There has been a lot of buzz within the investment community regarding the updated exemption created under Title IV of the JOBS Act. Regulation A+, or just Reg A+, was crafted by the SEC and Congress to allow issuers to raise up to $50 million from both accredited and non-accredited investors. Some industry followers describe the exemption as a “mini-IPO” type offer. Less costly than a full-blown IPO, smaller companies may now raise capital crowdfunding online and then, perhaps, trade shares on an exchange.

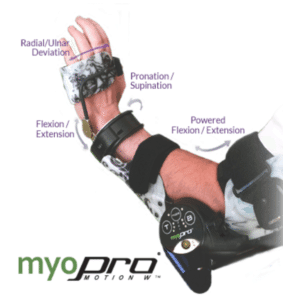

Last week, Myomo – a medical robots company, filed a form 1-A with the SEC indicating its intent to use Reg A+ to raise growth capital. Myomo had enlisted the assistance of Tripoint Global and its affiliate Banq to assist in the funding round. Myomo predicts it will list on the NYSE following the Reg A+ offer – a first for the exemption.

Last week, Myomo – a medical robots company, filed a form 1-A with the SEC indicating its intent to use Reg A+ to raise growth capital. Myomo had enlisted the assistance of Tripoint Global and its affiliate Banq to assist in the funding round. Myomo predicts it will list on the NYSE following the Reg A+ offer – a first for the exemption.

While there is much excitement regarding Reg A+, challenges remain. There have been some questionable issuers that have filtered through the system with outlandish valuations and preposterous expectations. Over time, people expect the Reg A+ crowdfunding sector to sort itself out. It may also be the vehicle to re-energize the waning IPO market.

Crowdfund Insider spoke with Mark Elenowitz last week. Elenowitz is the CEO of Tripoint Global. He is very optimistic about Reg A+ and foresees numerous crowd-financed public offers in the near future.

Our discussion is below.

Crowdfund Insider: Tripoint Global has been a successful investment banking firm. So why did you decide to launch BANQ?

Mark Elenowitz: TriPoint has been an institutional firm for many years focusing on diligence, structure and creative instruments. We have always been on the forefront of regulatory changes and trends. When the JOBS Act came out, we recognized immediately some of the issues that could arise and created BANQ to address some of those issues.

Mark Elenowitz: TriPoint has been an institutional firm for many years focusing on diligence, structure and creative instruments. We have always been on the forefront of regulatory changes and trends. When the JOBS Act came out, we recognized immediately some of the issues that could arise and created BANQ to address some of those issues.

We felt that the JOBS Act allowed Wall Street to catch up to Main Street, allowing issuers to now use social media and other electronic communications to market their offerings to the larger audience. Our concern was transparency of information and leveling the playing field for individual investors to get access to the same structure, diligence, and preferences that previously were limited to institutions. BANQ allows that same level of disclosure and data for all.

Crowdfund Insider: You describe Reg A+ as the future of IPOs. Please explain.

Mark Elenowitz: The Small Cap market and capital formation have been limited for small issuers of the past several years. It is very difficult for companies to conduct public offerings. Most capital raises were done as PIPEs (private investment in public equity) which is limited to accredited investors. We have seen the number of IPOs trail off but Reg A+ is an opportunity to bring back the small cap IPO.

In the past, the only way for issuers to conduct an IPO was to use an investment bank. The number of banks that participate in these small underwritings is very few. The larger investment banks are still conducting offerings for larger companies and raises, but there was a void for the smaller issuer. The traditional IPO has a significant amount of regulation that limits what information can be communicated to potential investors and when. Reg A+ allows the use of Testing the Waters, which allows communication about the offering before filing, during the filing process, and after qualification. This is a huge change that allows issuers to now be able to gauge interest not only from the Wall Street community, but also from the crowd.

In the past, the only way for issuers to conduct an IPO was to use an investment bank. The number of banks that participate in these small underwritings is very few. The larger investment banks are still conducting offerings for larger companies and raises, but there was a void for the smaller issuer. The traditional IPO has a significant amount of regulation that limits what information can be communicated to potential investors and when. Reg A+ allows the use of Testing the Waters, which allows communication about the offering before filing, during the filing process, and after qualification. This is a huge change that allows issuers to now be able to gauge interest not only from the Wall Street community, but also from the crowd.

Issuers can now spend time developing investor interest and more importantly can do so using the internet and general solicitation across all 50 states to non-accredited investors. We now can have a convergence of the traditional underwriting with electronic offerings. This hybrid approach is what we are doing for our clients. It is made up of three parts: Crowd, Institutional, and Wall Street syndicate. This allows institutions to follow the crowd sometimes confirming or validating the prospects of the product or service, and the Crowd to follow pricing and structure that professional’s demand.

Crowdfund Insider: While about $2 billion in Reg A+ offers have qualified only about $170 million has been raised. Much of this has been for Real Estate offers. Why is that?

Mark Elenowitz: There is a large disconnect from regulation and implementation.

Many of the offerings that are being marketed should not be public to begin with.

The entrepreneurs that are attempting to raise the capital are attempting with valuations that are not realistic, business prospects that will require significantly more capital down the line and the many of the companies are early stage.

Also, many of the companies that are attempting to market to Wall Street members don’t understand the compliance requirements and deposit issues that retail brokerage firms require. Many compliance departments are still uncertain what Regulation A+ is and how to manage it within their own internal regulations.

