The Bitcoin Association, which is focused on the development and promotion of Bitcoin “Satoshi Vision” (SV) (a controversial Bitcoin Cash (BCH) fork whose developers and community claim that their project is the “real” Bitcoin or how its creator, Satoshi Nakamoto, intended it to be), claims that the BSV network can now compete with VISA in terms of the number of transactions processed per second.

The Bitcoin Association, which is focused on the development and promotion of Bitcoin “Satoshi Vision” (SV) (a controversial Bitcoin Cash (BCH) fork whose developers and community claim that their project is the “real” Bitcoin or how its creator, Satoshi Nakamoto, intended it to be), claims that the BSV network can now compete with VISA in terms of the number of transactions processed per second.

The Bitcoin Association (BA) also says that BSV transaction processors (the digital currency’s miners) are able to earn better returns than those who support the much more established Bitcoin (BTC) network.

The BA noted in its latest report that the Bitcoin SV scaling test network (testnet) had “consistently sustained 1,300 transactions per second for a prolonged period, in addition to handling a peak load of 6,400 transactions per second.”

The report added:

“To put the transaction capacity in perspective, the VISA network, which has long been viewed as the gold-standard for payment processors, handles an average of 1,700 transactions per second.”

It further mentioned that the Bitcoin SV testnet has managed to process blocks of nearly 2 GB in size, which reportedly contained a total of 7.877 million transactions.

Bitcoin SV (BSV) and BCH have forked from the original BTC protocol due to differences in how developers and their communities want to scale and make further updates to the open-source Bitcoin protocol.

BCH and BSV community members want to scale Bitcoin far beyond what the BTC developers aim to achieve (on-chain). Most BTC developers support layer-two scalability solutions such as the Lightning Network (LN), however, many members of the crypto community are critical of this approach as they claim that Bitcoin should be scaled on-chain. Otherwise, they argue that it’s not really Bitcoin that’s being scaled, as it’s just another separate network that’s processing transactions, which might not have been what Satoshi wanted.

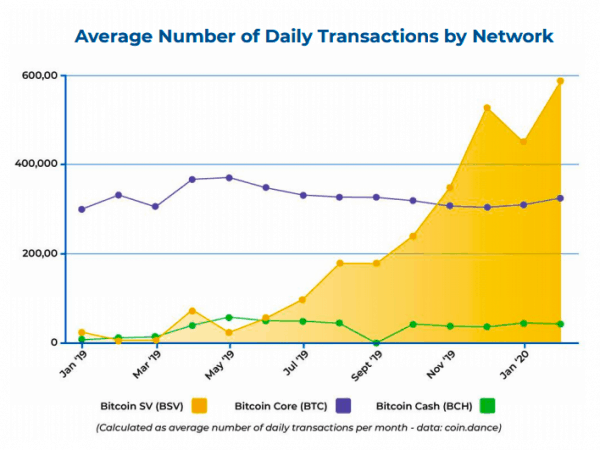

The annual report from the BA covers the time period from February of last year to February 2020. It claims that BSV provides better returns in the form of transaction fees than other versions of Bitcoin.

The report states:

“Bitcoin SV is emerging as the most profitable Bitcoin network for transaction processors (miners) to be working on, offering better returns than BTC on the majority of days from September 2019 to February 2020.”

According to data from Messari, the Bitcoin SV network only generated $255 in transaction fees during the past 24 hours (for its miners). Meanwhile, the much larger and more secure (due to network effects and other sound technical design choices) Bitcoin (BTC) network generated $214,199 in transaction fees, according to Messari’s calculations.

It remains unclear exactly how the BA came to its conclusions in its recent report.

During an interview with Crowdfund Insider, Steve Shadders, the CTO at nChain, a company focused on BSV development, explained why he (and the Bitcoin SV community) believe that their version of Bitcoin is the “real” iteration of the pseudonymous digital currency.

