Peer to Peer Lender Fincera Targeted by Local Chinese Government in Demand to Cease Lending Operations

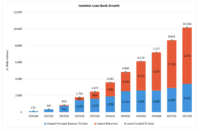

Fincera Inc. (OTCQB: YUANF), a China-based peer to peer lending platform providing access to capital for SMEs, has become the target of a local government attempt to shut down P2P lenders. According to a note from Fincera, the Hebei provincial government, where Fincera is based,… Read More

Read more in: Asia, Global, Investment Platforms and Marketplaces, Politics, Legal & Regulation | Tagged china, fincera, online lending, p2p, peer to peer, yong hui li