“Reaching New Heights”

The Cambridge Centre for Alternative Finance (CCAF) has published their annual report on alternative finance covering the Americas. According to Reaching New Heights: the 3rd Americas Alternative Finance Industry Report covering data for 2017, across the Americas alternative finance grew by 26% to reach $44.3 billion in 2017. The bulk of this amount was driven by the US accounting for 97% of the Americas market and $42.81 billion.

For this years report, 35 countries in the Americas were surveyed. This included survey submission from 234 unique platforms. In addition, external data was collated from 47 platforms. This represents an increase of 134% in platform coverage for the year.

Robert Wardrop, Director of CCAF, said this year’s report illustrates the uneven yet considerable growth of online alternative finance in many countries across North, Central and South America.

So how does this compare to the previous report, even with the change in platform coverage?

In 2016, CCAF reported $35.2 billion for the year. The growth rate was approximately 23% from the prior year. Throughout the last five years (2013-2017) the average annual growth stands at 89%. Total volume over the last five years amounted to $124.5 billion. Of this amount, 35% came in 2017 alone.

In 2016, CCAF reported $35.2 billion for the year. The growth rate was approximately 23% from the prior year. Throughout the last five years (2013-2017) the average annual growth stands at 89%. Total volume over the last five years amounted to $124.5 billion. Of this amount, 35% came in 2017 alone.

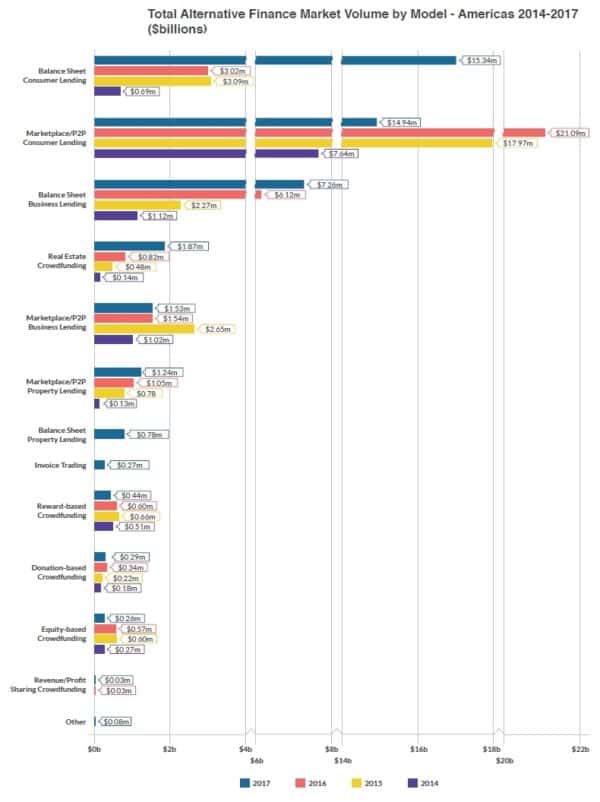

For the US, Consumer Lending was the key driver in the market. Balance Sheet Consumer Lending accounted for $15.2 billion (35.5% of market share) and Marketplace/P2P Consumer Lending accounting for $14.7 billion (34.3% of market share).

Canada, the second largest market, generated $868 million – a respectable amount for a country with a population that is a fraction of the US. The balance between Latin America and the Caribbean was $663 million.

The report notes that Canada saw considerable growth, up by 159% from $335 million in 2016 to $868 million in 2017. The Canadian alternative finance market was driven primarily by alternative business funding, which accounted for 61% of the total.

LATAM and the Caribbean grew by 94% from $342 million in 2016 to $663 million in 2017.

Brazil, Mexico, and Chile drove 78% of the region’s growth, with Brazil jumping ahead of Mexico and Chile to become the region’s market leader.

Not including the US, SME business financing was the clear market driver.

According to the report, 85% (or $566 million) of all alternative finance volumes across the region came from business financing. CCAF states this is particularly pronounced in Chile, where alternative business funding accounted for 27% of the overall Latin America / Caribbean (LAC) business funding market.

Diego Herrera, Financial Markets Lead Specialist for the Inter-American Development Bank (IDB), said that many regulators in the region use the series of studies that the University of Cambridge has published with the IDB support to design their policies and regulations.

Diego Herrera, Financial Markets Lead Specialist for the Inter-American Development Bank (IDB), said that many regulators in the region use the series of studies that the University of Cambridge has published with the IDB support to design their policies and regulations.

