General solicitation is growing for securities offerings conducted under Rule 506(c) and Reg A+ Tier II in the US. A more limited form of general solicitation is also available to issuers participating in offerings pursuant to Title III of the JOBS Act (Crowdfunding). Issuers may use a variety of newly available marketing channels, including funding platforms and social media sites, to market their offerings and solicit investors. We are seeing a growing use of social media, videos, postings on funding platforms and investor relations sections on corporate websites being used to attract investors to new securities offerings. But offering securities for sale is very different than selling a consumer product.

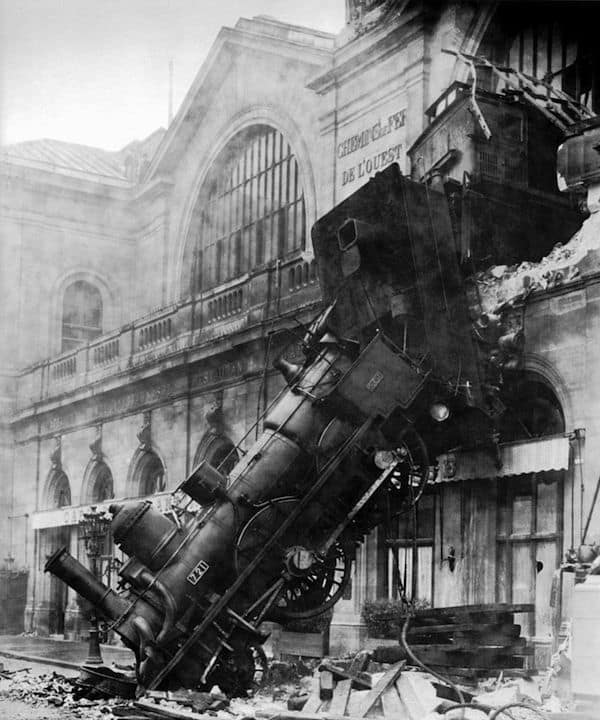

The enactment of general solicitation does not change the antifraud rules of the federal and state securities laws. Indeed, general solicitation and its breadth can pose risks where issuers and the funding platforms that host securities offerings can get into some regulatory trouble.

The enactment of general solicitation does not change the antifraud rules of the federal and state securities laws. Indeed, general solicitation and its breadth can pose risks where issuers and the funding platforms that host securities offerings can get into some regulatory trouble.

While issuers are now permitted to use general solicitation, the antifraud provisions of the federal securities laws remain applicable to the offer and sale of securities. A sale is easy to understand, but the definition of a securities “offer” is broad and worthy of some discussion. Section 2(3) of the Securities Act of 1933, as amended, defines the term “offer” to “include every attempt or offer to dispose of, or solicitation of an offer to buy, a security or interest in a security, for value.” Section 401 of the Uniform Securities Act, as amended, which has been adopted by many states, borrows its definition of “offer” extensively from the Securities Act and so it is equally broad.

Issuers and platforms where the securities offering is posted must ensure that their statements are not misleading, including that there are no misrepresentations or omissions of material fact regarding the company, the securities offered or the offering itself. This requirement is not only applicable to private placement memoranda or offering circulars, but also to the statements appearing on websites, videos, blogs, social media posts and in sales literature.

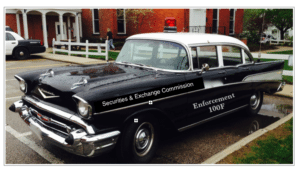

Both the SEC and the states have enforcement powers to address misrepresentations or omissions made in securities offerings. The SEC has federal jurisdiction, and the states generally have jurisdiction when you solicit their residents. For example, if you are offering securities to investors located in the State of New Jersey, the New Jersey Bureau of Securities will have jurisdiction to bring an enforcement action against you to redress any offering fraud, including misrepresentations or omissions of material fact. Separately, the services offered by funding platforms and marketing service providers need to be carefully evaluated to consider when the service provider is providing marketing services or actually is engaging in conduct that requires registration as a broker-dealer or investment advisor. This includes an understanding of how content is created, types of acceptable communications with the public, manner of payment and other services provided, and limitations on what your staff can discuss when speaking to a potential investor.

