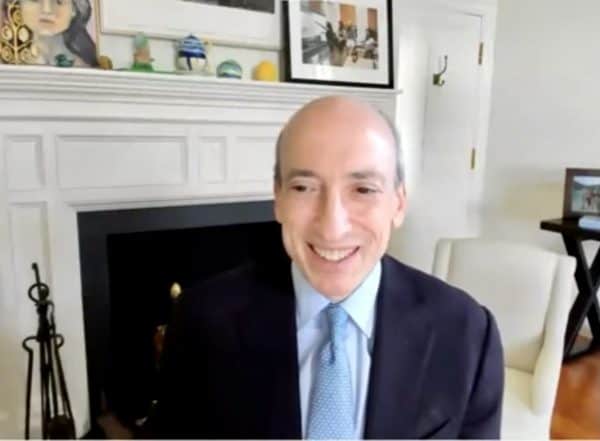

Gary Gensler, the Chairman of the Securities and Exchange Commission (SEC), testified today in front of the House Subcommittee on Financial Services and General Government, part of the Appropriations Committee, where he presented the litany of challenges his agency faces including emerging Fintech issues.

The first question posited by the subcommittee Chairman Mike Quigley, inquired about crypto and Gensler said he believes there are gaps in the system:

“I think the bigger gap is around what is called exchanges, crypto-exchanges. I would think, if we could work with Congress, to bring investor protection to the platforms where these – sometimes commodities, sometimes securities, are trading on the platform.”

Gensler said his concerns included front running orders – something you cannot do with listed stocks. Gensler wants to bring similar protection to crypto investors as you may see at the NYSE.

In prepared remarks, Gensler addressed multiple topics of note.

Regarding SPACs, Gensler said the SEC has 700 S-1 filings year-to-date for blank check firms. Gensler said this surge of SPACs has raised policy questions as to whether investors are being protected and are retail investors receiving the information they need. He questioned whether, or not, SPACs fit into the SEC’s mission of a fair and orderly market.

“It could be the case that SPACs are less efficient than traditional IPOs. One recent study shows that SPAC sponsors generate significant dilution and costs. SPAC sponsors generally receive 20 percent of shares as a “promote.” The first-stage investors can redeem when they find the target, leaving the non-redeeming and later investors to bear the brunt of that dilution. In addition, financial advisors are paid fees for the first-stage blank-check IPO, for the PIPEs, and for the merger with the target. Further, it’s often the case that the investors in these PIPEs are buying at a discount to a post-target IPO price. It may be that the retail public is bearing much of these costs.”

Gensler said he has requested that SEC staff propose recommendations for the Commission for possible rules or guidance in this area.

Regarding crypto, Gensler said there are many regulatory gaps in digital asset markets.

“… trading volume [in crypto markets] has ranged from $130 billion to $330 billion per day. These figures, however, are not audited or reported to regulatory authorities, as the tokens are traded on unregistered crypto exchanges. That is just one of many regulatory gaps in these crypto asset markets.”

Gensler noted that none of these digital asset markets have registered as an exchange.

“Tokens currently on the market that are securities may be offered, sold, and traded in non-compliance with the federal securities laws. Furthermore, none of the exchanges trading crypto tokens has registered yet as an exchange with the SEC. Altogether, this has led to substantially less investor protection than in our traditional securities markets, and to correspondingly greater opportunities for fraud and manipulation. The Commission has prioritized token-related cases involving fraud or other significant harm to investors.”

He also said that DeFi platforms and crypto lending platforms “raise a number of challenges for investors.”

If anything, Gensler has been pretty consistent in his public commentary on topics such as crypto. Clearly, crypto exchanges are under the microscope.

You can anticipate more regulatory action regarding crypto exchanges and digital assets – either directly from the SEC or in cahoots with Congress.