Earlier this week, leading marketplace lending platform Prosper announced modifications in its rate pricing. The company stated that the changes were a direct result of a few factors, which includes the forward-looking credit market, interest rate expectation, the U.S. credit environment, and the competitive environment in the U.S. consumer unsecured lending.

Earlier this week, leading marketplace lending platform Prosper announced modifications in its rate pricing. The company stated that the changes were a direct result of a few factors, which includes the forward-looking credit market, interest rate expectation, the U.S. credit environment, and the competitive environment in the U.S. consumer unsecured lending.

The lender explained:

“Over the course of the last 12 months, rates through the Prosper platform have been raised twice and Prosper has made conservative adjustments to its loss expectations. These rate changes underscore our commitment to operating a marketplace that balances the economic incentives for both our borrower and investor communities.”

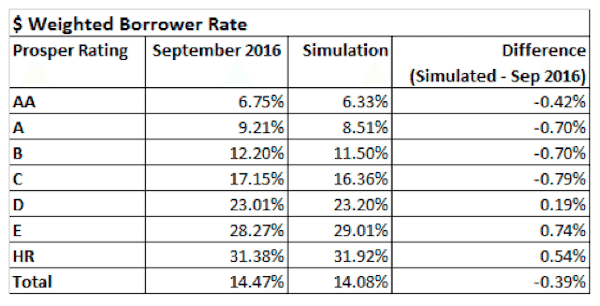

Prosper then revealed a table that summarized the simulated impact of the rate decrease compared to the portfolio originated through its platform in September 2016.

Prosper went on to add:

“Borrowers in the AA-C rating grades will generally see rates that are lower. Borrowers in the D-HR rating grades will see higher rates. While the exact portfolio composition going forward will be a result of future marketing mix and borrower reaction to the pricing change, we believe this is a fair representation of the potential impact of the changes to borrowers and investors. As one can see, higher quality borrowers will begin seeing lower rate offers while higher risk borrowers will begin seeing higher interest rate offers.”