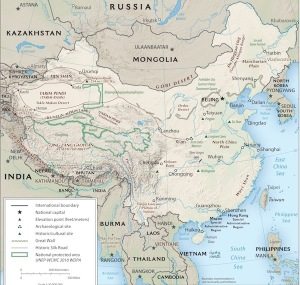

In mid – May a party was held in Shanghai, China, at the Hult International Business School. The event was held in recognition of the launch of SeedAsia – the first Pan Asia equity crowdfunding platform to service the region.

In mid – May a party was held in Shanghai, China, at the Hult International Business School. The event was held in recognition of the launch of SeedAsia – the first Pan Asia equity crowdfunding platform to service the region.

Many prominent business leaders were in attendance which also included a video message from crowdfunding luminary Jason Best from US based Crowdfund Capital Advisors.

SeedAsia was co-founded by Tom Russell who received his MBA in Shanghai. During a period with a tech incubator called Digital Asset Deployment in Shanghai, he came across UK crowdfunding platform Crowdcube. He immediately saw the enormous potential intrinsic to the concept of crowdfunding.

“there was an instant understanding that this was an incredibly powerful model that would change the world. The idea of taking something as powerful as equity crowdfunding and trying to have it accepted into Asia was too enticing to pass on. The journey started there and gradually a strong team has been built around the company.”

Crowdfunding in Asia has lagged other parts of the world in many respects which is surprising due to the phenomenal economic growth which has been experienced by many countries in the region. Perhaps the crowdfunding revolution is finally ready to take hold. Russell explained his perspective on Asian crowdfunding,

“Crowdfunding in its many different forms has developed at a slower space here in Asia than in North America and Europe, however, it is picking up momentum. In fact, as I write this, there is a ‘crowdsourcing week‘ conference in Singapore, which looks to be a thoroughly inspiring event with some great speakers associated with crowdfunding. I can also say that there has been a lot of interest in SeedAsia from both startups and investors in Asia. I would add that crowdfunding is gaining traction at a time when the startup ecosystem in Asia is becoming much stronger and increasingly transparent. The combination of the two trends could prove to be very supportive for the growth of the region.”

SeedAsia is focusing on the tech industry, providing potential investors with an efficient and transparent platform. Much of the discussion on Asia in the United States surrounds the fact that many countries in the region build the products designed elsewhere – but perhaps crowdfunding will spark a change. Russell describes SeedAsia positioning;

SeedAsia is focusing on the tech industry, providing potential investors with an efficient and transparent platform. Much of the discussion on Asia in the United States surrounds the fact that many countries in the region build the products designed elsewhere – but perhaps crowdfunding will spark a change. Russell describes SeedAsia positioning;

“..to enable early stage tech investment to become increasingly mainstream, whilst incorporating the characteristics of early stage investment such as the risks and the value-add of early investors. We aim to achieve this through providing a platform which offers pre-screened deal flow and a high degree of transparency around the startup and the investors who are interested in the deal or have invested previously.”

Much of the preparation for the site was invested in the regulatory environment. The diversity of the region has been a challenge for the  platform. SeedAsia believes they have the staff in place to manage the site and to assure deal flow and provide investors have a rock solid experience. Russell commented on managing the regulatory environment stating;

platform. SeedAsia believes they have the staff in place to manage the site and to assure deal flow and provide investors have a rock solid experience. Russell commented on managing the regulatory environment stating;

“The regulatory research for the team has been the bulk of the work since first coming across equity crowdfunding early last year. I can say that along the way we have met with half a dozen law firms and had many challenging discussions.

The final piece to the puzzle was hiring Andrea Cohen as full time legal counsel. She has a great depth of experience in this field from her work at Sharespost. We now have a firm grasp on not only how to secure SeedAsia investors, but also how to operate efficiently allowing SeedAsia to scale without a burdensome legal process.”

SeedAsia will be the first crowdfunding platform to pair qualified investors with pre-screened tech startups throughout Asia. The founders hope to create an information marketplace, capture economies of scale, and resolve current inefficiencies in capital allocation to high potential start-up companies across Asia.

SeedAsia will be the first crowdfunding platform to pair qualified investors with pre-screened tech startups throughout Asia. The founders hope to create an information marketplace, capture economies of scale, and resolve current inefficiencies in capital allocation to high potential start-up companies across Asia.

The SeedAsia process should streamline the time necessary in the capital raising process. Russell went on to explain the platform;

“We envision SeedAsia as a thoroughly mainstream investment platform for high technology startup companies based in Asia”

“We believe Asia is the place to be, the focus of energy and activity is here in Asia. We want to provide support and be an integral part of building this new era of innovation in Asia.”

Russell’s partner and co-founder of SeedAsia, Yelena Sedykh, clarified further the SeedAsia perspective;

“Asia is home to a fast developing entrepreneurial ecosystem with enormous worldwide market potential for its products. But it’s still disorganized and lacking in transparency. There is no easy way for investors to find and screen interesting companies.

SeedAsia offers this unique value to investors: first, access to information about great startups through its online platform, and second, the ability to invest efficiently

using standardized transactional forms. The work done by our team gives investors from most countries easy access to Asian startups that only a very few here even in Asia would have.”

Investors participating in SeedAsia are expected to invest as little as $2000 but up to $250,000 in the listed companies. An Investment Committee has been formed to vet the forthcoming companies ready to crowdfund their business.