LendingRobot has officially launched their next big vertical: a Robo-Hedge Fund for alternative lending.

Crowdfund Insider initially wrote about the forthcoming Robo-fund when we uncovered an SEC filing for a pooled investment vehicle last November. While the filing became public at that moment, the “LendingRobot Series” Robo-Fund has been in the works for quite some time.

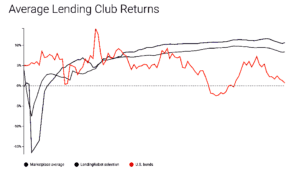

LendingRobot was created as an efficient and effective method to provide institutional grade tools for smaller investors to invest in P2P/Marketplace lending assets. During the past few years, LendingRobot has upgraded and improved their services for individuals using their platform responding to requests and growing the platform. What has remained is the superior investment returns delivered when one compares (on average) what an individual can accomplish on their own by investing directly in Lending Club, Prosper, and Funding Circle loans.

LendingRobot was created as an efficient and effective method to provide institutional grade tools for smaller investors to invest in P2P/Marketplace lending assets. During the past few years, LendingRobot has upgraded and improved their services for individuals using their platform responding to requests and growing the platform. What has remained is the superior investment returns delivered when one compares (on average) what an individual can accomplish on their own by investing directly in Lending Club, Prosper, and Funding Circle loans.

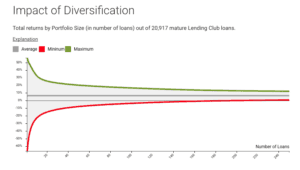

The reality of investing in online lending is that it is becoming increasingly difficult for individuals to invest directly. Selecting loans can be highly competitive with loans getting scooped up quite quickly. In 2016, LendingRobot had more and more people interested in diversifying across many loans and multiple platforms to mitigate risk. To do that manually is very difficult. Handling taxes on these investments …. well, enough said.

The LendingRobot Series is described as a “one-stop” solution for cloud-based, automated investing secured by Blockchain (DLT) technology. The Robo-fund uses machine learning and proprietary algorithms to hopefully provide market-beating returns. Unlike many other hedge funds, liquidity will be facilitated and transparency is paramount. In “normal” circumstances, investors can expect to fully redeem shares in about three weeks – when the need arises. Investors will be able to quickly and easily diversify their investments across a broad portfolio of consumer, SME, and real estate loans.

LendingRobot describes how the Robo-fund will work. The company will manage investments across four different Series, with target maturity going from 20 to 36 months, and estimated net returns up to 9.66%. Investor’s money is converted in Units of ownership in these Series, that are issued on a weekly basis. By default, loans payments keep being re-invested and the Units value increases. LendingRobot publishes every week a detailed ledger of its holdings, down to the value and individual payments made by each note.

Crowdfund Insider spoke to LendingRobot founder and CEO Emmanuel Marot who shared with us that this new fund has been a work in process for quite some time.

Crowdfund Insider spoke to LendingRobot founder and CEO Emmanuel Marot who shared with us that this new fund has been a work in process for quite some time.

“We have wanted to do this for a long time. We immediately imagined it,” said Marot. “The regulatory complexity made it a challenge … but now is the right time.”

Launching a Robo-Hedge fund is obviously an easier way to scale. Today, LendingRobot manages over $120 million for more thatn 6500 investors. Once the fund is set up, it is a single entity to manage.

“We like to automate everything through software. Managing a fund is easier than managing an individual’s account.”

Asked if the returns in the Robo-Hedge fund will match the returns experienced by LendingRobot investors today. Marot says overall yes, but he expects they may be better. This is even after taking slightly higher fees.

LendingRobot started with just two lending platforms: Lending Club and Prosper. They later added Funding Circle – available to accredited investors only. Today they are adding LendingHome to their portfolio of their assets. LendingHome is one of the fastest growing online lenders having quickly zoomed ahead of many other online lenders. LendingHome topped $1 billion in

LendingHome is one of the fastest growing online lenders having quickly zoomed ahead of many other online lenders. LendingHome topped $1 billion in mortgage-based loans last month claiming the title of the fastest growing marketplace lender. Marot “loves their APIs” and called them a brilliant team.

But will other platforms be forthcoming?

Speaking to Marot, additional lenders are definitely on the list. He does not want to chase the fanciest platforms but they are looking at other classes of loans. Marot will only work with online lenders that are well-established with plenty of data and history to ingest. He loves the SoFi platform, an online lender that has grown from student loans to mortgages and consumer credit. There will be more.

What about retail clients? Will they be left behind with this accredited only offer?

Marot says supporting retail clients is very important to him and his team. He mentions a letter from an investor that thanked him for what LendingRobot provides: with only $3000 invested via LendingRobot the individual recognized that “nobody else in the finance industry could serve me like you guys.”

The biggest challenge to serving smaller investors is regulatory. Rules ostensibly created to protect smaller investors also come with a cost that can be hard to justify. Marot believes the effort to create a “sophisticated investor” qualification could go a long way in helping smaller investors. The accredited investor definition makes little sense as it is not based on ability but the fact that an investor can take a hit. Marot says that some of their accredited investors are in their early twenties but they are clearly not sophisticated.

Asked how much money has been lined up for the Robo-Hedge fund and Marot reveals an interesting enigma;

“We have 100s of people on the waiting list. We reached out to our existing investor first and we expected about 40 to sign up…”

The initial investor commitment has been set at a $100,000 minimum but that will evolve over time.

Marot remains optimistic about the future of online lending. A close observer of this sector of finance, he predicts it will continue to evolve, grow and thrive. There are risks to online lending, beyond myopic policy makers. Solid platforms will survive and smaller ones will consolidate. He is not a big fan of Goldman Sachs’ Marcus platform but he sees banking becoming more and more involved.

Marot remains optimistic about the future of online lending. A close observer of this sector of finance, he predicts it will continue to evolve, grow and thrive. There are risks to online lending, beyond myopic policy makers. Solid platforms will survive and smaller ones will consolidate. He is not a big fan of Goldman Sachs’ Marcus platform but he sees banking becoming more and more involved.

Will LendingRobot expand beyond the borders of the US? Absolutely.

First, LendingRobot will accept international investors. But do not be surprised if LendingRobot shows up in another country at some point in the future.

For now, Marot and his team are working on re-defining intermediaries and the services they deliver. LendingRobot is providing greater transparency and better returns for investors as they stake their claim as part of the future of internet finance.