Also, many of the companies that are attempting to market to Wall Street members don’t understand the compliance requirements and deposit issues that retail brokerage firms require. Many compliance departments are still uncertain what Regulation A+ is and how to manage it within their own internal regulations.

In time, they will embrace it but for now many are quite cautious and have elected to sit on the sidelines.

We are conducting our offerings with those compliance concerns in mind and are creating product and procedure that mimics what they are used to and we will settle the transactions (meaning close the deal and deliver securities) in a manner they are accustomed to.

Crowdfund Insider: Do you think early stage companies can use Reg A+ to raise capital?

Mark Elenowitz: I believe it will be very difficult for an early stage company to use Reg A+.

There is a cost associated with the offerings. Beyond the legal, accounting and filing fees, there is a large marketing component that needs to be spent to attract investor interest.

When an early stage company does not have enough capital to operate, to spend a significant amount of money they don’t have to just test the waters, is not efficient.

The key point that issuers must understand is that this is a public offering. Issuers are accepting funding from investors and now have the responsibility and cost to creating shareholder value and acting in the best interest of all shareholders. Many issuers don’t recognize that the offering is step 1 in a long journey of being a public company.

The key point that issuers must understand is that this is a public offering. Issuers are accepting funding from investors and now have the responsibility and cost to creating shareholder value and acting in the best interest of all shareholders. Many issuers don’t recognize that the offering is step 1 in a long journey of being a public company.

The costs of being public are just beginning and will be continuous on annual basis. I recommend all CEO’s look in the mirror and are comfortable with proceeding with public investors. They may decide other financing alternatives may be more attractive. There are other options like Title III (CF) that might be more beneficial to their needs.

Crowdfund Insider: Some of the early issuers that have filed Reg A+ offers have been criticized for having outlandish terms (IE valuations). What are your thoughts on this?

Mark Elenowitz: This has been a huge issue. There are companies that have no operations, not funds in the bank or paid in capital but believe they are worth $300 million +.

These deals are not going to get done and are creating confusion in the marketplace among issuers. Many have come to me with misinformation and poor guidance. There are many service providers that are not licensed and these service providers are playing into the issuers dreams of raising huge amounts of money at huge valuations. This is not realistic. The Crowd is not uneducated. They may have an affinity towards the product, but they also recognize potential.

These deals are not going to get done and are creating confusion in the marketplace among issuers. Many have come to me with misinformation and poor guidance. There are many service providers that are not licensed and these service providers are playing into the issuers dreams of raising huge amounts of money at huge valuations. This is not realistic. The Crowd is not uneducated. They may have an affinity towards the product, but they also recognize potential.

Transactions should be structured based upon defensible projections, assumptions, and peer’s valuations. Those CEOs that recognize this are the ones that will have successful offerings.

Crowdfund Insider: Reg A+ is still a very new exemption. How do you see this sector of the online funding industry evolving over the coming years?

Mark Elenowitz: I think it will continue to grow. The likelihood of a complete electronic crowd offering of any meaningful $25 mil+ capital raise is not here today. An issuer still needs Wall Street to be a part of that offering, but I truly believe in time, perhaps 3-5 years from now the makeup of an offering will be more Crowd and less Wall Street.

We need to see more successful offerings and better quality issuers.

Crowdfund Insider: What needs to be improved?

Crowdfund Insider: What needs to be improved?

Mark Elenowitz: Transparency, disclosure, and quality of the issuers.

Crowdfund Insider: What are the some of the issuers you are lining up in the near future?

Mark Elenowitz: Our issuers are move advanced in their life cycle. They are companies with large consumer awareness, customer bases, and affinity groups. They have revenue and have been funded previously with private equity, venture and friends and family. One of our clients has already received $19 million and one has over $34millionn invested. They will all be listed securities on higher exchanges.

Our companies are also easy to understand. Investors have 30 seconds to understand the Company. Life Science companies, including biotechs, have complex science and technology behind their innovations. This data and information requires a more informative explanation and education for investors to understand the merits of the opportunity. When marketing a Reg A+ opportunity, the story needs to be short, direct and easy to understand. Reg A+ investors will typically spend on a few minutes at most determining if the investment is of interest. Explaining a biotech takes time and needs to have points further detailed beyond the short presentation. While ultimately the biotech opportunity may be a great investment opportunity, the investor will move on their search before the story is properly explained.

Investors have 30 seconds to understand the company. Life Science companies, including biotechs, have complex science and technology behind their innovations. This data and information demands a more informative explanation and education for investors to understand the merits of the opportunity.

When marketing a Reg A+ opportunity, the story needs to be short, direct and easy to understand. Reg A+ investors will typically spend only a few minutes at most determining if the investment is of interest. Explaining a biotech firm takes time and needs to have points further detailed beyond a short presentation. While ultimately the biotech opportunity may be a great investment opportunity, the investor will move on their search before the story is properly explained.

When marketing a Reg A+ opportunity, the story needs to be short, direct and easy to understand. Reg A+ investors will typically spend only a few minutes at most determining if the investment is of interest. Explaining a biotech firm takes time and needs to have points further detailed beyond a short presentation. While ultimately the biotech opportunity may be a great investment opportunity, the investor will move on their search before the story is properly explained.