Revolut has announced a $66 million Series B funding round to fuel an “aggressive expansion across Asia and North America”. The funding was described as a clear demonstration of strength for the UK based digital bank as a clear alternative to more traditional banking providers.

“Asia and North America are far from immune to hidden banking fees and dated technology. The fintech revolution has been an astounding success across Europe, and now is the time to broaden our horizon and embark on our global mission,” commented Revolut Founder & CEO Nikolay Storonsky. “With over 700,000 customers across Europe in just two years, I’m confident that Revolut will attract similar demand across Asia and North America.”

Total investment in Revolut now stands at $83 million. Revolut is currently gearing up for a $5 million crowdfunding round on Seedrs scheduled to take place later this month (July). An earlier crowdfunding round raised £1 million and was hugely over-subscribed registering pledges of £17+ million from more than 10,000 potential investors. This most recent investment was led by Index Ventures with existing investors, Balderton Capital and Ribbit Capital, also participating.

Beyond Banking

Martin Mignot, Partner at Index Ventures said that Revolut is on a mission to create a world where moving money is easy, instant, free and transparent. This is regardless of currency or country.

Martin Mignot, Partner at Index Ventures said that Revolut is on a mission to create a world where moving money is easy, instant, free and transparent. This is regardless of currency or country.

“It is removing barriers between people and merchants, enabling them to transact seamlessly around the world,” said Mignot. “Very few founders have both the clarity of vision and the single-minded focus that Nik and his team have exhibited to date. They simply won’t stop until their mission is complete.”

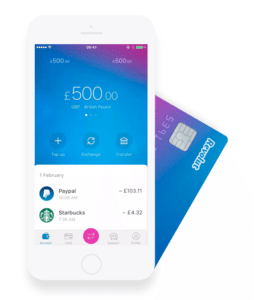

Revolut, which launched two years ago, has positioned itself as the banking alternative for those with a global lifestyle. With Revolut, customers may open a current account in 60 seconds, make free international money transfers, hold and exchange 16 currencies in-app with the interbank exchange rate and spend fee-free globally with a contactless MasterCard.

[clickToTweet tweet=”Revolut: On a mission to create a world where moving money is easy, instant, free & transparent #Fintech @RevolutApp” quote=”Revolut is on a mission to create a world where moving money is easy, instant, free & transparent #Fintech “]

Revolut recently launched business accounts across Europe, allowing companies to hold, exchange and transfer in 25 currencies with the interbank exchange rate, and issue employees with corporate cards for global fee-free spending.

Revolut recently launched business accounts across Europe, allowing companies to hold, exchange and transfer in 25 currencies with the interbank exchange rate, and issue employees with corporate cards for global fee-free spending.

Revolut said they expect to hire key country managers across Europe with a particular emphasis on markets like Germany, France and Scandinavia. While clearly position its banking services to a global audience, Revolut did not provide additional details on its planned expansion into North America and Asia.

Revolut said it would soon launch personal IBAN accounts across Europe, meaning customers can now have their salary paid into their Revolut account, and will soon integrate cryptocurrency within the app, allowing customers to hold, exchange, spend and transfer internally in Bitcoin, with Litecoin and Ethereum soon.

“We are also committed to improving our user experience by adding a wealth of new products in the coming months. From the integration of cryptocurrency to pay-as-you-go travel insurance at the tap of a button, we are demonstrating why we go ‘Beyond Banking’,” added Storonsky.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!