Crowdfund Capital Advisors (CCA) and its co-founders have been a leading voice advocating on behalf of online capital formation since Sherwood “Woodie” Neiss and Jason Best helped to create the language of the JOBS Act law that legalized securities crowdfunding in the United States. Neiss continues to operate CCA as a data provider of online capital formation as well as a consultancy and advisor for the industry.

Recently, Crowdfund Insider connected with Neiss for an update on Reg CF including his perspective as to how it is performing today and how the securities exemption can be improved. Our discussion is shared below.

Overall, what type of performance did the Reg CF sector generate during 2019? (IE Number of deals, number of successful deals and total raised).

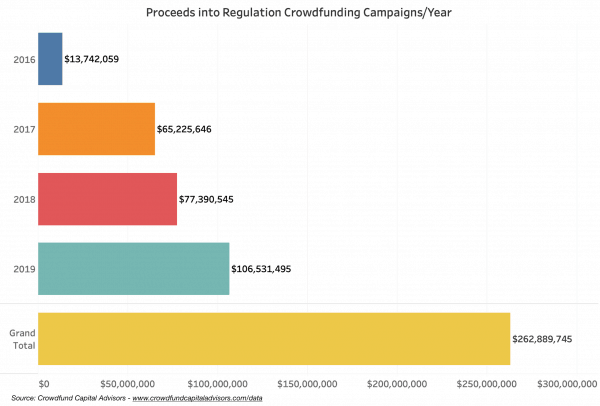

Sherwood Neiss: 2019 was an interesting year for Reg CF. While the number of offerings was down slightly, the total amount raised was up significantly and there were many follow on rounds by companies. In 2019, there were 714 offerings by 643 unique companies across 44 states in the Union (including Washington, DC and Puerto Rico). 47 of the offerings in 2019 were follow on rounds. Total offerings were down 6% from 2018. However, the total amount raised was up an impressive 37% from $77.7 million in 2018 to $106.5 million in 2019. The average raise of successfully funded companies jumped from $183k in 2018 to $270k in 2019. (The running average raise since the launch of Reg CF is $239k).

Sherwood Neiss: 2019 was an interesting year for Reg CF. While the number of offerings was down slightly, the total amount raised was up significantly and there were many follow on rounds by companies. In 2019, there were 714 offerings by 643 unique companies across 44 states in the Union (including Washington, DC and Puerto Rico). 47 of the offerings in 2019 were follow on rounds. Total offerings were down 6% from 2018. However, the total amount raised was up an impressive 37% from $77.7 million in 2018 to $106.5 million in 2019. The average raise of successfully funded companies jumped from $183k in 2018 to $270k in 2019. (The running average raise since the launch of Reg CF is $239k).

The 47 follow on rounds raised $18.8 million and their average raise was $400k. 680 companies closed their funding rounds in 2019. Of those, 58% were successful at hitting their funding targets. This success rate has remained fairly steady around 60% since the launch of Reg CF.

Based on these results we can conclude a few things:

a) Given the increase in average raises over time, Reg CF is a viable funding alternative for startups and small businesses that are facing the valley of death ($25k to $250k in capital that they cannot fund themselves) .

b) Given the 60% average success rate, companies seeking capital have a much greater chance of success with Reg CF than with pretty much any other funding alternative.

c) Given the geographic distribution of companies, Reg CF as a model has proven that communities across the country are capable of deploying capital into their local businesses and supporting valuable enterprises.

And d) Given the large number of follow on rounds and their higher average raises, Reg CF continues to be popular as a funding mechanism (and an alternative to Angels/VCs) well past an initial funding round.

From your data, do you discern a trend as to business sectors or geographies?

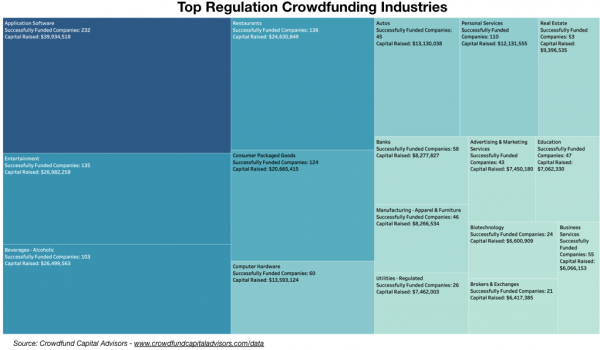

Sherwood Neiss: We map company offerings to Morningstar’s list of 69 industry groups. Since the launch of Reg CF, companies in 58 different industries have been successfully funded.