“In fact, many of the jurisdictions have understood the size of their Alternative Finance ecosystem with this reliable source of data,” said Herrera. “Regulation has become one of the most important drivers for the success of fintech ecosystems in the region through the mitigation of legal uncertainty and the creation of secure conditions for entrants. As the regional ecosystem evolves, so too does the Fintech policymaking and regulatory proposals.”

Juan Ketterer, Institutions for Development Manager, Inter-American Development Bank, added that this year’s report highlighted that alternative finance is a very dynamic Fintech vertical in Latin America and the Caribbean.

“The steady 94% growth is opening the way to the first yearly US $1 billion [total]. The region is using alternative finance to finance businesses with a total of US $566 million out of US $663 million. Alternative finance is part of the solution to close the gap of financial inclusion to more than 45 million Micro, Small and Medium Enterprises. The inclusion of numbers on gender, showing how, on average, 31 per cent of the fundraisers, while 32% of the funders are female, is a new key result. We will follow through this critical data to determine the effect of women in the alternative finance vertical.”

Some other interesting data points provided by the CCAF Americas report include:

- The US is the second largest alternative finance market in the world as it trails China (dramatically). As shared in the CCAF Asia report, China hit US $358 billion in 2017 growing by 47% versus year prior.

- Real Estate Crowdfunding increased by 128% to $1.8 billion in 2017 from $821 million in 2016. The model accounted for 4.2% of the total market in 2017 and grew by 128% annually.

- Balance Sheet Consumer Lending accounted for $15.3 billion, up an impressive 409% from the $3.0 billion in 2016. The model accounted for 34.5% of the total market in 2017. This was the largest model across the region.

- Marketplace/P2P Business Lending registered $1.5 billion, slightly down 0.33% from the $1.5 billion in 2016.

- Marketplace/P2P Consumer Lending reached $14.9 billion, down 29% from the $21.1 billion in 2016. This model accounted for 33.6% of the total alternative finance market volume in 2017 in the Americas.

- Equity Crowdfunding accounted for just $260.9 million in 2017, down 54% from $569.5 million in 2016. This sector is stagnating

- Rewards platforms are included as well. As with the other parts of the world, this sector is in decline down by 26%

- The research identified 48 platforms that pivoted away from ‘orthodox’ alternative finance models or were no longer active.

CI reached out to Tania Ziegler, the Lead in Global Benchmarking at the CCAF. Ziegler manages the Centre’s alternative finance benchmarking program that covers Europe, the Americas, Asia Pacific, and the Middle East and Africa. We asked her a series of questions related to the CCAF Americas report.

CI: Overall, what were your impressions of 2017 v. 2016 for the evolution of alternative finance in the Americas?

Tania Ziegler: 2017 saw a lot of growth across the region, but very much at different levels. In the United States, we observed steady growth (24% up from the previous year) but this driven largely by strong incumbent firms and, in particular, consumer lending activities. We noted that a handful of platform respondents from previous year’s had left the ecosystem for more traditional activities, there was some consolidation in the market, and there was a limited number of new entrants when compared to previous years.

Tania Ziegler: 2017 saw a lot of growth across the region, but very much at different levels. In the United States, we observed steady growth (24% up from the previous year) but this driven largely by strong incumbent firms and, in particular, consumer lending activities. We noted that a handful of platform respondents from previous year’s had left the ecosystem for more traditional activities, there was some consolidation in the market, and there was a limited number of new entrants when compared to previous years.

Canada saw exponential growth (159%), with a focus on finance for business borrowers. Unlike previous years, the Canadian landscape shifted away from non-investment model such as reward and donation crowdfunding, towards more sophisticated lending models. We also saw significant investment from Canadian platforms towards R&D activities, especially in process streamlining. Canada seems to have a strong emphasis on innovation-driven activities in lending.

CI: The US continues to dominate in the Americas yet trails China. Why is that?

Tania Ziegler: The US is certainly the market leader in the Americas, but is dwarfed considerably by China (whose market volume was $358 billion in 2017).

Simply put, China’s Fintech market is reflective of a retail investor environment that is far quicker to embrace technology, coupled with somewhat underdeveloped traditional banking options for both individual funders and fundraisers.

Yet, it is important to note that in 2017, we saw a significant slow down in alternative finance compared to previous years.

