XTI Aircraft has received approval by the SEC to sell equity in its company under Regulation A+. The offer is now live on StartEngine for the next 30 days and is available to all investors – globally.

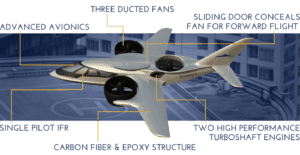

XTI Aircraft has designed a 6 seater, vertical take-off and landing aircraft that has the potential to provide “unprecedented” air transportation on a personal level beyond anything available today. The Harrier like plane, labeled the TriFan 600, has impressive stats: 400 mph max cruise speed; range of 800 to 1200 miles; max altitude of over 30,000  ft. All of this and no airport necessary. By combining the best of both helicopter and fixed winged aircraft, the TriFan 600 may deliver unparalleled convenience, comfort and range. Of course purchasing a TriFan plane will not be inexpensive. The preliminary retail prices is estimated to come in at $10 to $12 million per plane.

ft. All of this and no airport necessary. By combining the best of both helicopter and fixed winged aircraft, the TriFan 600 may deliver unparalleled convenience, comfort and range. Of course purchasing a TriFan plane will not be inexpensive. The preliminary retail prices is estimated to come in at $10 to $12 million per plane.

The company is said to be managed by a “powerhouse” team, including former executives from Sikorsky and Cessna. Launched in 2012, Denver based XTI was founded by David Brody. He has put together a team that includes Jeffrey Pino, formerly of Bell Helicopter and Sikorsky; Charles Johnson, former COO of Cessna; and Dennis Olcott, former Chief Enginer of Adam Aircraft. This group is determined to pull it all together to deliver the first TriFan 600. After raising new capital, XTI intends on building its first prototype with completion expected in 2.5 years.

The concept of the TriFan 600 is fantastic. Now it is down to the execution AND the capital necessary to finance the project. Investors who find the concept compelling may purchase shares in the company during the several weeks. Since announcing the “Testing the Waters” (TTW) campaign, over 2000 possible investors have expressed the interest of investing approximately $19 million in the company.

The concept of the TriFan 600 is fantastic. Now it is down to the execution AND the capital necessary to finance the project. Investors who find the concept compelling may purchase shares in the company during the several weeks. Since announcing the “Testing the Waters” (TTW) campaign, over 2000 possible investors have expressed the interest of investing approximately $19 million in the company.

“This is a limited-time opportunity to join all of us on the XTI leadership team as shareholders,” said Vice Chairman Jeff Pino. “We’re on track to make this aircraft a reality. We understand the risks, but we also know that the potential return is very strong. We couldn’t be more excited.”

The offering circular explains XTI seeks a minimum raise of $3 million. The maximum raise is set at $20 million. The net proceeds of any funds raised will be used in four key areas: (i) hiring key members of the management team; (ii) expanding sales and marketing to enable the company to take refundable customer deposits; (iii) pursuing additional funding; and (iv) continuing development of the aircraft. Once the aircraft is completed, XTI expects to be selling between 85 to 95 TriFan’s each year.

“The TriFan 600 has captured the imagination of large and small investors,” states Brody. “They’re impressed by the aircraft’s potential to revolutionize air travel and by the company’s leadership team.”

This is the second Reg A+ offer to qualify on the StartEngine platform. The first being Elio Motors which will close on February 1st. This is an early-stage company so investors must be aware of the intrinsic risk. If you are interested in reading more about XTI you may view the offer here.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!