Prior to the US government’s decision to backstop all deposits, under the management of the Federal Deposit Insurance Corporation (FDIC), bank accounts were ONLY insured up to$250,000. While this amount has not been much of a problem in the past, last week, the world changed, and the Feds were compelled to backstop all deposits – either that or risk a financial meltdown. Clearly the right decision.

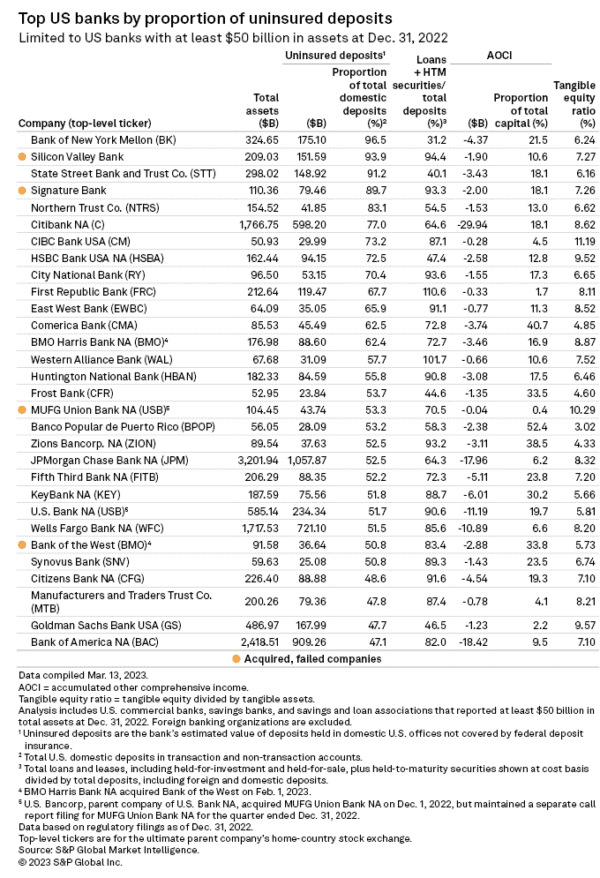

S&P Global Market Intelligence has distributed an overview of the extent of banks holding accounts over the $250K threshold. S&P reported that Silicon Valley Bank was at 94.4% and Signature BanK was at 93.3% at the end of 2022.

Among the three trust/custodial banks, Northern Trust had the highest ratio at 54.5%.

Silicon Valley Bank and Signature Bank held some of the highest proportions of estimated uninsured domestic deposits across the entire banking sector.

Silicon Valley Bank ranked second among banks with more than $50 billion in assets, while Signature Bank ranked fourth.

Only three other banks estimated uninsured domestic deposit rates above 80%. All three, Bank of New York Mellon, State Street Corp., and Northern Trust Corp., are large trust/custodial banks. However, when compared to Silicon Valley Bank and Signature Bank, the trio had much lower ratios of total loans plus held-to-maturity, or HTM, securities to total deposits.

S&P said that large US banks held $7.891 trillion in estimated uninsured deposits at year-end 2022, almost a 41% increase since the end of 2019. At the same time, deposits have started to flee banks as rates have moved dramatically higher and better income operations are available. Deposits at large US banks dropped to 47.3% of total domestic deposits from a peak of 50.5% in the fourth quarter of 2021. This is near the 45.9% ratio seen at the end of 2019.