Both the SEC and the states have enforcement powers to address misrepresentations or omissions made in securities offerings. The SEC has federal jurisdiction, and the states generally have jurisdiction when you solicit their residents. For example, if you are offering securities to investors located in the State of New Jersey, the New Jersey Bureau of Securities will have jurisdiction to bring an enforcement action against you to redress any offering fraud, including misrepresentations or omissions of material fact. Separately, the services offered by funding platforms and marketing service providers need to be carefully evaluated to consider when the service provider is providing marketing services or actually is engaging in conduct that requires registration as a broker-dealer or investment advisor. This includes an understanding of how content is created, types of acceptable communications with the public, manner of payment and other services provided, and limitations on what your staff can discuss when speaking to a potential investor.

The key takeaways here are obvious. Any securities offering on a website must disclose all material information. While this has always been required by the securities laws, it is particularly important when an issuer is using general solicitation to reach the public. Almost universally what is being presented are development stage companies; that is, startups where there is a great risk that investors can lose part or all of their investment, and where there may be difficulty obtaining current, reliable information about the company. The shares being offered frequently are restricted, meaning an investor may have to hold the securities for a time period before selling and because there may be no public market, the investor may have difficulty selling even when they are permitted to do so. There may be no FINRA member broker-dealer involved in the securities offering, and thus no independent due diligence. Gatekeepers such as broker-dealers have due diligence obligations when recommending securities to their customers in order to protect investors. Thus in the absence of broker-dealers and due diligence, it is even more important that the content appearing on websites, in sales literature or elsewhere be fully accurate and not misleading.

The key takeaways here are obvious. Any securities offering on a website must disclose all material information. While this has always been required by the securities laws, it is particularly important when an issuer is using general solicitation to reach the public. Almost universally what is being presented are development stage companies; that is, startups where there is a great risk that investors can lose part or all of their investment, and where there may be difficulty obtaining current, reliable information about the company. The shares being offered frequently are restricted, meaning an investor may have to hold the securities for a time period before selling and because there may be no public market, the investor may have difficulty selling even when they are permitted to do so. There may be no FINRA member broker-dealer involved in the securities offering, and thus no independent due diligence. Gatekeepers such as broker-dealers have due diligence obligations when recommending securities to their customers in order to protect investors. Thus in the absence of broker-dealers and due diligence, it is even more important that the content appearing on websites, in sales literature or elsewhere be fully accurate and not misleading.

This is the context in which the SEC and other regulators will be viewing websites and marketing materials using general solicitation. It is well known that the SEC and other regulators surf the internet in an effort to locate and ferret out investor fraud, particularly offering fraud. Issuers and offering platforms need to remain thoughtful about what the SEC, for example, will see when it scrolls a funding platform’s website in a search for potential misconduct harmful to investors.

Here are some of the things that may raise regulatory concern:

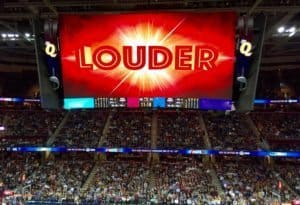

Inflated investment return and dividend earning projections are a problem. In some instances, suggestions that strong past performance will recur exacerbate this issue. Exaggerated or unwarranted claims, opinions or forecasts concerning, for example, estimated annual returns and cash distributions, raise questions as to the justification or basis for such claims. Overly positive testimonials without appropriate disclosures may also cross the line. Any of these activities without appropriate disclosures can serve as an invitation for a regulator to open an investigation. All communications with prospective investors must be consistent with the risks of the offering and the uncertainty of distributions, rates of return and yield.

