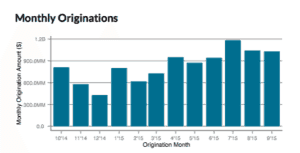

Orchard has published its’ monthly industry report covering the marketplace lending sector for consumer unsecured loans. According to data provided by the company, total origination volume has consistently increased quarter-over-quarter during the past year.

Orchard has published its’ monthly industry report covering the marketplace lending sector for consumer unsecured loans. According to data provided by the company, total origination volume has consistently increased quarter-over-quarter during the past year.

Some highlights included in the document;

- Borrower interest rates have been relatively consistent with a 96 basis point increase in September and a 61 basis point increase year over year.

- Following Fed action, rates are expected to increase in 2016

- Average loan size is increasing. In October of 2014 a typical borrower received $7,024. A year later in September 2o15 that number has jumped to $11,516 as smaller loans have declined and consumers borrow bigger amounts.

- Weighted average borrower interest rate by FICO score indicates a low rate (<680) in September saw borrowers receive a rate of 22.7%. On the other end of the spectrum, a borrower with a FICO score of 820 or better received a rate average of 8%.

Orchard receives profound data from online lenders so you know the numbers are solid. The complete report is available directly on the Orchard platform.