This is important. In the United States, the wealth disparity is growing – not closing. While there are multiple reasons why this wealth gap has occurred, the growing dominance of big money over smaller investors has clearly exacerbated this societal challenge. Unfortunately, policy officials have inflamed the issue with misguided regulations that, while perhaps well intentioned, have made things worse.

This is important. In the United States, the wealth disparity is growing – not closing. While there are multiple reasons why this wealth gap has occurred, the growing dominance of big money over smaller investors has clearly exacerbated this societal challenge. Unfortunately, policy officials have inflamed the issue with misguided regulations that, while perhaps well intentioned, have made things worse.

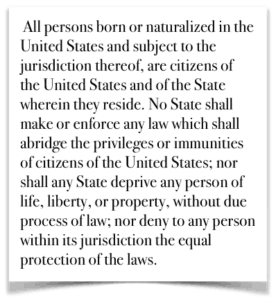

In a white paper authored by Dara Albright, James Jones, and Kim Wales, the trio explain the problem and deliver an important fix. The document, entitled, “The Renaissance of the Retail Investor and Its Monumental Impact on Marketplace Lending, Equities Crowdfunding, and the US Retirement system,” outlines what policy makers must accomplish. The paper explores the constitutionality of the definition of an “accredited investor”; a rule that has disenfranchised the vast majority of the population allowing the wealthy to access certain investment opportunities while the great unwashed masses sit on the sidelines and observe. Before 1982, an accredited investor could qualify as being “sophisticated”. This meant if a person was capable of evaluating the merits and risk of an investment – they could participate  if they so desired. Not so today.

if they so desired. Not so today.

According to the authors;

“In recent decades, the U.S. capital markets have become increasingly monopolized by institutional investors – all at the expense of America’s small businesses and small unaccredited retail investors, defined as individuals who earn less than $200,000 per year and have a net worth of less than $1 million minus the value of the primary residence; or a couple that earns less than $300,000 per year with a net worth of less than $1 million minus the value of the primary residence.”

Simultaneously, policy makers have crushed the small cap IPO market forcing small, promising companies to remain private as long as possible. This means only VCs, private equity and very rich may invest in companies with a bright future. By the time a company may consider an IPO all of the returns have been scooped up by big money. Once again, the little guy gets screwed.

The problem exists on the fixed income side as well. The white paper explains;

The problem exists on the fixed income side as well. The white paper explains;

“While retail accessible fixed-income asset classes, including “high-yield” bond funds, continue to underperform and experience massive cash outflows, private debt continues to lure institutional capital with stronger risk-adjusted returns. Unfortunately, the same restrictive laws that prohibit small retail investors from investing in private equity also preclude them from bolstering their fixed income portfolios with private debt investments.”

In recent years, “alternative assets” have become a crucial component for institutional investors. Big money understands they can drive superior risk-adjusted returns. Citing Morning Star, the document states that “alternatives assets will become a growing percentage of institutionally managed portfolios as high as 33% by 2017-2018, up from an estimated 27% for 2015.” Meanwhile, the vast majority of the population is legally prohibited from participating in this shift. Banned and blocked.

What Must Be Done

The white paper authors believe the choice is clear. To mitigate the growing inequality two things must occur:

The white paper authors believe the choice is clear. To mitigate the growing inequality two things must occur:

- Access to alternative investment opportunities must be democratized, and

- Retirement plans must be able to efficiently support micro alternative investing.

The authors strongly recommend elected officials declare the current definition of an accredited investor unconstitutional.

“It is time that the government stop authorizing its agencies to waste their time vetting investors when they should be focused on examining investments.”

The democratization of access to capital AND access to investment opportunity is occurring now. We just need enlightened public officials to clear the way.

The whitepaper is embedded below.

[scribd id=308868141 key=key-yLZcPdABvVO4rz041S6Z mode=scroll]