The Cambridge Centre for Alternative Finance (CCAF) has published its 4th annual European Alternative Finance report. The publication, entitled “Shifting Paradigms” – completed in partnership with the University of Agder in Norway, tracks the growth of alternative finance across Europe including the UK.

According to CCAF, in 2017 the alternative finance market grew by 36% to € 10.44 billion – dominated by the UK.

Excluding the UK, European online alternative finance industry grew 63% from €2.06 billion to €3.37 billion in 2017.

While growth remained strong, in 2016 the market grew 102%. Between 2013 and 2017, the average annual growth rate for Europe was reported at around 80%.

The UK captured 73% of the alternative finance market in Europe or more than €7 billion.

The top three European markets following the UK, include:

- France at €661 million

- Germany at €595 million

- The Netherlands at €280 million

- The Nordic countries collectively generated €449 million, making them the third-largest regional market in Europe following France and Germany.

In comparison, the Asia Pacific Market grew at a 4 year average growth rate of 145%. China accounts for well over 90% of the market.

The Americas, dominated by the US with 96% of the market, grew by just 26% versus year prior and an average growth rate of 89% over the past 4 years.

CCAF said that while Europe is smaller in contrast to the other two regions, it is noteworthy that Europe’s per-annum growth has been far steadier, growing 79% annually on average between 2013 and 2017.

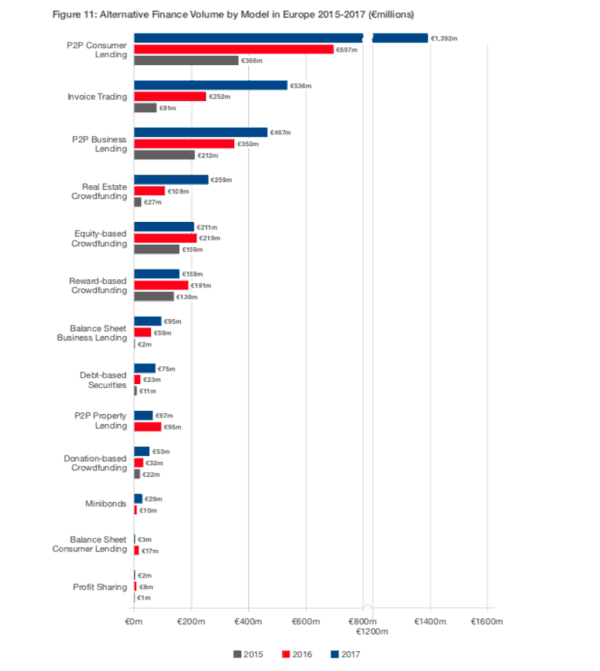

Regarding specific models, peer to peer (P2P) consumer lending accounted for 41% of all European alternative finance. Invoice trading came in second at 16% with P2P business lending at 14%.

Real estate (property) crowdfunding garnered 8% of the volume with equity crowdfunding at just 6%.

P2P consumer lending grew by 99.8% from € 697 million in 2016 to €1.392 billion in 2017. CCAF said this growth may be attributed to strong incumbent firms that have increased their operations internationally.

Invoice Trading grew even by jumping 113% between 2016 and 2017, increasing from €252 million to €536 million.

P2P Business Lending grew 33% from €350m to €467m and real estate crowdfunding jumped by 136% rising to €259 million from €109 million year prior.

Equity crowdfunding declined to drop from €219 million in 2016 to €211 million in 2017.

As with past reports, CCAF worked closely with Fintech platforms to garner the data correlated in the report. CCAF said that this year’s study gathered data from 269 platforms with reported operations in 2017. These 269 platforms were responsible for 519 unique data entries across 45 countries in Europe. CCAF is recognized as the leading research institute for the global alternative finance sector.

Professor Raghavendra Rau, Academic Director of the Cambridge Centre for Alternative Finance, said the sector continues to evolve in creating both new opportunities and challenges:

Professor Raghavendra Rau, Academic Director of the Cambridge Centre for Alternative Finance, said the sector continues to evolve in creating both new opportunities and challenges:

“It has, therefore, never been more important to understand its evolution and track the trajectory of its growth. This year’s report is entitled ‘Shifting Paradigms’ to emphasize the dynamics of this still relatively nascent marketplace, responding to consumer demands as well as recent regulatory changes.”