In 2019 the top industry groups were entertainment, application software, consumer packaged goods, restaurants, alcoholic beverages, real estate, biotechnology, computer hardware, education, utilities, personal services, advertising and marketing services, autos, consulting and banks. The majority of these industry groups were also present in 2018 with the exception of brokers, business services and medical devices that were part of the top industries in 2018 but were not in the top in 2019.

Typically 80% of the capital committed goes to the top 17 industries. While some might expect that the majority of capital goes to only a handful of industries, this is disproven in Reg CF.

The broad range of industries represented speaks to the wide appetite of Reg CF for both issuers and investors. It also speaks to those industries that are not typically venture-funded like entertainment, consumer packaged goods, restaurants, alcoholic beverages, education, personal services, advertising and marketing and consulting. Both of these are unspoken benefits of Reg CF.

Given the growth of Reg CF over time and the wide appeal of companies in a broad range of industries, we would expect Reg CF to continue to play an important role in funding companies that otherwise would not find capital elsewhere.

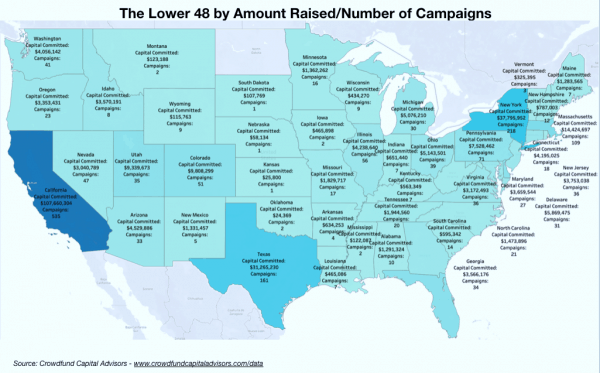

Since the launch of Reg CF, all states in the union (less North Dakota) have launched Reg CF campaigns. This speaks to the ability of this funding vehicle to democratize access to capital. That being said, 80% of the capital committed went to 12 states: California, New York, Texas, Massachusetts, Florida, Colorado, Utah, Pennsylvania, Delaware, Ohio, Michigan and Arizona.

If you compare this to both the public markets and where private equity/venture capital money flows you will see the same 3 states (CA, NY, TX) at the top for investments. There might be several reasons for this: a) These states have higher population density and more capital to fund startups and small businesses. b) Many startup ideas are offshoots from established companies.

If these companies are in the states with the most public/private funding, then by default these startups have a higher likelihood of being domiciled there. And c) there tends to be a more developed startup culture in California, New York, and Texas. If these companies are competing with established (or sexier) businesses for capital, Reg CF might provide them with a funding alternative they otherwise wouldn’t have. Interestingly enough, the top industries are different among the states. Entertainment companies led in California (although Application Software companies were a close second).

Application Software companies led in New York and Florida, But in Texas, it was restaurants and alcoholic beverages in Massachusetts.

It appears that where a state has a core competency in an industry, the startups (and hence the Reg CF companies) appear there as well.

Drilling down into each state, within California, San Francisco, Los Angeles, and San Diego had the most offerings, capital commitments and investors.

For New York, it was New York City and Brooklyn. And for Texas, it was Austin and Houston.

Again, major metropolitan areas with large population centers, developed startup cultures and developed industries.

Are most firms startups?

Sherwood Neiss: There’s an even split between startups and more established firms in Reg CF.

When looking at a company’s incorporation date in comparison to when they filed with the Securities and Exchange Commission to raise money, it appears that close to 50% of firms are less than 2 years old … squarely in the startup world. However, this means that the other 50% are more established. As a matter of fact, the data shows that in any year about 20% of the companies are more than 5 years old. These types of businesses typically qualify for more traditional financing. So it is interesting to see that despite the age of the firm, Reg CF has broad appeal among companies. The reason (or strategy) might be different for each type of company. The more established companies might be using Reg CF to turn their large customer base into investors. Typically these firms have loyal customers that are engaged in the business and want to support a company’s need for cash (typically for expansion purposes).