Inflated investment return and dividend earning projections are a problem. In some instances, suggestions that strong past performance will recur exacerbate this issue. Exaggerated or unwarranted claims, opinions or forecasts concerning, for example, estimated annual returns and cash distributions, raise questions as to the justification or basis for such claims. Overly positive testimonials without appropriate disclosures may also cross the line. Any of these activities without appropriate disclosures can serve as an invitation for a regulator to open an investigation. All communications with prospective investors must be consistent with the risks of the offering and the uncertainty of distributions, rates of return and yield.

Descriptions of issuer offerings on a website with no risk disclosures or risk disclosures that are buried in legends at the bottom of the webpage, or on a different page of the site altogether and in type that is difficult to read are also problematic. Similarly, where the description of the issuer or the securities offering are overwhelmingly positive may create equally thorny issues. While it is understood that issuers and funding platforms are seeking investments, such actions must be compliant with the requirements of the federal securities laws. Rather, positive statements should be balanced with risk disclosures so there is a balancing of the potential rewards with the high risks so a statement is not misleading. For example, something like: “share in our profits,” but nothing about the potential that an investor may lose some or all of her investment will raise regulatory concern. Other funding platforms provide details concerning an issuer or an offering, all painted as positive information, but require you to sign on to the site to see the offering documents. If the offering documents are the only place where risks are disclosed, it invites regulatory scrutiny when the risk materials are locked away while an investor can openly read the purportedly positive information concerning an issuer.

Exaggerated or unwarranted communications may also be deceptive and misleading, such as “we are the fastest growing company in our industry with growth of X percent year after year;” or the hyping of a particular asset class without identifying risks such as real estate with terms such as “high return,” or “equity buildup;” or unqualified representations regarding management goals and achievements, such as “groundbreaking” and “never seen before” technologies” that will “revolutionize” the industry; or “leaders” in an industry “have taken notice and are partnering with [the issuer] to transform the industry once and for all.” More examples are not difficult to find: our “annual growth rate to date is 60%,” “[t]he products are developed, the process is in place, the partners are on board and now we are ready to kick the revolution into high gear — and we’d like to invite you to join us for the ride;” we only sell “the highest income producing assets: [real estate],” or, that an investment in a sole asset class [like real estate] is “100% diversified.” Suggestions that an offering is pre-IPO when there is no guarantee that any company will go public; inappropriate comparisons between FDIC insured bank interest to debt yields or stock market performance without discussing the differences in risk. It is clearly a red flag when statements on the website or sales literature contradict statements in the private placement memorandum or offering circular, and when information in marketing materials is not fair and balanced.

Exaggerated or unwarranted communications may also be deceptive and misleading, such as “we are the fastest growing company in our industry with growth of X percent year after year;” or the hyping of a particular asset class without identifying risks such as real estate with terms such as “high return,” or “equity buildup;” or unqualified representations regarding management goals and achievements, such as “groundbreaking” and “never seen before” technologies” that will “revolutionize” the industry; or “leaders” in an industry “have taken notice and are partnering with [the issuer] to transform the industry once and for all.” More examples are not difficult to find: our “annual growth rate to date is 60%,” “[t]he products are developed, the process is in place, the partners are on board and now we are ready to kick the revolution into high gear — and we’d like to invite you to join us for the ride;” we only sell “the highest income producing assets: [real estate],” or, that an investment in a sole asset class [like real estate] is “100% diversified.” Suggestions that an offering is pre-IPO when there is no guarantee that any company will go public; inappropriate comparisons between FDIC insured bank interest to debt yields or stock market performance without discussing the differences in risk. It is clearly a red flag when statements on the website or sales literature contradict statements in the private placement memorandum or offering circular, and when information in marketing materials is not fair and balanced.

