EquityZen, a secondary market for private securities and fund platform, recently posted an update on platform performance. The results are interesting.

EquityZen, a secondary market for private securities and fund platform, recently posted an update on platform performance. The results are interesting.

First of all, investing in any early stage firm is a risky endeavor. Many, if not most, early stage companies fail or meander along. As with any VC fund, the few successes will (hopefully) outweigh the many investments that do not perform well. As the securities crowdfunding sector is still very much in its early days and early stage investing is a long game – good data on performance is slowly trickling out. EquityZen provides access for accredited investors to participate in later stage firms that are pre-IPO. So how have the EquityZen investments performed?

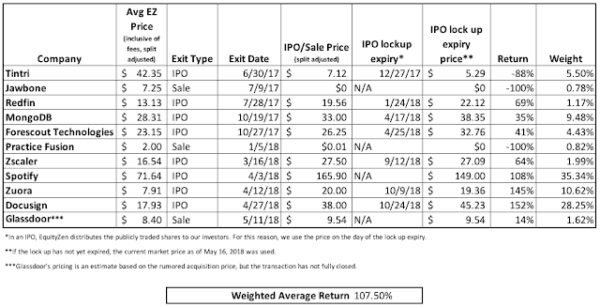

During the past five years, EquityZen has conducted over 4000 transactions in more than 100 private companies and some of those firms have exited. EquityZen reports that, while not all companies have faired well, their average investor has seen “very positive returns over the past 12 months.”

EquityZen states that in the past year, 11 portfolio companies have exited with 8 IPOs and 3 acquisitions. Of these exits 3 have not done well for their investors but the other 8 have.

To quote EquityZen:

“I am keeping the math simple here, as many of our funds invested at various times and price points across these companies, and investors may have sold at varying prices once the publicly traded shares were distributed to them. The weighted average return across these 11 companies would be 107.5% including any fees that EquityZen received. Furthermore, only three of the companies lost money for our investors and these three companies represented just 7% of the transaction volume that exited in the past year. Nearly a 30% failure rate may seem pretty high, but it pales in comparison to the 70% of startups that raise a seed round and go on to either shutter or never experience an exit event.”

[clickToTweet tweet=”‘The weighted average return across these 11 companies would be 107.5% including any fees that EquityZen received'” quote=”‘The weighted average return across these 11 companies would be 107.5% including any fees that EquityZen received'”]

EquityZen adds that returns experienced are in line with an aggressive, high growth tech investing approach with some investors losing all of their money and others generating 200% plus returns.

“…we are incredibly proud to have delivered an overwhelmingly positive return to our investors broadly and to continue to develop this market for all participants.”

Of course, historic returns are not necessarily indicative of future results but this is the data they have.

As with any type of investment portfolio, diversification is key to generating ongoing positive results. EquityZen says they are pleased to deliver, “singles, doubles, and triples for those seeking a more calculated high-risk investment.” As an investor, if you only invest in public markets you may miss out on gains driven by the private markets.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!