Wrisk wants to give insurance a digital upgrade and it is crowdfunding on Seedrs to finance its vision of of insurance. Wrisk is seeking a minimum raise of £500,000 at a pre-money valuation of £7 million. Launched today, the Insurtech company has already raised over £200,000 towards its first funding hurdle. Wrisk closed an initial “super-seed” round of £3,000,000 earlier this year.

Wrisk wants to give insurance a digital upgrade and it is crowdfunding on Seedrs to finance its vision of of insurance. Wrisk is seeking a minimum raise of £500,000 at a pre-money valuation of £7 million. Launched today, the Insurtech company has already raised over £200,000 towards its first funding hurdle. Wrisk closed an initial “super-seed” round of £3,000,000 earlier this year.

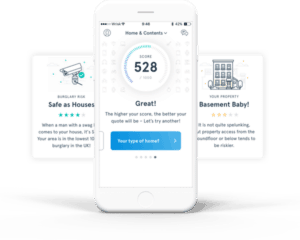

Citing opaque pricing, horrific customer service and infinite paper forms, Wrisk wants to shake up the antiquated insurance indinsutry with their smartphone app that makes purchasing insurance and filing claims a breeze. Wrisk says it has already secured partnerships with global brands such as Munich RE, BMW and Hiscox. Early investors include Oxford Capital, QIC, Hiscox and multiple angel investors. Last year, Wrisk was also selected to join the 2016 BMW Innovation Lab – the first ever Fintech business incubator in the automotive sector.

Insurance So Simple, It’s Almost Unrecognizable

So who is Wrisk?

The Insurtech is co-founded by Niall Barton, an executive with a 39 year career in traditional insurance. Barton, who is CEO of Wrisk. has been both a broker and underwriter. From 1984 to 2002, Barton was a director of DP Mann Holdings Ltd. He became Director of Underwriting in 1994 and continued the role till becoming Chief Executive Officer in 2000.

The Insurtech is co-founded by Niall Barton, an executive with a 39 year career in traditional insurance. Barton, who is CEO of Wrisk. has been both a broker and underwriter. From 1984 to 2002, Barton was a director of DP Mann Holdings Ltd. He became Director of Underwriting in 1994 and continued the role till becoming Chief Executive Officer in 2000.

Barton is joined by Darius Kumana who is described as an expert UX practitioner. Kumana was previously Head of Digital at specialist insurer Markel International where he helped build out their digital capability.

Barton and Kumana jointly stated;

“Insurance – the idea of sharing the loss of one against many – is a great idea, but frankly it’s embarrassing how badly it’s executed. We believe that consumers deserve better, so we’re giving insurance a much-needed digital upgrade. Wrisk will truly transform the user’s experience of buying, updating and claiming on their insurance. And while it’s no easy task, we’re delighted that household names such as Munich Re, Hiscox and BMW are willing to lend their support and help us realise our vision. We are also extremely excited to offer our future customers the opportunity to own shares in Wrisk through Seedrs, and to play a part in shaping our ambitious future.”

The management team is creating a single App for consumers to buy different types of insurance – from motor to travel, home to health. The team calls it “macro-insurance” where a single plan can cover all types of insurance. Customers will be able to swiftly and efficiently buy, update and claim on their insurance anywhere, anytime and with immediate effect using their smartphones.

The management team is creating a single App for consumers to buy different types of insurance – from motor to travel, home to health. The team calls it “macro-insurance” where a single plan can cover all types of insurance. Customers will be able to swiftly and efficiently buy, update and claim on their insurance anywhere, anytime and with immediate effect using their smartphones.

The Wrisk team has worked with actuaries and data scientists to develop a “Wrisk Score,” similar to a credit score, but for personal risk. This will allow customers to really understand the risks they face in their day-to-day lives, laying out steps to reduce those risks and bring their premiums down.

As well as targeting consumers who already buy insurance, Wrisk will also appeal to a previously untapped mass market – those who avoid buying insurance in the first place because the process is torture.

Mike Dennett, CEO BMW Group Financial Services UK, described Wrisk as a prime example of a strong startup that relates to auto finance;

“The insurance market is in desperate need of digital solutions that we can offer to our customers, and we are delighted that we will be giving our customers access to insurance through Wrisk. We have every belief that this business has significant potential ahead.”

Bronek Masojada, CEO of Hiscox one of Wrisk’s insurance partners, explained they were attracted to Wrisk’s innovative approach in improving the insurance customer’s experience;

“Their commitment to innovation and customer focus are very much in line with the Hiscox values and we are proud to partner with them.”

The Wrisk App will launch in Q1 2018, starting with contents insurance, followed by motor later in the year.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!