Shadders noted:

“Simply because the stated goal of the project is to restore Bitcoin to the original design described by Satoshi and lock it down in that state. To that end we have studied the whitepaper, the original code and later statements of Satoshi to try and understand it better. It is very clear that Bitcoin was always intended to scale massively on chain. Aside from the fact Satoshi himself said it directly there are obvious clues:

1) The first implementation implement direct IP2IP communication between peers

2) The whitepaper describes lightweight SPV clients interacting at the edge of the core miner network

3) The script language contains an op code enabling 4GB of data to be pushed to the stack.

4) There are fundamental incentives built into the system that give advantages to competitive miners that continuously invest in increasing their capacity.

This scaling is necessary for it to become useful on a global scale rather than a technical curiosity.”

Responding to a question about what the short- and long-term goals of the Bitcoin SV project are, Shadders said:

“Ultimately, to deliver a Blockchain that is capable of servicing the global population as a commodity ledger of transaction history. The first step is finalize the protocol in a state as close as possible to the original design. That work was substantially completed with the Genesis upgrade in February but some small changes will require one more hard fork to complete.

The second step is deliver a software implementation capable of horizontal scaling. We call the project Teranode and currently building prototypes. The design workshops for Teranode have been very informative.

We picked apart every process flow in Bitcoin at a detailed level to come up with an architecture that does not rely on any central coordination. What we found was there is nothing in Bitcoin’s design that is not fundamentally parallelizable. It’s almost as if the design carefully considered the future scaling needs and baked parallelism right into the protocol.”

When asked about why Bitcoin SV developers say that bigger block sizes will allow more transactions to be processed in a shorter period of time and at more affordable costs, and how this could potentially compromise the cryptocurrency network’s level of decentralization, Shadders remarked:

“‘Decentralization’ is a word that is often used in Bitcoin circles but rarely is it clearly defined. The whitepaper (quoted) makes the goal of Bitcoin clear which is to replace the need for a ‘trusted central authority’ with the Bitcoin network itself in order to enable ‘any two willing parties to transact directly with each other without the need for a trusted third party.’

A common misconception is that this property requires a large number of nodes. But what matters is nodes that can take action to enforce the Bitcoin rules. Miners write to the Blockchain. If you are running the bitcoin daemon and receive a dishonest block with an invalid transaction in it, you can’t do anything to sanction the miner that produced that block except for mine a competing block.

It doesn’t matter if there 3 miners or 3 million, it matters that the majority of hashpower acts honestly because if they do then an invalid block will be orphaned and no one will waste the resources to try. Mining is a huge investment and it makes no rational sense to go against the majority, as it will always be harmful to your investment. In fact the larger the investment the more a miner has to lose by attempting to go against the majority so arguably the larger a miner is the more incentivised they are act honestly.

If you define decentralization as the number of nodes on the network, people might be surprised to hear that the number of actual nodes (those that are mining blocks) isn’t very different between BTC and Bitcoin SV. Although it’s not as simple as that because each node may service many actual miners via mining pools.”

During the interview, Shadders had said that it would be a good idea to tokenize fiat currencies or traditional assets on the Bitcoin SV network.

He explained:

“The Bitcoin blockchain can be used as a base carrier layer for any application that requires an immutable, ordered record of events. Fiat transactions are an example of this. It is fast, cheap and efficient, it has global reach and offers features that current transaction processing facilities do not so it’s a no brainer that central banks are exploring the idea of tokenizing their currencies.

I think this is a likely a pathway to further adoption of Bitcoin. Fiat is well understood by consumers and business alike so the psychological barrier to entry is lower and when the utility is demonstrated it will be easy to get people using it. In the process they’ll also be using Bitcoin even if they don’t realise it.

Fast forward a decade or two and with high utility, the price of Bitcoin should stabilize since it’s underpinned by something of substance. At this point, people will start to realize that transacting in the native Bitcoin token is even more efficient and therefore cheaper.”