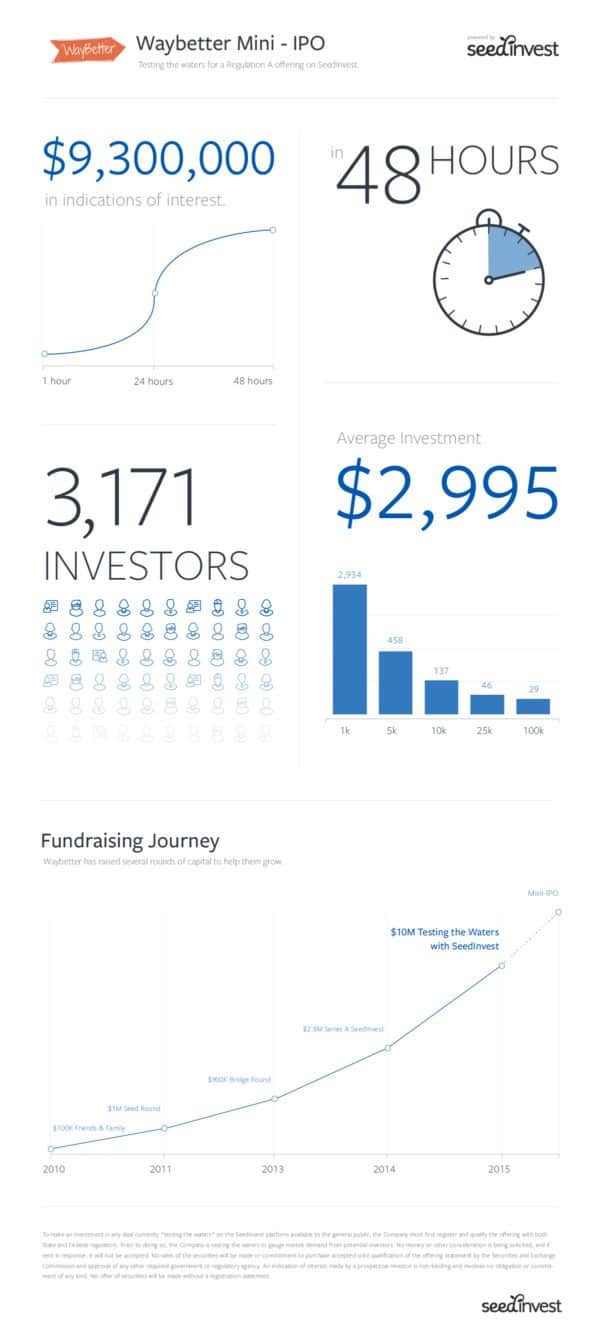

SeedInvest, an equity crowdfunding platform, announced on Friday that WayBetter, which runs the social dieting website, DietBet, successfully conducted one of the first “testing the waters” fund-raising campaigns under the new mini-IPO rules, which went into effect on June 19th. The company received $9.3 million of investment interest from 3,171 people within just 48 hours of listing. As of today indicated interest stands at almost $11 million.

The new regulation, under Title IV of the U.S. JOBS Act, enables high-growth private companies to raise up to $50 million from anyone. Historically, start-up companies were only permitted to raise funds from accredited investors, who comprise just the wealthiest top 2% of Americans.

The new regulation, under Title IV of the U.S. JOBS Act, enables high-growth private companies to raise up to $50 million from anyone. Historically, start-up companies were only permitted to raise funds from accredited investors, who comprise just the wealthiest top 2% of Americans.

According to SeedInvest CEO and Co-Founder, Ryan Feit, this change is particularly powerful for consumer-facing companies that have large-scale groups of passionate customers or users:

“Regulation A enables companies to offer shares to all of their loyal customers for the first time online,” said Feit. “WayBetter was the first company to leverage SeedInvest to take advantage of the recent changes and is a terrific example of the potential for mini-IPOs.”

Over 40 companies have raised capital through SeedInvest, but WayBetter was one of the first back in 2013. Since then, it has grown from 4 employees to 15 and increased its user base from 2,000 to over 270,000. The company has raised two rounds of capital on SeedInvest’s platform, as well as secured investments from River Park Ventures, Wilson Sonsini, Sparx Ventures, Kima Ventures, and Loeb Enterprises.

Over 40 companies have raised capital through SeedInvest, but WayBetter was one of the first back in 2013. Since then, it has grown from 4 employees to 15 and increased its user base from 2,000 to over 270,000. The company has raised two rounds of capital on SeedInvest’s platform, as well as secured investments from River Park Ventures, Wilson Sonsini, Sparx Ventures, Kima Ventures, and Loeb Enterprises.

The company plans to use the proceeds from its upcoming fundraiser to help create new social goal-setting applications, which encourage users to quit smoking, attend the gym, and improve sleep patterns. By gauging investor interest upfront through this campaign, the company was able to make a better-informed decision prior to conducting a Regulation A mini-IPO.

SeedInvest expects that WayBetter will be the first of many companies to leverage the historic changes in securities laws.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!