RDC (Regulatory DataCorp) announced on Wednesday it has renewed its agreement with UK-based digital banking group Monzo to help fight against anti-money laundering for the bank’s U.S. launch. According to RDC, the partnership will build on the success of the past two years in the UK where RDC’s data and technology is used to screen for financial crime risk as some 55,000 new customers sign up for a Monzo account every week.

“The agreement in the US will maintain the highest level of risk coverage currently implemented across Monzo’s UK business operations, screening against global politically exposed persons, sanctions lists and adverse media.”

Also through the partnership, Monzo will be able to configure screening thresholds in the US according to their requirements in the region with the use of RDC’s precise risk filtering technology. Speaking about the collaboration, Natasha Vernier, Head of Financial Crime at Monzo, stated:

“Rapid growth and international expansion have played an important part in our decision to renew the agreement with RDC as our global compliance screening provider. We need a solution that not only provides the most comprehensive and efficient risk screening coverage but one that easily scales in line with our growth and expansion plans – and we are confident that by working with RDC our anti-financial crime processes will be future-proofed for years to come.”

Tom Walsh, CEO of RDC, then added:

“We are delighted to be a part of Monzo’s exciting growth plans working alongside their compliance team to deliver next-generation screening data and technology that will continue to effectively protect against financial crime risk. We know that speed, efficiency and scalability have been crucial to Monzo’s success over the past two years and we stand ready to continue delivering solutions that will meet and exceed their requirements as the bank goes from strength to strength.”

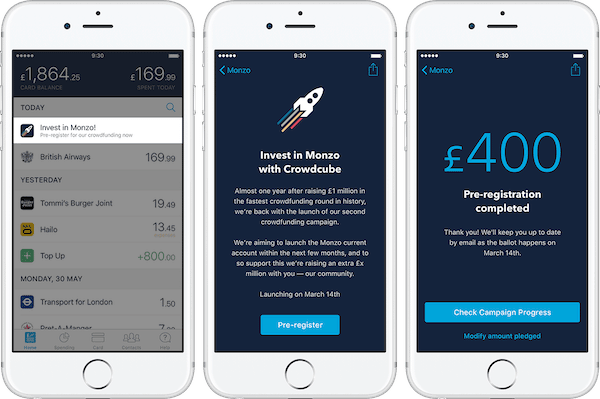

Monzo launched in the U.S. this past summer and said it never intended to stay just in the UK and the next stop was always in the U.S. The Monzo team stated they started in the U.S. with a “light version of Monzo.” First iterations included the following:

- Instant spending notifications

- Person to person payments

- Pots to split your savings from your spending money

- Friendly, 24×7, human customer service

- Fee-free spending abroad