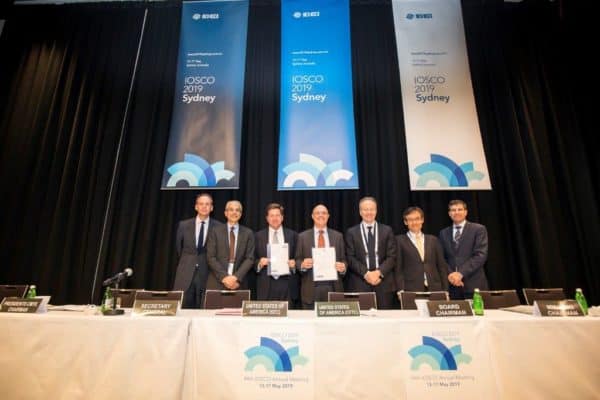

The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have both signed the IOSCO Enhanced Multilateral Memorandum of Understanding Concerning Consultation and Cooperation and the Exchange of Information (EMMoU). The announcement comes following the 44th Annual International Organization of Securities Commissions (IOSCO) Conference which took place last week in Sydney, Australia. The EMMoU seeks to boost cross-border enforcement amongst the IOSCO members.

IOSCO is the international forum that brings together the securities regulators from around the world to discuss and coordinate on issues of mutual interest. IOSCO works both with the G20 and the Financial Stability Board (FSB) on the global regulatory reform agenda.

During the Sydney meeting, participants engaged it a wide variety of topics impacting the securities industry today. Topics addressed, “What is the role of securities regulators in sustainable finance?” Or “Are regulators agile enough in the face of rapidly evolving Fintech innovation?”

The EMMoU builds upon a previous MMoU signed by 123 regulators in 2002. Both the CFTC and the SEC were signatories of that document as well. The predecessor document is viewed as the “benchmark for cross-border cooperation in enforcement.”

In the past 17 years, things have changed in global markets. Signatories of the EMMoU have agreed to “new forms of assistance critical to effective enforcement, such as obtaining compelled testimony and obtaining asset freezes to protect customer funds, among other powers.”

SEC Chairman Jay Clayton who attended the IOSCO event stated:

“As investment products, services and markets evolve, it is critical that the international community of securities and derivatives regulators continue to cooperate to protect investors from bad actors perpetrating fraud across borders. The SEC took an active role in negotiating and drafting the EMMoU with the intent of building upon the tremendous success of the MMoU in facilitating international cooperation. This signing demonstrates the SEC’s continued strong commitment to combatting securities and derivatives fraud against American investors – including fraud which is carried out outside our borders.”

CFTC Chairman J. Christopher Giancarlo, who was also in attendance, added:

“The CFTC is proud to be part of the inaugural group of signatories to the EMMoU and to demonstrate its commitment to international enforcement cooperation. In today’s world of rapidly evolving technology and increasingly global financial markets, securities and derivatives violations frequently involve cross-border misconduct. As a result, effective enforcement requires that regulators around the world ensure that they are able to cooperate fully with their regulatory counterparts to ensure that investors are protected, markets are safeguarded and wrongdoers are held accountable.”

What are the key new EMMoU powers?

The additional key powers that IOSCO has identified as necessary to ensure continued effectiveness in safeguarding market integrity and stability, protecting investors and deterring misconduct and fraud include:

- To obtain and share Audit work papers, communications and other Information relating to the audit or review of financial statements

- To Compel physical attendance for testimony (by being able to apply a sanction in the event of non-compliance).

- To Freeze assets if possible, or, if not, advise and provide information on how to Freeze assets, at the request of another signatory

- To obtain and share existing Internet service provider (ISP) records (not including the content of communications) including with the assistance of a prosecutor, court or other authority, and to obtain the content of such communications from authorized entities.

- To obtain and share existing telephone records (not including the content of communications) including with the assistance of a court, prosecutor or other authority, and to obtain the content of such communications from authorized entities.

Additionally, The EMMoU envisages the obtaining and sharing of existing communications record held by regulated firms.