A recent study published by Cognizant addressing the fast growing peer to peer lending space in the United States. The report calls the market “maturing” and makes recommendations for participants to maintain growth. Prosper and Lending Club, the two largest P2P lenders in the space domestically, generated over $2.4 billion in loans during 2013. This was an impressive increase from the $871 million in loans in 2012. The total number is expected to increase dramatically in  2014. The amount of lending shifting to online platforms is finally starting to wake the sleepy banking industry.

2014. The amount of lending shifting to online platforms is finally starting to wake the sleepy banking industry.

The document shares some of the key findings of the research based off of a survey that took place from February to March of 2014. Approximately 11,000 respondents participated in the online sampling with about 700 indicating they had participated in P2P either as a lender or a borrower.

The authors state that P2P companies should address the following areas to encourage more lenders:

- Many believe that lending through marketplace platforms is risky, but are attracted by the solid rate of returns, which range from 7% to 24% per annum.

- Some would be willing to lend more often if they were provided with options such as immediate liquidity of funded loans, securing a part of the principal through insurance, updates on the borrower’s repayment track record and, importantly, if the marketplace platform was allied with traditional banks.

- There is a desire for provisions for bad debts and legal action against defaulters.

- Lenders are willing to extend domestic money transfer/international remittance based on the borrower’s credit scores or per- sonal guarantee. They believe that the receiver of the money will repay the loan. This can be a potential business model for cross-border remittance companies.

For the P2P borrower side of the equation:

For the P2P borrower side of the equation:

- They seek lower interest rates compared with banks and the opportunity to obtain loans despite a poor credit rating, and a quick and easy approval process.

- Some would like physical branches and opportunities for enhancing interactions with lenders through the digital platform.

The report closes with advice on the “way forward” including:

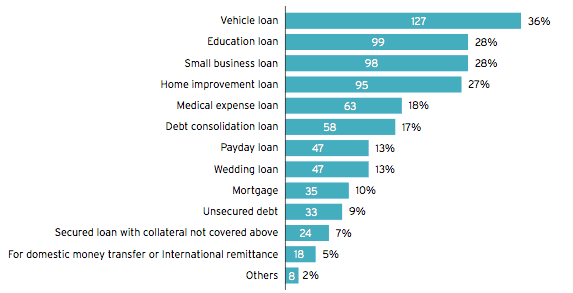

- Focus on vehicle and small business loans

- Focus on real estate and student loans

- Provide more options for lenders to analyze loans and borrowers

- Consider both financial and social factors for loan categorization. This includes social media indicators and past performance of borrowers.

- Provide quick approval of loans (although P2P lenders clearly beat traditional banks)

- Improve security of transactions

- Facilitate money transfer – both domestically and internationally

- Leverage existing bank networks

The complete report is available for download here.