The Bank for International Settlements (BIS) has issued a report on the interoperability of central bank digital currencies or CBDCs. While few countries have issued a CBDC, just about all developed countries, and some developing ones, are investigating the possibility of migrating fiat to a digital iteration. By the end of last year, approximately 25% of central banks were developing or working on CBDC pilots. These digital currencies could be used for interbank transfers or, perhaps, accessible to consumers and businesses. This specific report was crafted in partnership with the BIS Committee on Payments and Market Infrastructures, The BIS Innovation Hub, the IMF, and the World Bank.

The report states that central banks “must make critical choices on the access of non-residents and foreign financial institutions to central bank digital currencies (CBDCs), as well as ensuring multinational interoperability.” These are challenging options but the decisions must be made at an early point of CBDC development.

The report recognizes the differences between foreign banks, payment service providers, wholesale CBDCs (to wCBDC) and retail CBDCs (rCBDC). BIS also discusses another option where only domestic payment service providers gain access to the CBDC.

Obviously, the risks vary between the options but all must be studied.

The report states:

While CBDCs can enhance cross-border payments in various ways, eg by extending the availability of central bank money settlements around the clock and by eliminating the need for PSPs to act as liquidity providers, they will come with implementation challenges. Some of these are common to all types of money or traditional payment systems, yet some are specific to CBDCs, eg in terms of the required legal authority to issue CBDCs, macro-financial implications, controlling and monitoring CBDC holdings, and, depending on the technology used, different technical and operational challenges. The “clean slate” advantage of CBDCs, however, will allow central banks to address these challenges at an early stage.

There is no one size fits all – cautions the authors.

The report explains:

“Implementation of new payment systems takes time, while digital innovations are accelerating faster than ever. This, even when collaborating and coordinating on the design of their CBDCs, requires jurisdictions to build a CBDC ecosystem that is flexible enough to account for different forms of interoperability – interoperability and coexistence with the payment methods we have today, such as cash and commercial bank money, as well as interoperability with potential future types of public or private money, such as properly regulated and well-designed stablecoins. Any CBDC ecosystem must be built with the flexibility to adapt to a changing future. Other relevant considerations in the design of cross-border CBDC solutions, which may warrant cross-sectoral coordination, including ensuring compliance with AML/CFT rules, while safeguarding privacy and promoting competition.”

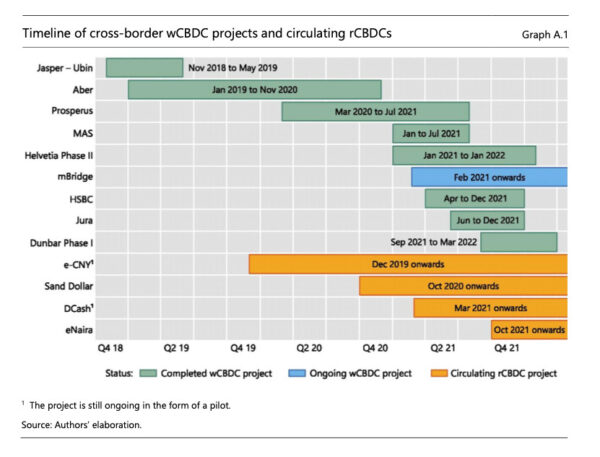

The report includes a helpful summary of the current projects around the world and the various statuses of CBDC initiatives.