Dr. Kristin Wallevik, Dean of the University of Agder’s School of Business and Law, said that the report’s message of shifting paradigms is of relevance for the financial sector, business education, and research:

“Here, by focusing attention on the important financial aspects of our ever more digital lives, we actively contribute to more informed decision making, policy formulations, as well as responsible development of new industries.”

Seeking additional insight, Crowdfund Insider reached out to Tania Ziegler, CCAF’s Head of Global Benchmarking, and Rotem Shneor a professor at the University of Agder who worked on the report.

Seeking additional insight, Crowdfund Insider reached out to Tania Ziegler, CCAF’s Head of Global Benchmarking, and Rotem Shneor a professor at the University of Agder who worked on the report.

We asked about the slowing growth of digital finance and it this was a sign of maturation, competition or the overall economy.

Ziegler said this appears to be the result of maturation but that even with the slowing growth, Europe grew at a faster pace than other regions:

“The over-all European region (including the UK) grew by nearly 40% from 2016 to 2017. When we exclude the UK, this growth jumps up to 63%. On the whole, we are seeing strong incumbent Fintech firms across Europe, and an emphasis on internationalization. As more Fintech friendly regulation emerges across Europe, the landscape should continue growing steadily across the continent in 2018,” said Ziegler.

Shneor added that this maturation pertained to the early adopters’ segment but the vast majority of potential users still do not make use of alternative finance channel.

“The speed of future growth is hence uncertain, but ongoing long-term impressive growth will continue. The extremely high growth rates in earlier years were a result of very low starting volumes, but as volumes increase the growth rates will decline, even though in absolute terms impressive growth will continue.”

Germany stood out due to its rate of growth. We asked if there was a specific catalyst.

“P2P Consumer Lending, for the most part, was responsible for the jump in Germany’s volume,” explained Ziegler. “This model grew by 79% from €181.5m in 2016 to €325.3m in 2017. Activity was primarily driven by a large increase in the volume of one key platform.”

According to the report, institutional investment dropped precipitously (over 50%) in the equity-based crowdfunding model. Is this a concerning sign?

Zeigler said that while both institutional investment and overall volume for equity-based crowdfunding shrank in 2017, this does not necessarily mean that this model will not improve in 2018. Since this model complements traditional angel and seed-level investment activities, it is important to view this model within the broader European VC and PE activities that went on in 2017.

In 2017, while deal size was on the rise, the number of early-stage deals fell. As such, it is not surprising that early-stage investments across European Equity-based Crowdfunding models followed similar trends for 2017. While institutional involvement in Equity-based crowdfunding decreased, the involvement of retail investors remained steady.

Shneor said that equity crowdfunding is one of the models where a “regulatory blockage exists.”

Shneor said that equity crowdfunding is one of the models where a “regulatory blockage exists.”

“The high entry barriers in most countries and the limitations on the promotion of offerings pose serious challenges for platforms in this sphere. In most cases, platform requirements have been very similar to those of traditional investment firms, which lead to traditional thinking and biases even among platforms who do operate. In addition, this also leads to a certain degree of platforms using regulation to block entry of new entrants and focus on relatively large ticket campaigns. All of these together pose a certain departure from idealistic notions of opening up the market and democratizing it, and the results are slower growth overall.”

We asked if Brexit having an impact in the UK as well as continental Europe. Zeigler said, while it is possible, it is too early to say what the impact is or may be. Zeigler noted that the UK continued to grow and made up the largest share of total regional volume – though this decreased from 81% in 2016 to 73% in 2017.

“Interestingly, 2017 saw a lot of internationalization of platform operations, with UK firms operating across Europe significantly. We also recorded a number of strong EU firms driving UK-fundraiser volumes. At present, firms are able to take advantage of certain harmonized rules but we don’t know how Brexit will affect this once the UK leaves the EU. We do know that several British platforms operating outside of the UK have developed contingency plans. Additionally, some countries have noted increased interest by British platforms opening offices to utilize passporting rules.”

The European Commission continues to discuss the creation of a pan-European securities crowdfunding exemption. This policy aligns with CMU but, as of yet, has not occurred. So will a single market online capital formation approach help to drive sector growth and utilization?

“In general, unified regulation would establish a helpful baseline for regulating the sector in regions that are still developing or have not yet implemented guidelines for operating in the market,” said Ziegler. “It should help continue to drive sector growth – particularly through equalizing international barriers to entry for platforms with newer markets. Moreover, platform survival depends on ability to reach scale, which remains a challenge in most small countries in relying only on domestic market. Harmonization of regulation will help increase volumes, experience and actual funding for projects currently underfunded.”