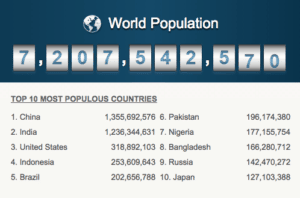

In the 19th century, there were 11 cities with over 1 million inhabitants. Today there are over 500 cities around the world where the population stands above 1 million. There are over 7 billion souls on this planet and this number is predicted to grow to 11 billion by 2050 creating many predictable challenges and as one would expect, many unforeseen problems as increasing demands are placed on urban areas, infrastructure and our intrinsic sense of community.

As it stands now, 54 percent of this growing population lives in cities but urban density has skyrocketed in recent years. Unfortunately development and infrastructure have been lagging behind as the quality of life for citizens has rapidly deteriorated in some metropolitan centers. Traffic seems to worsen everywhere, insecurity is always a problem and the impact on the environment is potentially devastating.

As many concerned individuals understand, governments lack the necessary resources or proper motivation. The private sector is not always aligned with projects that are most vital in cities. Returns may be too low and the risk exceptionally high.

As many concerned individuals understand, governments lack the necessary resources or proper motivation. The private sector is not always aligned with projects that are most vital in cities. Returns may be too low and the risk exceptionally high.

Exacerbating the situation, inequality has topped levels that undermines growth itself even as global wealth has jumped substantially during the past 100 years. It is not only the challenges of urban density that are rampant; it is also that cities are getting filled with an under-class creating a social dynamic where frustration can turn very quickly into civil unrest.

Many urban planners advocate for “vertical density” and the development of skyscrapers with appropriate conditions of “livability” and “walkability”. Aside from homes in tall buildings convenient for work, people also require public transportation, parks, athletic facilities, schools, entertainment and many other things that too many communities lack today.

I will cite as an example a city I know well. Bogota, Colombia, where I was born, counts over 10 million in population. Approximately 1.7 of these people are transient; working downtown but living outside the city without viable options for a convenient and desirable home.

I will cite as an example a city I know well. Bogota, Colombia, where I was born, counts over 10 million in population. Approximately 1.7 of these people are transient; working downtown but living outside the city without viable options for a convenient and desirable home.

The daily commute in any direction is on average an astounding 70 minutes each way. Transportation in the city is just shy of chaotic. Urban anxiety and insecurity is increasing as the city continues to expand horizontally aggravating the situation. People need to work but the quality of life deteriorates as daily stress and urban challenges grow.

Unfortunately another challenging situation is the lamentable corruption of the local government. While not unique to Colombia, this complicates matters even more. The recent Mayor of Bogota, Samuel Moreno, is currently spending his days behind bars after being found guilty of accepting bribes from contractors for public works contracts.

For most private developers it is safer to build 10 buildings six stories high instead of a single skyscraper 60 stories in height. And why would you blame them? Many existing skyscrapers around the world have exchanged hands more than a few times. From original owners to banks to funds; interest rates don’t always align to the construction industry.

Traditional equity financing is insufficient for many of the projects cities need today. Without a viable financing mechanisms I believe we are headed for an urban disaster.

Paradoxically, it may be precisely in my home town Bogota where a global solution for this enigma has been born.

BD Bacata, the first skyscraper in a generation in the nation of Colombia, wasn’t financed by banks. It was financed by some of these 1.7 million affected individuals I mentioned before.

BD Bacata, the first skyscraper in a generation in the nation of Colombia, wasn’t financed by banks. It was financed by some of these 1.7 million affected individuals I mentioned before.

Over 5,000 of these very same Bogota commuters have invested more than $220 million, starting at $10,000.00, to finance the first skyscraper in a generation. BD Bacata is to date, the world record in crowdfunding.

Local skeptics however, question if it is indeed a good investment for the investing crowd. I know they are dead wrong. The pent up demand of 1.7 million inhabitants could occupy not just this building, but perhaps 100 more.

Real estate crowdfunding in an urban market at scale unlocks enormous potential by empowering people to invest democratically in the solution to one of their biggest needs while simultaneously earning a profit. The profound potential for crowdfunding to generate a powerful catalyst for urban growth and utility is enormous. If this combination is not the ultimate shareholder value paradigm then I don’t know what is.

We are in the very early transitional stages of this new form of finance. The efficiencies delivered by digital technology has disrupted so many industries in recent years. The finance industry may be the penultimate case.

I believe that crowdfunding, and its transformational properties, will impact all forms of finance over the next decade. Real estate crowdfunding, combined with the dearly needed social impact, will finance the future of cities and be the tip of this transformational spear.

_________________

Rodrigo Nino is the CEO and founder of Prodigy Network, a commercial real estate crowdfunding platform. Nino has raised more than $300 million from 6,200 investors and is currently developing commercial real estate projects in Bogota and Manhattan with a projected value of more than $850 million. Major money center banks like Deutsche Bank, CIBC and Bank of America provided traditional financing for Prodigy’s Manhattan projects. As a proponent of the Crowd-Economy as the main tool against inequality, Nino has spoken at worldwide conferences and was a noteworthy guest at New York University, MIT, Yale University, Harvard University and the AEDES gallery in Berlin, Germany. Nino is often featured in leading publications, including The Wall Street Journal, Businessweek, Forbes, The Economist, The New York Times and Fast Company among others. A Colombian native and a Manhattan resident, Nino belives Prodigy Network’s crowdfunding model as an efficient and secure mechanism that enables smaller investors from around the world to invest in specific projects that were solely accessible to the very wealthy before.

Rodrigo Nino is the CEO and founder of Prodigy Network, a commercial real estate crowdfunding platform. Nino has raised more than $300 million from 6,200 investors and is currently developing commercial real estate projects in Bogota and Manhattan with a projected value of more than $850 million. Major money center banks like Deutsche Bank, CIBC and Bank of America provided traditional financing for Prodigy’s Manhattan projects. As a proponent of the Crowd-Economy as the main tool against inequality, Nino has spoken at worldwide conferences and was a noteworthy guest at New York University, MIT, Yale University, Harvard University and the AEDES gallery in Berlin, Germany. Nino is often featured in leading publications, including The Wall Street Journal, Businessweek, Forbes, The Economist, The New York Times and Fast Company among others. A Colombian native and a Manhattan resident, Nino belives Prodigy Network’s crowdfunding model as an efficient and secure mechanism that enables smaller investors from around the world to invest in specific projects that were solely accessible to the very wealthy before.