Last week on day one of Reg CF, the North American Securities Administrators Association (NASAA) posted a request for comments on a proposed rule. NASAA desires the requirement of an additional filing for Reg CF issuing companies to be completed in those states where either the issuer has its principal place of business or where 50% or greater of the aggregate amount of the offerings has been purchased by state residents.

Current NASAA President and Maine Securities Regulator Judith Shaw called the proposal another “opportunity to increase collaboration with our federal partners.”

“Ultimately, NASAA believes that the adoption of a model rule and uniform notice filing form by those states that wish to require notice filings will be a benefit to both issuers and regulators,”

What Shaw did not mention was the fact that each issuer must already file a mandated form with the SEC. This form, known as a Form C, is publicly available on the SEC website (as well as on Crowdfund Insider). The duplicative process, and the potential for an additional cost to issuers under Reg CF, caused concern from one prominent industry insider.

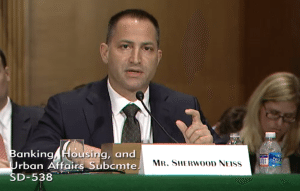

Sherwood “Woodie” Neiss, a Principal at Crowdfund Capital Advisors and one of the authors of the JOBS Act that legalized investment crowdfunding, told Crowdfund Insider;

Sherwood “Woodie” Neiss, a Principal at Crowdfund Capital Advisors and one of the authors of the JOBS Act that legalized investment crowdfunding, told Crowdfund Insider;

“When we were working with the Senate on Title III we stopped in Senator Brown’s office. The staffer told us that the state regulators were just in their office and that their fear was if crowdfunding was able to bring the transparency that we said, they would no longer be relevant. They also said that we would be taking away revenue that was theirs by pre-empting state registration. While we thought this was an absurd proposition — how can you get rid of a state regulator that needs to police the public entities in that state — clearly their action today shows that this fear is palpable.”

Neiss qualified the proposal by NASAA as obtuse and driven by a need for ongoing relevance.

Neiss qualified the proposal by NASAA as obtuse and driven by a need for ongoing relevance.

“This action by the state regulators screams of greed and fear. Greed that they need to charge the smallest of issuers (and those that can least afford it) a fee to perform a de minimus issuance in their state and fear of losing the smallest bit of power. It also lacks the foresight of these individuals to understand the world we live in today.”

Neiss pointed to the reality that we live in a world of technology. He is of the opinion that state regulators appear to be turning away from the fact they already have access to any information they need.

“State regulators refuse to understand how technology can not only facilitate capital formation in their own back yards but at the same time help them do their jobs in a way they’ve never been able to do so before. By controlling the flow of information to either funding portals or broker dealers, regulators can easily track and oversee the industry without having to burden it with bureaucracy or costs,” stated Neiss. “While the intent of the JOBS Act and Title III was to show how technology can facilitate capital formation, promote entrepreneurship, innovation and jobs, the state regulators have just thrown down the gauntlet and essentailly said they could care less about startups, small businesses or our economy in general but rather are only interested in their own pocketbook and power.”

The request by NASAA is open for comments until June 17th. This provides plenty of time for other interested parties to highlight the potential redundancy of the proposed rule.

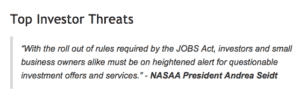

Historically, NASAA has not been supportive of any variant of investment crowdfunding. The organization that represents public officials has attacked state Blue Sky pre-emption under Title IV or Reg A+ of the JOBS Act. Several years back, NASAA listed investment crowdfunding as one of their “Top Investor Threats.”

Historically, NASAA has not been supportive of any variant of investment crowdfunding. The organization that represents public officials has attacked state Blue Sky pre-emption under Title IV or Reg A+ of the JOBS Act. Several years back, NASAA listed investment crowdfunding as one of their “Top Investor Threats.”

[scribd id=313938102 key=key-495gf2Y6TTXR09Dkxtue mode=scroll]