondents have capital allocated to the marketplace lending space. in 2015, only 29% of respondents were invested in this industry.

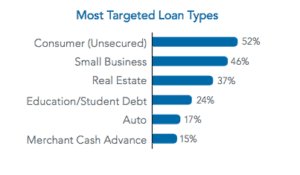

- Loans in which investors showed the greatest current interest in 2016 were consumer (unsecured) (52%), small business (46%) and real estate (37%).

- Presented with risk factors associated with marketplace lending, respondents expressed the greatest concern over market-wide credit events, with 85% of respondents somewhat or very concerned.

- 47% of respondents identified real estate loans as the best future investment opportunity. This is indicative of a desire for loans secured by hard assets that are more resilient in a downturn.

The authors predict that platforms will continue to “explore more niche markets”. They also expect significant platform consolidation to occur in the coming year. The regulatory environment continues to be a point of concern as both appointed and elected officials focused on the online lending industry.

The report is embedded below.

[scribd id=307909857 key=key-4YmUfMwyS4Y2CVJfRi9A mode=scroll]