DealMaker has emerged as a top online capital formation platform providing services to enable the primary issuance of securities across the full stack of crowdfunding exemptions. This includes Reg CF, Reg A+, and Reg D. At the same time, due to its base of operations in Toronto, DealMaker is able to help a firm raise capital in Canada. The company’s ambitions are global, but currently, much of its efforts are focused on the US due to the significant size of the market.

Co-founded by CEO Rebecca Kacaba, previously a partner at a large law firm, she is keenly aware of the importance of facilitating access to capital and the benefits of online capital formation.

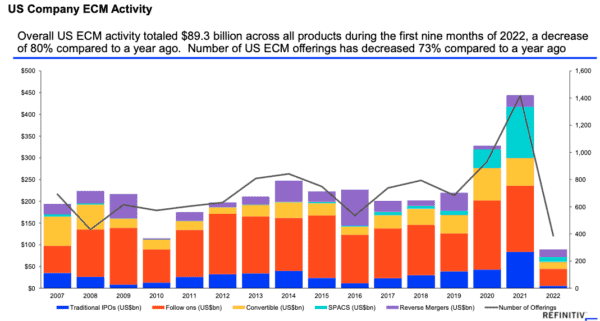

Recently, CI connected with Kacaba to discuss with her today’s capital markets and private securities. Asked about the current initial public offering (IPO) environment, which has declined along with the broader market, we asked her how policymakers could work to improve the situation. She said that according to recent data, IPOs have declined dramatically in 2023. As of Jun 12, 2023, IPOs are –42.86% less than the same time in 2022, which had 119 IPOs by this date. Globally, during the first quarter of 2023, there were only 86 IPOs, a 47% fall QoQ and the lowest total since Q4’13.

“It’s no surprise that companies are delaying their plans to go public—between inflation, the ongoing banking crisis, and generally poor stock market performance, many companies that are “ready” have decided to wait for better conditions,” said Kacaba. “The result is a massive backlog of large companies that “should” be publicly-listed, but aren’t. With billions of dollars in venture capital tied up in exit purgatory, earlier-stage companies are suffering from the downstream effects: fewer and smaller deals, with more investor-favored offering terms.”

Kacaba said that while economic conditions are adding pressure to the situation, the decline of the IPO has been a subject of concern for many years now.

“IPOs are an important “last step” in the funding lifecycle and are a key part of the public markets,” she explained. “Before 2000, typically, a company was private for 4-6 years before going public. Now, the average is 11-14 years. It’s the SEC’s responsibility to understand this trend and be able to see if out-sized costs and/or regulatory revisions are part of the cause.”

Kacaba added that as policymakers have increased the amount of regulation, the cost of becoming a public firm has increased dramatically. At the same time, wealthy investors have learned how to back promising young firms prior to going public. Unfortunately, this can cut out retail investors from participating in the wealth equation.

This week, the SEC’s Small Business Capital Formation Advisory Committee (SBCFAC) will hold its first meeting with its new members. The prior incarnation of the Committee expressed their concern that the SEC was not doing enough to support access to capital for smaller firms. In fact, they sent a letter to the Commission expressing their belief that small companies are at risk of “dying on the vine.” Is this hyperbole?

“No. Having gone through the challenges myself, few people understand how hard it is to be an entrepreneur,” said Kacaba. “Predatory financing is real and a concern and can kill a vibrant business. Investors need to make money but capital needs to go into the ecosystem at reasonable rates of expected return. Crypto threw a lot of this out of whack where investors expected gargantuan returns versus real businesses. Innovation is necessary for us to keep creating and predatory financing kills that. The American dream is what makes America great.”

The last Committee made many common sense recommendations, such as Finders and creating more avenues for smaller investors to participate in private offerings, she explained.

“Hopefully, the new Committee will do the same.”

Another top issue with Committee has been the definition of an Accredited Investor. Recently, the US House of Representatives passed legislation to broaden the definition. Kacaba said the current net worth requirements are “antiquated and go against an open market with equal opportunity.”

“The name and definition should evolve to Educated Investor. FINRA’s own survey shows how this new generation of investors is self-directed, relying on their own research versus hiring an advisor. Regulations that stifle investment opportunities to everyday Americans only serve to widen the wealth gap further. Although the intent is to protect – the result is simply to prevent the opportunity to treat retail investors as intelligent adults capable of managing their finances,” Kacaba explained.

She lauded the bi-partisan legislation that allows for a sophistication qualification that may rectify the current shortcomings.

As DealMaker is a large enabler for Reg A+ issuers, we asked Kacaba about secondary transactions and state rules that hinder the process. She believes that new rules should be incorporated to remove state “Blue Sky” impediments – similar to what Reg A did with primary offerings.

As for Finders, Kacaba supported SBCFAC’s recommendation to create a “simple playbook for Finders.”

“[Finders] are such an integral part of the small-cap ecosystem. Clearer regulations are better for everyone. This has been on the list for small business advocates for years. The SBCFAC has been a proponent of Finders. The last Commission attempted to create new rules. Unfortunately, Finders is not currently on the regulatory agenda for the Commission.”

And what about the Commission’s push into ESG – including pending rules on climate disclosure?

Kacaba believes the Commission needs to be realistic. The more regulation, audit, and reporting stress you put on public firms, the costlier the compliance becomes.

“Right now, the value proposition is hard for small-cap companies to adhere to these standards. If you drive that activity to ATS’s, that’s fine. You’re just creating an alternative regime. My position is that offering guidelines are acceptable, again – provided that they are at the right stage/size for the company and don’t unintentionally kill growth in the sector. Reviewing HealthTech and MedTech requirements are a good barometer of how more stringent regulations and disclosures directly impact innovation and investment in the space.”

As for some of the policies she would like to see the SEC, Congress, and the SBCFAC promote, Kacaba mentioned The Expanding Access to Capital Act (H.R. 2799)

that incorporates a substantial improvement to Regulation A+, doubling the maximum offering amount from $75 million to $150 million per 12-month period.

Kacaba said this change would be a “huge deal” for Reg A+ issuers as well as the broader equity crowdfunding industry. The exemption would become more attractive to larger, more established private firms that have greater capital requirements – especially when companies are staying private for longer and IPOs are at record lows.

The bill would also allow certain low-revenue companies to raise from accredited investors without needing to go through the cumbersome and expensive process of registering with the SEC. In short, H.R. 2799 would make it easier for small and medium-sized businesses to access capital and ensure innovation in all sectors is founded in the US.

Kacaba reiterated her opinion that policymakers must address the definition of an Accredited Investor as it currently does not reflect business acumen and education.

“The House Financial Services Committee recently heard testimony from entrepreneurs and VCs who argued that the current accreditation restrictions aren’t just onerous, they’re unfair,” stated Kacaba. “If Americans can legally gamble away their life savings at a casino, or spend the bulk of their income on lottery tickets, why should they be barred from participating in potentially high-growth investment opportunities that have a better rate of return than both of the above examples?”