In our Asia-Pacific report this year, we noted that this downturn comes alongside profound industry shake-ups and regulatory changes. Though technology-enabled altfin models certainly will continue to grow in China, until regulation catches up, we expect that 2018’s figures will be somewhat dampened.

CI: In the US, Responses pertaining to regulations from platforms were highly divided. Which sector appeared to be more comfortable with the regulations? Did platforms highlight specific areas of improvement?

Tania Ziegler: Yes, this was a really interesting finding in our report.

The US opinion on regulation is very divided, especially when it came to equity-based platforms. Our survey found that in 2017, it was a near even split between platforms that felt that current regulation was ‘adequate’ or ‘excessive’.

Given the volume decrease and platform flight from Equity-based Crowdfunding in this year’s data-set, coupled with the significantly divided perceptions towards regulation, the research team wanted to understand the breakdown of the JOBS Act with respect to firms operating this model. Forty-five percent of firms operated under Title III [Reg CF], followed by 30% under Title II [Reg D 506c], 12.5% under Title IV (Tier 1) and 12.5% under Title IV (Tier 2) [Reg A+]. I was surprised to note that the 50/50 perception divide more or less held when we observed responses by Title as well.

CI: What about the emergence of traditional finance into the Fintech space. Is this becoming more apparent/relevant?

Tania Ziegler: Yes, absolutely.

I think that our upcoming 2018 results will really highlight this, as we began to see volumes in 2017 from ‘new-comer’ firms that have their roots in traditional providers. At the same time, I think we should be looking not only at traditional finance providers that are trying to develop ‘tech’ solutions to compete with fintech firms, but also BigTech firms and e-commerce/social media platforms that could make a big splash.

We see this already in Asia, and perhaps the new adage ought to be ‘ he who holds the data, holds the keys’.

CI: In LATAM, the alternative finance market is mainly for SMEs. Contrast the evolution in LATAM to the USA? [Diego Herrera, Financial Markets Lead Specialist, IDB responded to this question]

Diego Herrera: In LATAM, this year, data shows an increase in the regional market volume from US$324 million in 2016 to US$739 million in 2017, a 166% growth rate. When analyzed per countries, Brazil appears to have the most significant volume of origination in LAC with US$269 million (36% of the total), followed by Mexico (US$151 million, 20%), Chile (151 million, 20%), and Colombia (US$50 million, 7%). These four countries are responsible for more than 84% of the region’s total. These numbers yield a couple of interesting facts: First, Brazil is the largest market in the region overthrowing Mexico from that position. Second, all of these markets sustained rates of growth of more than 100%. For instance, Peru and Colombia increased their volumes more than ten times, when compared to 2016.

CI: Globally, do you believe institutional money is necessary for alternative finance platforms to thrive?

Tania Ziegler: For firms to thrive in the US, the availability of institutional money is very much key… In part because regulation has made it very difficult for these firms to successfully cater to individual retail investors.

Many of the firms that we saw significantly modify their operations or products did so to be more in-line with how the expectations or needs of their institutional investors. In many ways, when we look at the US market from a comparative perspective, the ecosystem is not very ‘crowd’ focused when compared to other high-growth jurisdictions (think UK, Europe).

For Latin America and the Caribbean, about half of all volumes came from Institutional Investors.

This is a fairly significant increase, as previous years had indicated that the LAC was predominantly a retail investors market. This development is important not just in terms of driving volume, but also in terms of how fintech firms are now collaborating and partnering with institutions. That is possibly more critical to a fintech firms’ deal origination and day-to-day business. I expect that this will really drive further growth across LAC, and engender more sophisticated models in the very near future.

CI: What about the emergence of blockchain based platforms. Any material impact (yet)?

Tania Ziegler: I don’t think that there has been a really true material impact just yet, but I imagine that in 2018 and 2019 we will see how crowdfunding firms will embrace potential blockchain solutions.

I also imagine that as the ICO space goes through its own regulatory growing pains, we may begin to see a blending of ‘orthodox’ altfin platforms adapting ICO-based options.

Finally, in our survey this year, we allowed platforms to indicate the currency that they would be reporting volumes in. We had Bitcoin as an option. We had only 2 platforms globally respond in Bitcoin. I am interested to see if that will change in 2018, but I am not holding my breath.

The CCAF Americas report for 2018, Reaching New Heights: the 3rd Americas Alternative Finance Industry Report is available below.