Conflicts of interest and affiliate relationships with either an investment advisor or broker-dealer need to be disclosed. When a funding platform operator also serves as an investment advisor to a private fund offering securities on its marketing platform, serves as a broker-dealer registered representative and provides marketing services, a careful evaluation of both the conflicts of interests that such a structure can create as well as the different regulatory requirements are important. The various forms of compensation that the sponsors receive and the conflicts need to be clearly disclosed to prospective investors in all marketing media and a clear understanding should be had of how and when the broker-dealer (FINRA) compliance oversight applies to your operations. For platforms offering indirect investments in an operating company through a private managed investment fund, the indirect nature of the investment, lack of shareholder rights directly in the operating company, the added costs of the investment advisor which ultimately affects investor returns (as compared to investors investing directly in the company) and the different risk factors need to be clearly disclosed.

Conflicts of interest and affiliate relationships with either an investment advisor or broker-dealer need to be disclosed. When a funding platform operator also serves as an investment advisor to a private fund offering securities on its marketing platform, serves as a broker-dealer registered representative and provides marketing services, a careful evaluation of both the conflicts of interests that such a structure can create as well as the different regulatory requirements are important. The various forms of compensation that the sponsors receive and the conflicts need to be clearly disclosed to prospective investors in all marketing media and a clear understanding should be had of how and when the broker-dealer (FINRA) compliance oversight applies to your operations. For platforms offering indirect investments in an operating company through a private managed investment fund, the indirect nature of the investment, lack of shareholder rights directly in the operating company, the added costs of the investment advisor which ultimately affects investor returns (as compared to investors investing directly in the company) and the different risk factors need to be clearly disclosed.

Investment hype without discussion of risks, or presentations highlighting only an incomplete financial picture, the omission of special compensation all raise concern. Suggestions that the fact that “professional” investors are participating somehow alleviates the risks in an investment are equally troublesome. Whether angel or venture capital investors are participating does not mean an offering is no longer high risk, and the angels and venture capitalists will be the first to admit so. Suggestions that a funding platform performed analytics so that only issuers who passed its muster appear on the site also can be misleading where it is implied the offering is a good investment, when there was no real or independent due diligence, or when there is no description of what the analytic process entails. The selection or “curation” of deals is also important to consider in your website’s regulatory review because engaging in subjective evaluation of offerings, posting and promoting those offerings may require the platform to become registered with the SEC and FINRA.

A tangential issue is a common disclosure appearing on funding platform websites that they are not a registered broker-dealer, where they state they do “not give investment advice or endorse or recommend the purchase or investment in any securities.” Platforms should understand that stating you are not a broker-dealer, and are not providing investment advice or recommendations will not end an inquiry nor insulate you if you are engaged in activities that require broker-dealer registration. The SEC will conduct a factual inquiry to determine what precisely your activities are and whether those activities require registration. Broker-dealer registration is required for certain conduct with respect to the offer for sale of securities because it triggers registration, training and conduct requirements for sales practices, including marketing, soliciting and recommending securities, which have been developed over the years to protect investors. The use of marketing platforms by investment advisors to private investment funds (i.e., real estate funds) needs to also be carefully considered in light of increased scrutiny by regulators.

A tangential issue is a common disclosure appearing on funding platform websites that they are not a registered broker-dealer, where they state they do “not give investment advice or endorse or recommend the purchase or investment in any securities.” Platforms should understand that stating you are not a broker-dealer, and are not providing investment advice or recommendations will not end an inquiry nor insulate you if you are engaged in activities that require broker-dealer registration. The SEC will conduct a factual inquiry to determine what precisely your activities are and whether those activities require registration. Broker-dealer registration is required for certain conduct with respect to the offer for sale of securities because it triggers registration, training and conduct requirements for sales practices, including marketing, soliciting and recommending securities, which have been developed over the years to protect investors. The use of marketing platforms by investment advisors to private investment funds (i.e., real estate funds) needs to also be carefully considered in light of increased scrutiny by regulators.

