On April 20, 2017, amendments to Rule 147  and new Rule 147A, federal intrastate offering exemptions, finally went into effect. The amendments to Rule 147 and new Rule 147A are intended to modernize and update the exemption that allows companies to raise money from investors who are located within one state without having to register those securities with the SEC. The SEC’s goal in modernizing the exemption was to assist smaller companies with capital formation

and new Rule 147A, federal intrastate offering exemptions, finally went into effect. The amendments to Rule 147 and new Rule 147A are intended to modernize and update the exemption that allows companies to raise money from investors who are located within one state without having to register those securities with the SEC. The SEC’s goal in modernizing the exemption was to assist smaller companies with capital formation

Changes

Both amended Rule 147 and new Rule 147A now have the following provisions included:

- A requirement that the issuer has its “principal place of business” in-state and satisfies at least one “doing business” requirement that would demonstrate the in-state nature of the issuer’s business

- A new “reasonable belief” standard for issuers to rely on in determining the residence of the purchaser at the time of the sale of securities

- A requirement that issuers obtain a written representation from each purchaser as to residency

- A limit on resales to persons residing within the state or territory of the offering for a period of six months from the date of the sale by the issuer to the purchaser

- An integration safe harbor that would include any prior offers or sales of securities by the issuer made under another provision, as well as certain subsequent offers or sales of securities by the issuer occurring after the completion of the offering

- Legend requirements to offerees and purchasers about the limits on resales

Amended Rule 147 vs New Rule 147A

The key differences between Rule 147 as amended and new Rule 147A are that issuers relying on Rule 147A do not have to be incorporated in the state in which they are selling securities and are not banned from general solicitation. Although issuers can generally solicit, they still have to make sure whoever actually purchases securities are residents of the same state.

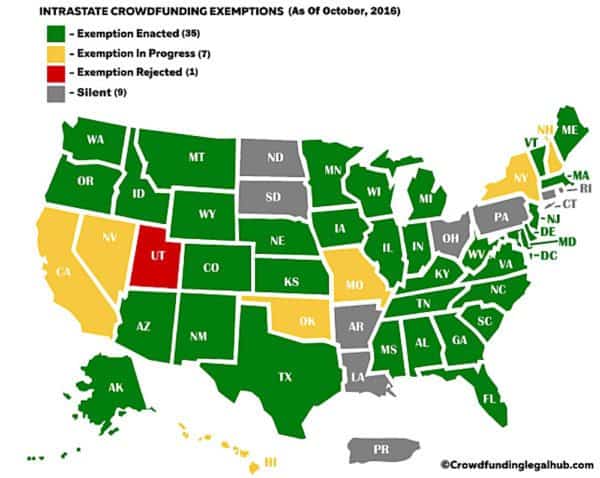

That means that an issuer that’s incorporated in Delaware but has its principal place of business in California and does most of its business in California can start a “crowdfunding campaign” in reliance of Rule 147A where anyone can see the offering online so long as only residents of California actually purchase securities. This is obviously simplifying it and the issuer would still have to abide by California’s securities laws, however. It will be interesting to see if this new rule causes a competition between the states to make their intrastate crowdfunding laws more appealing to issuers and startups. As you can see from the figure below, there are already numerous states that have enacted and are trying to enact their own state-specific crowdfunding laws.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!