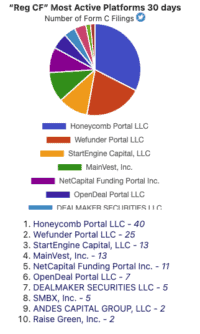

Honeycomb Credit Raised Money in Reg D Offering at the End of 2023

Honeycomb Credit, a FINRA-regulated Funding Portal, raised equity capital at the end of 2023. According to the Form D filed with the Securities and Exchange Commission, Honeycomb sold $8.844 million in shares of the firm. Of note, Honeycomb raised new money in the amount of… Read More

Read more in: Investment Platforms and Marketplaces | Tagged funding portal, honeycomb, honeycomb credit