Similarly, offers and sales in states without a broker-dealer where neither the issuer or its selling agent is registered or falls under an exemption can be unlawful selling activity. State securities administrators’ dockets are filled with actions against unregistered firms and individuals offering and selling securities in states (see http://nasaa.cdn.s3.amazonaws.com/wp-content/uploads/2011/08/2015-Enforcement-Report-on-2014-Data_FINAL.pdf at 7 (In 2014, “the single most common target of state securities enforcement actions was unregistered individuals, followed by unregistered firms. A total of 746 reported actions involved unregistered individuals and unregistered firms”)). Section 201 of the Uniform Securities Act makes clear that it is unlawful for any person to transact business in an adopting state as a broker-dealer or agent unless she is registered under the act. “Agent” means any individual other than a broker-dealer who represents a broker-dealer or issuer in effecting or attempting to effect purchases or sales of securities, absent an exemption.

The rules are pretty clear: If you look like, walk and quack like a broker-dealer, you probably are one and need to be registered. If you offer or sell securities in a particular state, you need to ensure your activities are not illegal under that state’s laws. And the disclosure in any securities offering must include all material facts and there cannot be an omission of a material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading. Communications on websites and in advertisements should also be fair and balanced, meaning overly positive statements should be offset with risk disclosures reminding investors that these investments are highly risky and that investors can lose some or all of their investment.

The rules are pretty clear: If you look like, walk and quack like a broker-dealer, you probably are one and need to be registered. If you offer or sell securities in a particular state, you need to ensure your activities are not illegal under that state’s laws. And the disclosure in any securities offering must include all material facts and there cannot be an omission of a material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading. Communications on websites and in advertisements should also be fair and balanced, meaning overly positive statements should be offset with risk disclosures reminding investors that these investments are highly risky and that investors can lose some or all of their investment.

Rather than extolling the virtues of doing it right, keep in mind that you are offering and selling securities in a highly regulated industry and enforcement actions are afoot. Funding platforms need to routinely evaluate that their design, issuer and investor onboarding processes, layout and day-to-day business operations comply with the different regulatory regimes to avoid liability exposure to the issuer, platform and the platform operators personally. Ask your securities attorney to take a look to make sure you are on the right side of the law.

Scott Andersen is principal at finLawyer.com and outside General Counsel of FundAmerica. He has also been Deputy Regional Chief Counsel at FINRA, Enforcement Director at FINRA and the NYSE, Co-Chief of the Securities Prosecutions Unit of the NY Attorney General’s office, and Asst. Attorney General for the State of NY. He has been investigating, prosecuting and supervising criminal, civil and regulatory enforcement actions for over nineteen years. He concentrates his practice on SEC and FINRA regulatory defense and securities regulatory counseling.

Scott Andersen is principal at finLawyer.com and outside General Counsel of FundAmerica. He has also been Deputy Regional Chief Counsel at FINRA, Enforcement Director at FINRA and the NYSE, Co-Chief of the Securities Prosecutions Unit of the NY Attorney General’s office, and Asst. Attorney General for the State of NY. He has been investigating, prosecuting and supervising criminal, civil and regulatory enforcement actions for over nineteen years. He concentrates his practice on SEC and FINRA regulatory defense and securities regulatory counseling.

George S. Georgiades is managing partner at Georgiades & Associates (altfinesq.com) and an experienced securities attorney representing (crowd)funding portals, investment advisors, and broker-dealers in the United States and internationally. Since 2011, he has actively supported the implementation of the JOBS Act reforms and has worked proactively with crowdfunding portals, service providers, industry associations and regulators to fashion the adopting regulations. He has served as legal counsel to several of the leading venture-backed funding platforms. He is admitted to practice law in the State of New York.

George S. Georgiades is managing partner at Georgiades & Associates (altfinesq.com) and an experienced securities attorney representing (crowd)funding portals, investment advisors, and broker-dealers in the United States and internationally. Since 2011, he has actively supported the implementation of the JOBS Act reforms and has worked proactively with crowdfunding portals, service providers, industry associations and regulators to fashion the adopting regulations. He has served as legal counsel to several of the leading venture-backed funding platforms. He is admitted to practice law in the State of New York.