In a recent testimony to the Investor Advisory Committee of the Securities and Exchange Commission (SEC), Scott Kupor, CEO & Managing Partner of Andreessen Horowitz, a $6.5 billion multi-stage venture capital firm, gave an amazingly comprehensive and concise description of today’s vanishing IPO market, the causes and implications of the same, and some suggestions for cures. Here are the highlights.

Background.

Before diving into this testimony I thought it might be helpful to give some background on what we refer to as the vanishing or diminishing Initial Public Offering (IPO) market. It used to be that most companies couldn’t wait to get to the point of having their IPO. Not only did an IPO serve as as a way for the founders and insiders of the company to finally reap in the riches of their efforts, it used to be seen as the absolute culmination of success for a new company. Almost as importantly, it also meant that the general public (i.e. you and I) would be able to share in the wealth by being able to purchase a stake in that company and make money as it grew. Those days are long gone, however.

Since its peak during the “.com” bubble of the late 90’s early 00’s, the IPO market has been on a steady decline. Now the term decline is a bit of a misnomer in that it implies that the overall value of the IPO market has diminished, however that is not the case. The aggregate value of the market has remained somewhat the same over the years but the number and size of companies that make up this market value has changed significantly. A simple example should help put this into perspective.

Since its peak during the “.com” bubble of the late 90’s early 00’s, the IPO market has been on a steady decline. Now the term decline is a bit of a misnomer in that it implies that the overall value of the IPO market has diminished, however that is not the case. The aggregate value of the market has remained somewhat the same over the years but the number and size of companies that make up this market value has changed significantly. A simple example should help put this into perspective.

Instead of companies, for a second let’s compare two groups of individuals. In “Group 1” we have five 20 something individuals who each make $100k per year and in “Group 2” we have a 60 year old individual who makes $500k per year. The aggregate income of both groups is the same but the make-up of that income is completely different. More importantly, the future earning potential of the two groups is drastically different. Few would argue that the single individual in Group 2, who is in the later stages of his life, would have a greater future earning potential in the long run than the five younger individuals making up Group 1. First, each of the five individuals in Group 1 have the potential to earn $500k or more by the time they are 60 (i.e. resulting in a total potential future value for Group 1 of $2.5M by age 60). Second, because there are multiple individuals in Group 1 as opposed to the single individual in Group 2, the probability that Group 1 will be successful (on average) is significantly higher then for Group 2 (e.g. the theory of diversification). With that in consideration, if you were asked today which of these groups you would prefer to invest invest your money with you would most likely want to invest with Group 1 because, while the two groups make the same amount now, you would have a better probability to make a larger return in the future by going with Group 1.

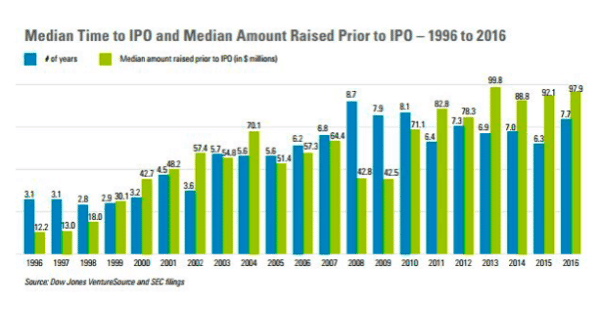

Now let’s use the above example to illustrate what has happened in the IPO market over the last several decades. During the heyday of IPO’s from 1980-2000, the characteristics of companies going public looked more like Group 1 above; inherently successful but typically young and smaller in overall value. Today however, the companies who go public are more like those in Group 2 above; much older and wealthier. Graphically here is a simple illustration of the change in average age, and pre-IPO values, of companies going public since 1996:

