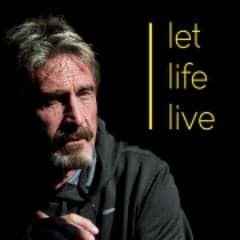

John McAfee, a blockchain advocate and former software entrepreneur that created McAfee ant-virus software, is the target of a Securities and Exchange Commission (SEC) enforcement action pertaining to the promotion of initial coin offerings (ICOs).

John McAfee, a blockchain advocate and former software entrepreneur that created McAfee ant-virus software, is the target of a Securities and Exchange Commission (SEC) enforcement action pertaining to the promotion of initial coin offerings (ICOs).

The civil action by the SEC was joined by criminal charges brought by the Tax Division of the US Department of Justice in an indictment that was filed last June but unsealed today.

The SEC’s complaint, filed in the U.S. District Court for the Southern District of New York, charges McAfee and Jimmy Watson, Jr., described as McAfee’s bodyguard, with violating antifraud provisions of the federal securities laws, violating the anti-touting provisions, and Watson with aiding and abetting McAfee’s violations. The complaint seeks permanent injunctive relief, conduct-based injunctions, return of allegedly ill-gotten gains, and civil penalties. The SEC also seeks to bar McAfee from serving as a public company officer and director.

The DOJ’s June 15, 2020 indictment was unsealed following McAfee’s arrest in Spain where he is pending extradition.

According to the DOJ’s indictment, John McAfee earned millions in income from promoting cryptocurrencies, consulting work, speaking engagements, and selling the rights to his life story for a documentary. The DOJ states that from 2014 to 2018, McAfee allegedly failed to file tax returns, despite receiving considerable income from these sources. The indictment does not allege that during these years McAfee received any income or had any connection with the anti-virus company bearing his name.

According to the DOJ, McAfee allegedly evaded his tax liability by directing his income to be paid into bank accounts and cryptocurrency exchange accounts in the names of nominees. The DOJ indictment further alleges McAfee attempted to evade the IRS by concealing assets, including real property, a vehicle, and a yacht, in the names of others.

Regarding the SEC’s allegations, McAfee, along with his purported bodyguard Watson has been charged for promoting ICOs via his Twitter account without disclosing he was being compensated to do so. McAfee’s Twitter account has over one million followers, many of which followed the iconoclastic personality due to his comments pertaining to blockchain technology as well as comments regarding deep state activity.

According to the SEC’s complaint, McAfee promoted multiple ICOs on Twitter. The SEC claims that McAfee pretended to be impartial and independent even though he was paid more than $23 million in digital assets for the promotions.

The SEC alleges that when certain investors asked whether he was paid to promote the ICOs, McAfee allegedly denied receiving any compensation from the issuers.

The SEC’s complaint also alleges that McAfee made other false and misleading statements, such as claiming that he had personally invested in some of the ICOs and that he was advising certain issuers.

The SEC alleges that Watson assisted McAfee by negotiating the promotion deals with the ICO issuers, helping McAfee cash out the digital asset payments for the promotions, and, for one of the ICOs McAfee was promoting, having his then-spouse tweet interest in the ICO. The SEC claims that Watson was allegedly paid at least $316,000 for his role.

The SEC claims that while McAfee and Watson profited, “investors were left holding digital assets that are now essentially worthless.”

The SEC’s complaint also alleges that McAfee and Watson engaged in a separate scheme to profit from a digital asset security by secretly accumulating a large position in McAfee’s accounts, touting that security on Twitter while intending to sell it, and then selling McAfee’s holdings as the price rose.

“Potential investors in digital asset securities are entitled to know if promoters were compensated by the issuers of those securities,” commented Kristina Littman, SEC Cyber Unit Chief. “McAfee, assisted by Watson, allegedly leveraged his fame to deceptively tout numerous digital asset securities to his followers without informing investors of his role as a paid promoter.”

If convicted of the charges brought by the DOJ, McAfee faces a maximum sentence of five years in prison on each count of tax evasion and a maximum sentence of one year in prison on each count of willful failure to file a tax return. McAfee may also face a period of supervised release, restitution, and monetary penalties.

The DOJ adds that an indictment merely alleges that crimes have been committed. The defendant is presumed innocent until proven guilty beyond a reasonable doubt.

SEC v. John David McAfee and Jimmy Gale Watson Jr.

USA v. John David McAfee