According to Reserve Bank of India Deputy Governor R Gandhi, approval of new types of NBFCs (non-banking finance companies) will continue. Detailed information has not yet been released from the bank, but Gandhi commented while inaugurating the ASSOCHAM summit discussing NBFCs: The Changing Landscape’ reported Mumbai’s Deccan Herald:

According to Reserve Bank of India Deputy Governor R Gandhi, approval of new types of NBFCs (non-banking finance companies) will continue. Detailed information has not yet been released from the bank, but Gandhi commented while inaugurating the ASSOCHAM summit discussing NBFCs: The Changing Landscape’ reported Mumbai’s Deccan Herald:

“The new application forms will be simpler and the number of documents required to be submitted will be reduced and the entire process could be made online for ease, speed and transparency.”

According to Gandhi, the regulator will soon share a concept note regarding P2P lending:

“RBI will soon put up a concept note on P2P on its website for public comments and the contours of regulating P2P lending will be decided in consultation with markets regulator Securities Exchange Board of India (SEBI),” Gandhi said.

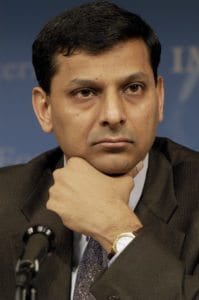

Earlier this month  , Governor of the Reserve Bank of India expressed the import of P2P lending:

, Governor of the Reserve Bank of India expressed the import of P2P lending:

“Peer to Peer Lending (P2P): P2P lending has shown accelerated growth over the last one year. While encouraging innovations, the Reserve Bank cannot be oblivious to the risks posed by such institutions to the system. A Concept Note on P2P lending will be put up on the Reserve Bank’s website for public comments by April 30, 2016 and based on the feedback, the contours of regulating P2P lending will be decided in consultation with the SEBI.”

According to the Cambridge Centre for Alternative Finance, India holds the largest proportion of recorded alternative finance activity in South Asia with a total of over $57 million raised between 2013-2015. Multiple peer to peer lending platforms have already raised capital in India including LoanZen, Capzest, KountMoney, Loanbaba, IndiaLends Faircent and LoanCircle. Stay tuned for more details.