Last week the SEC’s Small Business Capital Formation Advisory Committee held a meeting to discuss the definition of an Accredited Investor. This definition decides who can, and who cannot, access certain private securities offerings – all based on an income or wealth metric. It does not matter how much education or experience you may have – it all comes down to the size of your bank account.

Most promising early-stage firms raise capital from angel investors, venture capitalists, and other wealthy individuals. These people back these firms with the hope they will generate higher, risk-adjusted returns. While these investments may entail a greater amount of risk than parking your money in a mutual fund, it also tends to be the preferred path for successful firms that eventually become publicly traded – meaning early investors can capture outsized returns. Today the individual choice of accessing many of these offerings is blocked for most of the population.

In a presentation, available below, the SEC’s Office of the Advocate for Small Business Capital Formation, provides a helpful outline as to how the definition is applied today for individuals and other entities. For an individual, you need to earn over $200,000 or have a net worth (not counting your residence) in excess of $1 million.

While any increase in the current wealth metrics applied to the definition will impact Reg D offerings, the most popular security exemption, it will also impact other, newer/updated exemptions, as outlined by the deck.

Impact on Offering Pathways:

- Rule 506(b) Private Placements allow companies to raise unlimited capital from investors with whom the company has a relationship without using general solicitation

- No limits on accredited investors

- Limited to 35 nonaccredited investors with enhanced disclosures

- Rule 506(c) General Solicitation Offerings allow companies to raise unlimited capital by broadly soliciting investors

- No limits on accredited investors

- Nonaccredited investors may not participate

- Regulation Crowdfunding (Reg CF) Offerings allow eligible companies to raise up to $5M in a 12-month period from investors online via a registered funding portal

- No limits on accredited investors

- Nonaccredited investors subject to investment limits

- Regulation A Offerings allow eligible companies to raise up to $20M in a 12- month period in a Tier 1 offering and up to $75M in a 12-month period in a Tier 2 offering through a process similar to, but less extensive than, a registered offering

- No limits on accredited investors in Tier 2; limits apply in Tier 1

- Nonaccredited investors subject to investment limits

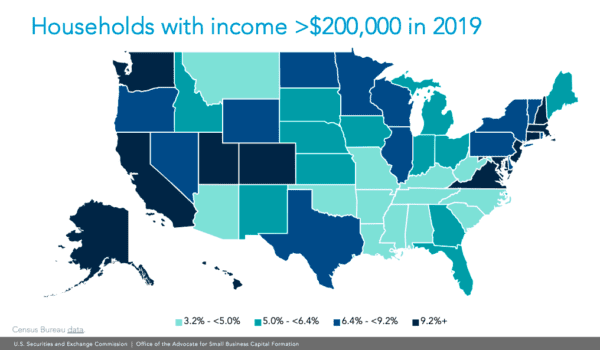

Within the presentation, it is also outlined how different parts of the country tend to represent more per household income than others. Certain metropolitan areas have a higher concentration of wealth than, say, flyover country. This means people in big metropolitan areas like New York City or the Bay Area qualify for greater access to private securities. At the same time, as the cost of living in much of the middle of the country is far lower than most urban areas, fewer people qualify as accredited because a six-figure income goes a lot further, say in Ohio, than mid-town Manhattan.

Another point made by the presentation is that households with higher incomes, or greater net worth, tend to be white or Asian, meaning other minority segments get cut out of this important market. This can have a pejorative impact on access to opportunity for underserved demographics.

The SEC should be looking to broaden the definition of an Accredited Investor – based on an individual’s ability to understand risk and a level of sophistication when it comes to a private securities offering. The data as outlined by the presentation should make that clear to current leadership at the Securities and Exchange Commission. Let’s hope they take these facts into consideration if they make a decision to change the definition.