Project Agorá: Central Banks and Banking Industry to Explore Tokenization of Cross-Border Payments

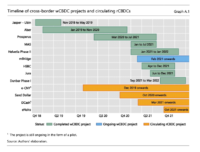

The Bank for International Settlements (BIS) together with seven central banks has recently announced plans to join forces with the private sector to explore how tokenisation can enhance the functioning of the monetary system. Project Agorá (Greek for “marketplace”) reportedly “brings together seven central banks:… Read More

Read more in: Blockchain & Digital Assets, Fintech, Global | Tagged bis, central banks, payments, tokenization