The SEC is constantly churning out releases and statements and, at times, advice for investors. Earlier this week they revisited an important topic: fees and expenses ladled on by funds and firms can harm your long-term investment returns.

The SEC is constantly churning out releases and statements and, at times, advice for investors. Earlier this week they revisited an important topic: fees and expenses ladled on by funds and firms can harm your long-term investment returns.

Most investors focus on top line numbers regarding returns not necessarily taking into consideration expenses (and taxes). Some less scrupulous funds and financial services do not really go out of their way to highlight returns net of fees. If they do not do this. Just walk away. As the SEC states, “these fees may seem small, but over time they can have a major impact on your investment portfolio.”

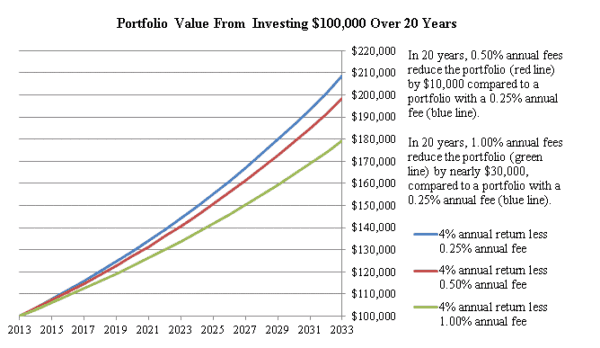

Below is a graph depicting a hypothetical portfolio starting at $100,000 and how it will grow over 20 years – fees included.

The SEC explains there are two types of fees: Transaction fees and Ongoing Fees. Both play a significant role in determining net gains. FINRA has a “Fund Analyzer” that may help you determine actual fees for Funds and ETFs. The SEC has periodically filed enforcement actions against duplicitous investment advisors that have fleeced the unsuspecting. Earlier this year the SEC filed charges against a Fort Myers based investment adviser Kingdom Legacy General Partner, LLC and its founder and controlling principal, Mark C. Northrop for charging fees as high as 50% (on trading profits). Hard to believe. So whether you are investing in traditional or alternative asset classes understand the cost to invest. It will pay off in the long run. More information is available here.