The startups might be turning to Reg CF because they are too early for Angels or VCs but have pre-IPO potential that the crowd is willing to take a risk on. Keep in mind that the average investment a crowd investor makes is around $1,000. What they are risking is much less than what an Angel or VC would. Hence the collective risk toleration of the crowd is less than that of individual Angels or VCs, however, the crowd’s combined investments may just equal the amount an Angel or VC would deploy into these seed rounds.

Either way, it turns out that Reg CF isn’t just for old or new companies. It is for all sorts of companies. And no matter the age of the firm, it is proven having the crowd as investors brings with it a new marketing opportunity as these crowd investors turn out to be passionate advocates for the companies they have invested in. And their collective voice tends to be greater than that of a single Angel or VC.

I believe you have generated some jobs created/economic impact numbers in the past. Do you have any data that you can share?

Sherwood Neiss: One of the reasons I am such a huge advocate for Reg CF is the economic opportunity it offers. We defined this in terms of jobs created and capital spent by companies using Reg CF as a funding tool.

When looking into jobs we compare the annual reports that companies file to the original jobs disclosed. Based on this, it appears that of all those companies that filed an annual report, there was a 22% increase in the number of employees between the year they filed to raise money and the year they filed their first annual report. Nearly one in three companies reported an increase in the number of jobs. The average increase in the number of jobs for those firms was an impressive seven.

From an economic perspective, these are companies all across the United States that are both raising funds and spending cash to support their operations. Since many of these enterprises are not in major metropolitan areas, the money that they are spending is typically with vendors within their communities.

This type of local investing and local spending is what helps prop up local economies. With that as the understanding take a look at the data. In 2016 when Reg CF launched, those companies that were successfully funded had revenues of $26M.

In 2019 revenues for those companies that were successfully funded jumped up to $202M!

Collectively since 2016, successful Reg CF companies have pumped almost $1B into local economies. While Reg CF can’t claim responsibility for all that $1B that is being reinvested into local economies by company purchases, if Reg CF hadn’t been there, it is very likely that a large percent of these businesses wouldn’t have had the cash they needed to grow and might be out of business.

You have advocated raising the Reg CF cap to $20 million from its current $1.07 million. What type of impact would this change generate?

Sherwood Neiss: While Reg CF democratizes access to capital and allows companies that might not otherwise receive funding, have access to it, its potential is greatly inhibited by the funding cap.

There’s no reason why not to increase (or remove altogether) the cap.

For one, there’s been no fraud taken place within this highly structured mechanism for raising funds.

2) Raising the cap doesn’t mean that the smaller offerings would be able to hit a $20 million target. It just means that those companies that are larger, more established, have a bigger customer/potential investor base, etc could benefit from this funding mechanism the same as the current market participants do.

3) From a regulatory perspective, more companies using Reg CF forces more market participants to disclose pertinent information about private companies and their financial well being that has never been disclosed before. More disclosures mean more investor protections. It also means more data for everyone (regulators, legislators, media, etc) to analyze and understand how to support pre-ipo startups and small businesses.

4) The SEC is currently looking for ways to harmonize private capital market offerings.

Currently, there are many different routes a company could take to raise funds. All of them come with their pros and cons.

Some of the biggest cons are state blue sky laws that are bureaucratic and costly and deter companies from using certain exemptions.

By increasing the cap, more companies could leverage this exemption. It would also allow the SEC to remove some of the less used exemptions that are too bureaucratic and too costly. This would improve efficiency in the private capital marketplace. In addition, unlike other exemptions, Reg CF tackles the Blue Sky issues while protecting investors by mandating disclosures for private companies.

Net-net, increasing the cap is not just in the best interest of issuers or the industry but investor protection and access to capital — the two pillars of the SEC.

There are over 40 different FINRA approved funding portals. Do you think they can survive in the current environment?

Sherwood Neiss: Platform evolution has been fascinating to watch. Ever since the launch of Reg CF, 72 platforms have registered with FINRA. 25 of them haven’t launched any campaigns. Of the 17 that had any volume in 2016, 6 of them are no longer around.

