LendingRobot has Relaunched its Investment Marketplace with More than P2P Loans

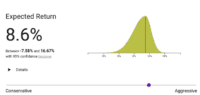

LendingRobot started its existence as a portal for peer-to-peer loan investors seeking to provide sophisticated tools for investors interested in the asset class. For a time, it was controlled by Fintech Nexus (LendIt or Lend Academy), which parted ways with the firm when Lime Financial… Read More

Read more in: Investment Platforms and Marketplaces, Featured Headlines | Tagged lendingrobot