Crowdfunding is exploding as a new way of attracting funding and financing for individuals, small businesses and entrepreneurs around the world. In 2013 alone the global crowdfunding industry was responsible for between $3 and $5 billion in funding. With the passage of the JOBS Act and the subsequent revision of 80-year-old US securities regulations, crowdfunding has become a formidable new source of funding for a variety of use cases. It’s truly one of those game-changing concepts that disrupts the traditional industries and players.

Crowdfunding is exploding as a new way of attracting funding and financing for individuals, small businesses and entrepreneurs around the world. In 2013 alone the global crowdfunding industry was responsible for between $3 and $5 billion in funding. With the passage of the JOBS Act and the subsequent revision of 80-year-old US securities regulations, crowdfunding has become a formidable new source of funding for a variety of use cases. It’s truly one of those game-changing concepts that disrupts the traditional industries and players.

Fraud in Crowdfunding

As crowdfunding becomes mainstream, the potential for fraud will inevitably increase. It seems that each new day is accompanied by a scathing article or op-ed warning that we need to protect the general public from the impending onslaught of boiler room con-artists. Indeed, the issue of fraud protection has transformed the process of legalizing equity crowdfunding into a grueling, complex and contentious three-year process – as regulators, industry stakeholders and special interests wrangled over new rules meant to protect investors from fraud.

The basis for the regulations is clear: In order for crowdfunding to become a viable and lasting means of funding for emerging companies, fraud has to be limited; unsuspecting contributors, donors and investors must be protected. Not many dispute these sentiments. However, before the crowdfunding industry is regulated as if it is the wild-west or an online red-light district, some basic questions should be answered: What is crowdfunding fraud? How prevalent is crowdfunding fraud? And, how can fraud be avoided, mitigated or prevented?

In order to discuss fraud, we’re going to have to define it in a crowdfunding context. While exploring the topic of fraud, one truth we have recognized is that defining fraud can be a challenge. The definition changes between contexts and jurisdictions. Having said that, we’ve taken some liberties in order to define fraud in a crowdfunding context while considering varying definitions and some oft-cited examples from the world of crowdfunding.

We will also explore some examples of alleged or perceived fraud in the crowdfunding space in an effort to understand what crowdfunding fraud looks like in the real world.

Survey of Crowdfunding Fraud Cases

In all the debate about crowdfunding fraud, one simple question seems to go unanswered: Just how widespread is fraud?

In all the debate about crowdfunding fraud, one simple question seems to go unanswered: Just how widespread is fraud?

We researched and reviewed articles, peer-reviewed academic studies, official and unofficial records covering nearly 10 years of crowdfunding. We also performed an extensive search for cases of crowdfunding fraud, and for similar cases where there were grievances and issues surrounding the conduct or outcome of a crowdfunding campaign.

While we will soon make this data available in an online format, we are actively soliciting verifiable cases of fraud or attempted fraud in preparation for a more formal academic study on the subject.

In clarifying the formal criteria for fraud for the purposes of crowdfunding and this study specifically, we offer the following refinements. Crowdfunding fraud occurs when:

- A crowdfunding campaign solicits and accepts money from backers or investors using deliberately misleading pretenses about the nature of the project or the expected outcomes;

- Backers or investors commit to funding a project, business or cause with a deliberate intention to cancel or reverse the transaction – or to extract returns not offered to other backers or investors;

- An intermediary attempts to aid or engage in the above behaviors, or deliberately fails to complete transactions.

Within this definition of fraud, there were very few reported cases of fraud – particularly when compared to the number of transactions and amounts involved. At the time of writing and to our best knowledge, there has been one case of alleged rewards-based crowdfunding fraud that resulted in a legal action being taken by a backer. In addition, there has been one case of alleged fraud committed by a backer of multiple rewards-based campaigns. Over 100 campaigns were said to be affected. There was also one case of rewards-based crowdfunding fraud that was cancelled before funds could be released.

We have also compiled a list of 30-40 cases of “possible fraud” – cases that fall into a gray area based on disputed facts and/or claims. Most of these cases are in the rewards-based crowdfunding industry. Based on the data we’ve compiled, no cases of investment crowdfunding fraud have been recorded to date.

Gray Areas: A Taxonomy of Crowdfunding Fraud

Due to the nature of crowdfunding fraud and the difficulties in proving specific cases, the crowdfunding industry might need a different kind of taxonomy to represent different situations that arise in crowdfunding campaigns. Based on a survey of the cases we’ve collected, here is a proposed taxonomy of fraud in a crowdfunding context:

Preempted Fraud

In “Preempted Fraud,” a suspicious crowdfunding campaign is shut down by the platform before any money changed hands. The policing is often done by members of the site (many who are just observers as opposed to contributors). Discussion often happens in public forums and platform administrators are alerted. In these cases, the escrow-protected nature of fund exchange proved an important safeguard for those backing a campaign.

Stillborn Fraud

“Stillborn Fraud” occurs when a campaign that is submitted for launch is summarily rejected by the platform. While campaigns are rejected for a variety of reasons ranging from technical errors to merely being incomplete, there are certainly many that get rejected because they carry a risk of fraud. They are filtered out before they are ever launched. This is equivalent of the round-one, open auditions for American Idol: It’s very obvious who the impostors are, and there’s no way they are ever going to proceed to the next round.