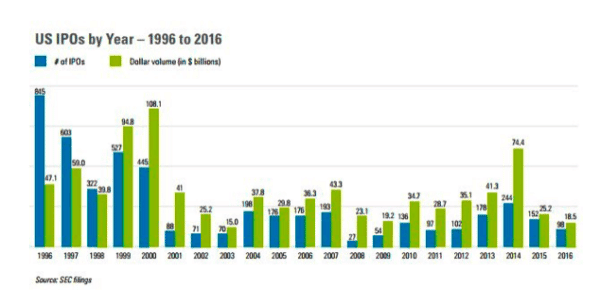

As you can see from the above chart there has been a fundamental shift over the last two decades from smaller and younger “Group 1” types of companies going public to older and larger “Group 2” types of companies. While this has of course led to a drastic decrease in the average total number of IPOs per year, again the total dollar volume of the IPO market has remained somewhat stable over the years as shown in the following:

What the above boils down to for us “average joe” investors is that companies are remaining private for longer periods of time (where all the value is being sucked out as discussed below) and the likelihood of making any real money by investing in an IPO today is all but gone.

The Causes.

In his testimony, Scott Kupor astutely identified the following three (3) key factors which have contributed to the above described IPO trends:

Lack of Capital Market Incentives. While a discussion of capital market regulating rules such as Order Handling Rules, Reg ATS and Reg NMS are well beyond the scope of this post, these regulations materially affect the profitability of traders and market-makers. As trading spreads narrow the incentive for market makers to deal with small cap stocks (i.e. “Group 1” companies) decreases significantly. Put simply, increased trading regulations have incentivized capital dealers and market makers to move away from small cap stocks and trade instead in larger cap stocks. Accordingly the market for small cap stocks has decreased significantly and companies are waiting until they have a larger amount of capital to go public so their IPO offering will be better received by investors (particularly institutional investors).

Short-Term Investment Pressures. Stock investment strategies, even for individuals, has shifted from long-term (buy and hold) to a significantly more short term (buy and flip) strategy. This is evidenced by the fact that the average investment holding period for stocks has dropped from 8 years (in 1960) to 8 months (in 2016). More importantly, investors expect to see significant returns on their investment during these shorter hold periods. Put another way, while our grandparents might have been happy with a 10% return over their 8 year holding period, we are more likely today to expect the same 10% in 8 months. This puts a lot of pressure on a growing young company and can often cause them to make decisions which are more oriented toward generating short-term investor return as opposed to long-term company growth. Consequently, many companies are choosing to stay private longer in order to avoid these significant investor pressures.

Compliance Costs. Finally, it should come as no surprise that the regulatory costs of being a public company are substantial and that these costs have only increased over the years with the introduction of Sarbanes Oxley and other applicable regulations. More importantly, the compliance rules are typically not dependent on the size of the company (i.e. small and large companies are treated the same). As a result, many smaller companies are putting off going public in order to defer these substantial costs until they are in a better capital position to rationalize the increased cost of being a public company.

Implications To Investors.

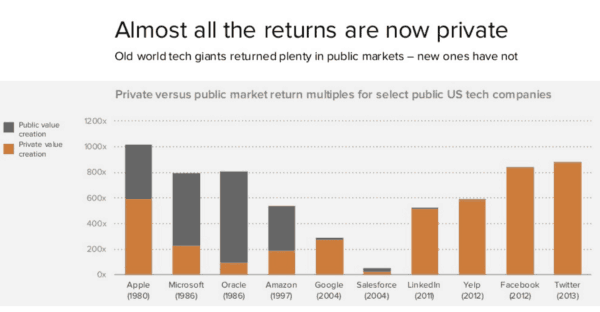

Mr. Kupor identifies several potential implications resulting from the above IPO trends, including decreased overall job growth and global capital market competition. Among those noted implications is something I have touched on several times before which is an issue that should be of tremendous importance to all retail investors. Today the overwhelming majority of returns from equity investment are being eaten up in the private markets; leaving little to no potential for significant returns for those investing through the public stock market. This phenomenon is readily illustrated by the following chart from a 2013 Andreessen Horowitz presentation:

As the above chart illustrates, the chances of making any real money today by investing in an IPO company are virtually non-existent. Long gone are the days when you could invest in shares of a public company like Amazon, Apple or Microsoft and expect to make a significant return on your investment. The following example put forward by Scott Kupor evidences the futility of trying to earn significant returns from IPO shares in today’s marketplace, even when investing in the most successful companies:

