Across the globe traditional banking operations are under attack by more nimble and user friendly companies that see opportunity in an industry that is in dire need of change. The internet and technology has completely altered so many different industries with its creative destruction. The finance industry happens to be next on the list.

While peer to peer lenders like Lending Club and OnDeck have captured headlines with their IPOs, the transformation is truly global and Canada is now seeing a rising tide of innovative financial entrepreneurs seeking to change the banking world across the provinces. Vancouver based Grouplend sees themselves as a “collaboration between tech entrepreneurs and financial industry veterans”. This is just what Canada needs.

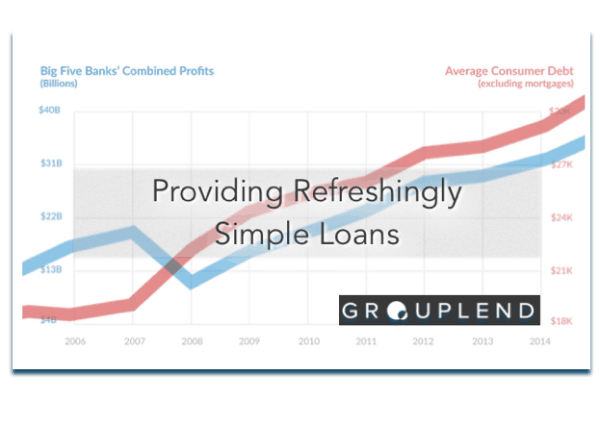

Founded by former banker Kevin Sandhu and successful software engineer Daniel Cowx, the pair note that the average Canadian’s debt has soared to over CDN $28,000 by the end of 2014. This is a situation where the problem is meeting a solution with peer to peer lending and the time is right for Canada. Recently I had the chance to catch up with Kevin to hear about his vision for P2P lending in Canada and the future of Grouplend.

Crowdfund Insider: How did you decide to launch Grouplend? What was the genesis for becoming an entrepreneur in the P2P space?

Crowdfund Insider: How did you decide to launch Grouplend? What was the genesis for becoming an entrepreneur in the P2P space?

Kevin: I spent a decade working in finance and grew frustrated with the lack of innovation and change. Industries around me were adopting new technology and data driven systems to deliver greater and greater value, yet finance and banking remained fundamentally unchanged for years, if not decades. At the same time, marketplace lending was taking off in many parts of the world, with Canada yet again lagging behind in innovation. I decided there was an opportunity to deliver real value to both borrowers and investors with a credit marketplace, driven by technology and data rather than manual and antiquated paper based systems.

A bank is a place that will lend you money if you can prove that you don’t need it. – Bob Hope #fintech #marketplacelending #p2plending

— Kevin Sandhu (@kevin_sandhu) January 13, 2015

Crowdfund Insider: Who are your co-founders who are helping to build Grouplend?

Crowdfund Insider: Who are your co-founders who are helping to build Grouplend?

Kevin: My co-founder and CTO, Daniel Cowx, has been instrumental in establishing the building blocks for Grouplend from a technology perspective. Security, stability and predictability are all critical to our business’s success and a strong technical foundation is core to our entire culture. The rest of the early team brought valuable skills in credit analysis, technology and marketing to help round out the necessary skills.

Crowdfund Insider: What is the regulatory environment for Peer to Peer lending in Canada? How does this compare to the US? The UK?

Kevin:Regulatory environment can be a bit tricky in Canada. In the current environment, it is only feasible to work with Accredited Investors and institutional partners to fund loans on a cost competitive basis. We hope that will change over time to allow a broader range of investors to participate but that’s the current lay of the land. On the lending side, we focus on consumer lending and do so on a direct basis, unlike common practice in the US where many platforms partner with existing banks to facilitate underwriting.

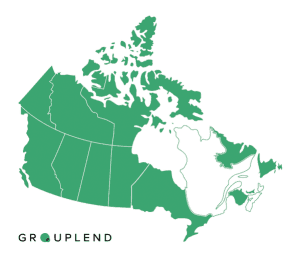

Crowdfund Insider: You are operating in all Provinces in Canada with the exception of Quebec and Nova Scotia. Will you begin operations in those provinces too?

Crowdfund Insider: You are operating in all Provinces in Canada with the exception of Quebec and Nova Scotia. Will you begin operations in those provinces too?

Kevin: Yes, we hope to be able to serve all Canadians in the near future.

Crowdfund Insider: How are you marketing / promoting the GroupLend services?

Kevin: We reach our customers in a number of ways, both direct and indirect. Education of the borrower market is key to delivering value and growing our business. We achieve that education through direct advertisements and through an affiliate partnership network.

Crowdfund Insider: What has your loan volume been since launch?

Kevin: As a private company, the exact amount is kept confidential but I can confirm that we are growing at very healthy pace and expect that to continue.

Crowdfund Insider: What is the total addressable market for your services (consumer credit) in Canada? Will you also target small business?

Kevin: Our focus in the near term will remain on consumer lending, but I wouldn’t rule out other product offerings if we felt that we could deliver value and leverage our existing capabilities. With respect to market size, a good rule of thumb is roughly 10% of the size of the US consumer credit market. We view the opportunity with our existing offering to be in excess of $30B.

Crowdfund Insider: How do you see Peer to Peer lending impacting traditional banks?

Crowdfund Insider: How do you see Peer to Peer lending impacting traditional banks?

Kevin: The ultimate impact of peer-to-peer lending on traditional banks is largely up to the incumbents to determine. Antiquated business models, legacy systems and high operating costs make them relatively uncompetitive with marketplace lenders but there are some aspects that banks continue to excel in, including extremely low costs of capital and large distribution networks. By working together, emerging technology driven lenders and traditional banks are capable of delivering the best value to borrowers and investors but it requires a large degree of cooperation. Without that cooperation, we are bound to see a slow decline of the traditional banking model, ultimately resulting in sheer obsolescence. The better outcome for all stakeholders will be difficult, but is achievable through open and transparent partnerships.

Crowdfund Insider: Will you integrate with institutional investors similar to Lending Club and Prosper (IE Orchard)?

Kevin: We work with Accredited Investors, both individual and institutional. Institutional investors are key to keeping costs competitive and allowing high growth platforms such as ours to scale quickly. We look forward to widening our investor base over time and will welcome institutional investors as part of that growth.

Crowdfund Insider: Do you see possibilities to expand beyond the borders of Canada? You have experience in Asian markets.

Kevin: It’s tempting, but the Canadian market has us quite busy for the moment. We would more likely expand into additional product offerings domestically before looking internationally.

Crowdfund Insider: Do you foresee an IPO in your future?

Crowdfund Insider: Do you foresee an IPO in your future?

Kevin: We are focused on growing the business and creating a lasting impact on the industry. At some point, the public markets may prove to be helpful in doing so, whether to access additional capital or raise general awareness. But those decisions are still some time away so no plans for an IPO at this time.

Crowdfund Insider: What are your thoughts on alternative forms of finance and the disruption that is ongoing?

Kevin: Decades of stifled innovation and lack of true advancement are finally giving way to an exciting time for financial services. Both borrowers and investors are benefiting from better value and greater convenience, while technology and data driven systems driving down costs and increasing accessibility to credit. I expect to look back in 5 or 10 years time to realize this was only the tip of the iceberg and I look forward to seeing what we and our peers achieve in that time.