The king of banks, JP Morgan Chase, has decided to partner with a so-far unnamed peer to peer / marketplace lending platform as it seeks to adapt to the fast changing sector of online finance. CEO Jamie Dimon, speaking on a panel at a US Treasury event in Washington, DC, made the announcement in a round about fashion, according to a report from Bloomberg. Dimon stated;

The king of banks, JP Morgan Chase, has decided to partner with a so-far unnamed peer to peer / marketplace lending platform as it seeks to adapt to the fast changing sector of online finance. CEO Jamie Dimon, speaking on a panel at a US Treasury event in Washington, DC, made the announcement in a round about fashion, according to a report from Bloomberg. Dimon stated;

“We haven’t announced it yet, we’re going to be doing a thing with one of these peer-to-peer, small-business lenders. The kind of stuff we don’t want to do or can’t do, but there’s somebody else who can do it and do it probably well. So this is going to be collaborative.”

Dimon cautioned that P2P lending was not perfect;

“Some of this peer-to-peer stuff will end up being good; it won’t all be good. You can use big data, all this other data, non-traditional data, could determine whether someone is a good credit or not,” stated Dimon.

The most obvious partner in SME lending would be UK based Funding Circle, a direct lender that targets small business loans. Funding Circle entered the US market in 2013 when it merged in operations of Endurance Lending Network. Funding Circle announced an expansion into multiple European countries earlier this year as its model has grown. JPM could also partner with either Lending Club or Prosper, as both marketplace lenders have melded into small business loans building off their consumer business. Many marketplace lending platforms have already established symbiotic relationships with other banks to help fill the lending gap.

The most obvious partner in SME lending would be UK based Funding Circle, a direct lender that targets small business loans. Funding Circle entered the US market in 2013 when it merged in operations of Endurance Lending Network. Funding Circle announced an expansion into multiple European countries earlier this year as its model has grown. JPM could also partner with either Lending Club or Prosper, as both marketplace lenders have melded into small business loans building off their consumer business. Many marketplace lending platforms have already established symbiotic relationships with other banks to help fill the lending gap.

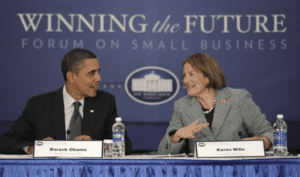

Providing access to capital to small business has been difficult for banks. As explained by former head of the SBA Karen Mills, it simply does not make economic sense for banks to make small SME loans due to excessive cost and challenging regulations. Small business is the engine for economic growth and job creation thus providing credit to SMEs is of strategic importance for the economy.

Providing access to capital to small business has been difficult for banks. As explained by former head of the SBA Karen Mills, it simply does not make economic sense for banks to make small SME loans due to excessive cost and challenging regulations. Small business is the engine for economic growth and job creation thus providing credit to SMEs is of strategic importance for the economy.

There is an ongoing discussion as to if, or how, traditional banks will survive the shift from bricks and mortar to internet finance. While direct lending has focused on the low hanging fruit of consumer lending and SMs, eventually all forms lending will be accessed online. Some industry followers believe it will be very difficult for banks to adapt. Others believe it is too early to count them out. As Dimon stated earlier this year, Silicon Valley is coming.

UPDATE: OnDeck Capital has announced via an 8-K filing they will commence a partnership with JPM in Q1 of 2016.