Crowdfunding platforms have a good incentive to avoid projects that might end up with contentious or disputed results. In today’s online culture, breaches of trust and reputation can be as damaging to a crowdfunding website as any bureaucratic investigation.

However, some dubious campaigns do slip through these first-tier fraud detectors, in cases such as:

Attempted Fraud

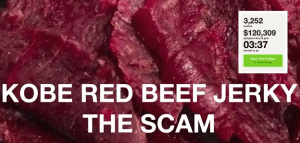

Attempted fraud could take place due to a campaign using IP that they did not own, or similar misrepresentations. While these deliberate attempts often are ‘preempted’ or ‘stillborn’, several campaigns have been launched that have used copyrighted IP or have disputable claims.

Attempted fraud could take place due to a campaign using IP that they did not own, or similar misrepresentations. While these deliberate attempts often are ‘preempted’ or ‘stillborn’, several campaigns have been launched that have used copyrighted IP or have disputable claims.

Cases of attempted fraud remind us that there indeed “bad actors” out there who, if given the chance, will try to use a crowdfunding platform to attract money from unsuspecting backers. They are good examples of how the transparency and public nature of modern crowdfunding platforms, by design, thwart these attempts at fraud. The effect of the Wisdom-of-the-Crowd does an effective job of “outing” these attempts before money changes hands.

Perceived Fraud

In these cases, accusations of fraud often come when the ‘perks and rewards’ are significantly delayed. Rewards-based crowdfunding has spawned a new category called ‘pre-order’ or ‘pretail’ crowdfunding – where backers get claim to an early version of the new product they are backing as a perk in exchange for contributing to the project. Startup companies with new product ideas are prone to delay and failure. It is not uncommon for backers to wait a very long time to receive their promised reward, and in some cases the project fails and the backer may never get the product.

Backer fraud

Fraud is not limited to those raising money. There has been at least one reported case where a contributor has deliberately pledged money to crowdfunding campaigns with the intent to withhold the funds, or to file a claim to get their money refunded.

Backer-Creator Fraud

There have been a few cases where project creators have contributed to their own campaigns either directly or through surrogates. This is further a gray-area since the intention may merely be to demonstrate some funding momentum or to ‘put the project over the top,’ but the crowd will sometimes respond negatively to this practice if they can even detect it. Ironically, there have been no reported cases (to our knowledge) of the most obvious backer-creator fraud scenario: Money Laundering. Either the inherent crowdfunding safeguards are preempting this situation, or the money launderers are indeed active and too clever to have been discovered.

Broker/Portal Fraud

Just like the social media revolution before it, crowdfunding has spawned hundreds and thousands of niche platforms – and thus increases the chance of fraud and other malfeasance. The greater the number of portals, the greater the risk that portal operators themselves may engage in fraud, or enable fraud. While this is a legitimate category, to date there have been no reported cases.

We Want More Fraud

While several articles and papers offered scathing critiques and warnings about crowdfunding fraud, none cite any successful cases of fraud. Examples cited in these studies were about the threat of fraud, or the potential for fraud. Even a recent study commissioned by the World Bank that addressed the issue of crowdfunding fraud in detail did not cite one case.

Crowdfunding and the transparency of social networks seem to be the antithesis of the proverbial boiler room. With that said, we want to gain a more comprehensive picture of fraud in the world of crowdfunding. It seems entirely fitting that we turn to the crowd to search for data.

Below is a link to a form where those in the crowd can submit potential cases of crowdfunding fraud for review and possible inclusion in an upcoming academic study on the matter.

Although individual contact information is not required, we would appreciate the inclusion of some contact information so we can give credit for the submission, follow up with questions and notify you when the study is complete.

Click here to submit a case of crowdfunding fraud

With your help, we may be able to offer some valuable insights on crowdfunding fraud – based not on conjecture, but on on actual cases and data; insights that can help guide and shape the next generation of crowdfunding regulations and best practices.

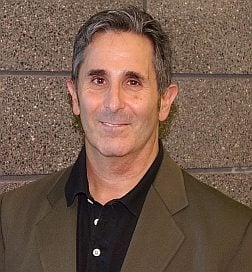

Christopher-john “CJ” Cornell, Ph.D., is Visiting Professor of Entrepreneurship & Innovation, and Director of Venture Development at Cogswell Polytechnical College in Sunnyvale, California. He is the author of many papers and articles on entrepreneurship, technology and on crowdfunding. As a serial entrepreneur, CJ Cornell has been founder or senior management of more than 10 successful startups, and recently was managing director of Propel Arizona, one of the largest crowdfunding sites in the US before it was acquired in 2014.

Christopher-john “CJ” Cornell, Ph.D., is Visiting Professor of Entrepreneurship & Innovation, and Director of Venture Development at Cogswell Polytechnical College in Sunnyvale, California. He is the author of many papers and articles on entrepreneurship, technology and on crowdfunding. As a serial entrepreneur, CJ Cornell has been founder or senior management of more than 10 successful startups, and recently was managing director of Propel Arizona, one of the largest crowdfunding sites in the US before it was acquired in 2014.

Charles Luzar is a programmer and journalist from Cleveland, Ohio. He is the Director of Crowdfund Insider and a recognized expert on the subject of crowdfunding.

Charles Luzar is a programmer and journalist from Cleveland, Ohio. He is the Director of Crowdfund Insider and a recognized expert on the subject of crowdfunding.