The UK Financial Conduct Authority has been tracking crypto holdings in the UK for some time now. Earlier today, the top securities regulator provided an update indicating the more people in the UK are now holding crypto in contrast to prior data. This is the 4th consumer crypto report shared by the FCA and data was gathered during January of 2021.

It is good to note that in January 2021 Bitcoin was around $41,000 soon moving to around $60,000. The rapid gain of the most popular crypto may have influenced some of the responses. Since the survey, Bitcoin, as well as other crypto-assets, have declined in value.

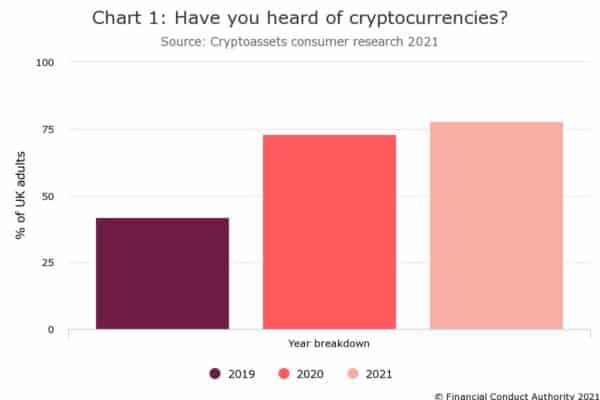

The FCA states that research indicates 2.3 million adults own crypto – up from 1.9 million adults a year ago. Additionally, awareness of digital assets is on the rise as now 78% have heard of crypto-assets in contrast to 73% year prior. This is in a country with a population of around 68 million including around 54 million adults. This means that about 42 million adults in the UK have some sort of awareness of crypto be it Bitcoin or other.

The FCA adds that while awareness is on the rise comprehension is waning with 71% of adults surveyed correctly identifying a definition of cryptocurrency from a list of options.

“Enthusiasm” for crypto is increasing as over half of crypto users saying they have had a positive experience and are likely to buy more (rising from 41% to 53%).

47% of crypto users are planning to buy cryptocurrency in the future with 30% indicating they will use previous gains from crypto to fund purchases. 17% said they have already done so and 26% said they will use other long-term savings or investments thus consumers appear to be optimistic regarding the path for cryptocurrency investment returns.

Fewer people also regret having purchased crypto, down from 15% to 11%.

Most consumers understand that purchasing crypto is a risky endeavor with 10% aware of the warnings being provided by the FCA.

Sheldon Mills, FCA’s Executive Director, Consumers and Competition, shared the following comment:

“The research highlights increased interest in cryptoassets among UK customers. The market has continued to grow, and some investors have benefitted as prices have risen. However it is important for customers to understand that because these products are largely unregulated that if something goes wrong they are unlikely to have access to the FSCS or the Financial Ombudsman Service. If consumers invest in these types of products, they should be prepared to lose all their money.”

The FCA crypto survey may be viewed here or below.