The 6 largest platforms in 2016 (Wefunder, StartEngine, Republic, Seedinvest, Nextseed and Microventures) are still the largest platforms in 2019.

Only 28 platforms had any volume in 2019 meaning that 44 have yet to launch, are out of business or heading in that direction. 5 new platforms with traction in 2019 include VidAngel Studios, Equitydoor, Stampede, Equifund, and Fundopolis. Only VidAngel Studio exceeded $1 million in commitments.

So based on the data, it seems that

a) there’s a lot of interest in launching new platforms,

b) the biggest players continue to grow and capture the vast majority of marketshare and

c) it is challenging for the smaller/newer platforms to gain traction.

This doesn’t mean that new players can’t enter the market. I think there’s room for platforms that want to focus on a demographic (women and minorities) or an industry (blockchain or cannabis) to come into the market and build traction. However, this will require a concerted marketing outreach to let potential companies know that a platform that specializes in them is open for business.

Industry participants have also pinpointed some other fixes needed to improve the exemption. Any thoughts on this?

Sherwood Neiss: I’m in full agreement with the fixes that the AIOP [Association of Online Investment Platforms] has brought forth in their position paper. Most importantly, the funding cap should be increased to $20 million.

The rest of the world seems to be moving their caps up but here in the United States, we are lagging behind.

Given our success and lack of fraud, the cap should be increased immediately. Also now that we know the funding model is working we need to remove limits on accredited investors that are sophisticated enough to understand the risks of investing in early-stage companies.

To further increase the likelihood of one of these companies being acquired, and to facilitate an exit that may benefit all investors, I believe the use of Special Purpose Vehicles should be allowed. This does nothing to reduce the ownership or rights of existing investors but facilitates corporate communication and the potential for acquisition, which may be in the interest of all investors.

I’m also a fan of allowing testing the waters. This addition would allow companies to see if there is sufficient interest in their offering before having to incur all the time and expense in putting an offering together.

Testing the waters increases efficiency without harming investors at all. A company that passes a testing the water phase still has to go through the process of raising the funds and hitting their funding target. If they pass the testing the waters phase but fail at their campaign, well then the investors aren’t harmed at all. There’s no downside to testing the waters.

Any predictions for the Reg CF sector for 2020?

Sherwood Neiss: The data shows capital is really starting to flow into the industry and I think by the end of 2020 almost half a billion dollars will have been committed to Reg CF companies.

Sherwood Neiss: The data shows capital is really starting to flow into the industry and I think by the end of 2020 almost half a billion dollars will have been committed to Reg CF companies.

Since the launch of Reg CF over 327,000 people have become investors in many of these pre-IPO startups and small businesses. I think we are near an inflection point where more eyes, ears, and dollars are focused on the crowd finance space. This should be assisted with an exit by one of the companies that ran a Reg CF offering. Since the launch of Reg CF there have been 75 offerings that have raised over $1 million. Of those, 15 were from companies that completed a follow on round of financing. This is indicative of a lot of crowd interest in these businesses, which should catch the interest of VCs, Private equity or a strategic acquirer. I wouldn’t be surprised to see the industry’s first “exit” this year. From the data, there seems to be 10 companies that should peak the interest of VCs or Private Equity based on capital raised, investor interest and annual growth. I think an exit will bode well for the industry. The media should be excited about it as there will be many in the crowd that see a multiple of their investment, not to mention the company founders that stand to become millionaires.

This will bring more eyes and dollars to other campaigns which should be the inflection point for the industry. Of course, another inflection point could be Congress or the Commission raising the cap to $20 million. Immediately you will have many midsize companies jumping into the online finance arena and the amount of capital committed would jump significantly. However, given their seemingly lack of interest in supporting capital formation for startups or small businesses, I won’t hold my breath.

As for us, we are broadening our dataset to include more online offerings. So we will be reporting on Reg A+, 506c and limited 506b deals. Mainly, we will be covering current platforms that are expanding their offerings to include these.

We are doing this for multiple reasons: a) there is more to online finance than just Reg CF, b) these other deals are larger in size and show the interest the crowd has in larger deals, and c) at some point all these deals will just be called “online” or “crowd finance” and hence we want to be on top of all the trends happening in this larger more inclusive space.