“A simple example illustrates this wealth shifting effect from public market investors to private investors. Microsoft went public in 1986 at a $350 million market cap; today, Microsoft’s market cap exceeds $500 billion. Thus a public holding of Microsoft from IPO has had the opportunity to enjoy a return of more than 1,400x on her original investment. Amazon is a similar story: an initial public market cap of approximately $440 million in 1997 that has grown just shy of 1,100x in the public markets. Contrast that with the incredible success story of Facebook, which debuted in the public markets around a $100 billion market cap. While the company has performed exceedingly well in the public markets, the returns to public market investors are about 4.5x. For public investors in Facebook to achieve returns comparable to those of Microsoft and Amazon shareholders, Facebook would need to reach a market cap of $100 trillion, a number that well exceeds the total global market cap of all listed stocks.

While everyday investors (both accredited and unaccredited) are gaining more access to the private markets via recent new regulations (i.e. the JOBS Act, intrastate crowdfunding and related regulations), average investor exposure remains very limited and the majority of the appreciation in the private markets still accrue to institutional and high-net worth investors.”

Suggestions for Reform.

As part of his testimony, Mr. Kupor presented several suggestions to help reform the present IPO decline and related implications. These include the following:

Improving Market Attractiveness. Mr. Kupor suggests exploring “all avenues” toward increasing the liquidity and attractiveness of the small cap stock market. This includes continuing to experiment with the “tick-size” regulations, possibly reducing the number of small cap trading venues, and looking for ways to increase market making activities with respect to Small Cap stocks. The intent of these measures are to help increase the overall attractiveness (particularly among institutional investors) and liquidity of the small cap market, thus making it more probably that a small cap IPO will be well received by investors.

Alleviating Short-Term Pressures. Mr. Kupor recommends considering tenure-based voting mechanisms (i.e. voting structures where long-term holders have greater voting rights). Mr. Kupor also suggests possibly requiring enhanced disclosure requirements for institutional investors with respect to material short positions. The intent of these measures are to help alleviate some of the significant short-term investor pressures discussed above which dissuade companies from going public.

Decreasing Compliance Costs. Finally Mr. Kupor suggests that the SEC undertake a comprehensive review of the current regulatory compliance costs for public companies and consider implementing a more cost-benefit regulatory framework that takes into account the size of the company being regulated (e.g. smaller companies would have less regulatory/reporting requirements). As Mr. Kupor astutely recognizes the current, one size fits all, regulatory regime often disproportionally hurts smaller companies. If a more cost-benefit regulatory framework was applied, the overall initial and ongoing costs of going public would be significantly reduced for smaller companies thus making the IPO option more appealing.

Conclusion.

Conclusion.

Without some form of substantive intervention this diminishing IPO trend is certain to continue. Mr. Kupor’s suggestions for reform are absolutely on point but it is going to take an SEC that is committed to working toward substantive reform in order to make any real progress. Whether or not that will occur in the foreseeable future (particularly under the Trump regime) is anyone’s guess. Hopefully at least we will continue to see the expansion of the private markets through the use of crowdfunding and similar regulations so everyday investors will have their chance to get a piece of the pie and not just the leftover crumbs.

Anthony Zeoli is a Senior Contributor for Crowdfund Insider. He is a Partner at the law firm of Freeborn in the Corporate Practice Group. He is an experienced transactional attorney with a national practice specializing in the areas of securities, commercial finance, real estate and general corporate law. Anthony recently drafted the bill to allow for an intrastate crowdfunding exemption in Illinois.

Anthony Zeoli is a Senior Contributor for Crowdfund Insider. He is a Partner at the law firm of Freeborn in the Corporate Practice Group. He is an experienced transactional attorney with a national practice specializing in the areas of securities, commercial finance, real estate and general corporate law. Anthony recently drafted the bill to allow for an intrastate crowdfunding exemption in Illinois.

Conclusion.

Conclusion.