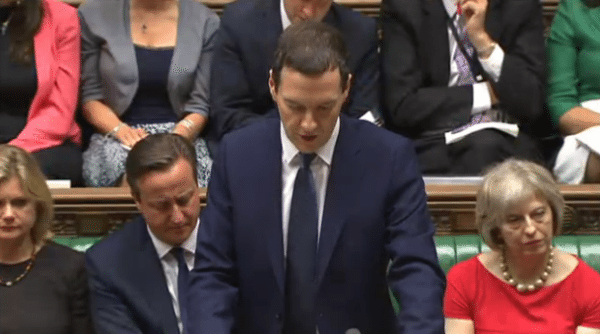

The Chancellor of the Exchequer’s summer budget was said to put economic security first and was a plan for “working people”. But incorporated in the policy statement was also aspects that should benefit disruptive financial firms on both the debt and equity side of the equation. Included in the released publications was the statement;

“Extending ISA eligibility – The government will introduce the Innovative Finance ISA, for loans arranged via a P2P platform, from 6 April 2016 and has today published a public consultation on whether to extend the list of ISA eligible investments to include debt securities and equity offered via a crowd funding platform.”

Reflecting on the Chancellor’s policy of including P2P assets in ISA’s, James Meeking, co-founder of Funding Circle stated;

“The inclusion of peer-to-peer lending within ISAs is a pivotal moment for our industry. Not only will it give investors a better deal, but it will help even more small businesses access the finance they need to grow, which in turn helps the economy. Everyone wins.

“According to our data, 41% of investors said they would invest more in marketplaces like Funding Circle if it was included within ISAs. One in ten people said they would transfer their existing stocks and shares into a Lending ISA. Additionally, TISA (Tax Incentivised Savings Association) estimates that more than £50 billion is invested in ISAs every year. If just 3% of this money was channelled through marketplaces such as Funding Circle it would create more than £1.5 billion of new lending to businesses annually, leading to approximately 75,000 new jobs.”

GLI Finance CEO, Geoff Miller shared his opinion on the UK government’s announcements;

GLI Finance CEO, Geoff Miller shared his opinion on the UK government’s announcements;

“We are very pleased with this Summer Budget, which has addressed two of the five key issues we highlighted in our Alternative Finance Manifesto, which we published ahead of the general election. Competition in SME lending is what we have built our business on – SMEs are the backbone of the UK economy, providing almost half of private sector employment, and they deserve fair access to funding to fuel the economic growth from which we will all benefit. We have been campaigning for the introduction of a mandatory referral scheme since 2013, and we expect this to come into effect in early 2016 – meaning that High Street banks will be mandated to refer SMEs to alternative finance providers when they reject their requests for bank finance.”

Nick Harding, CEO of Lending Works, welcomed the ISA statement too;

Nick Harding, CEO of Lending Works, welcomed the ISA statement too;

“We are pleased that peer-to-peer lending will be included in the new Innovative Finance ISA from 6 April 2016. However, it’s a shame that the Treasury and the FCA have decided against the creation of a Lending ISA.

“Separating peer-to-peer lending into its own ISA wrapper would have enabled the industry to ensure that both the rewards and the risks of peer-to-peer lending are clearly defined and communicated to our customers. This is what 95% of peer-to-peer lenders were calling for, alongside us and our industry peers*.

“Despite this, the inclusion of peer-to-peer in ISAs should be celebrated. It will enable lending platforms like Lending Works to continually grow, maintain high lending capital volumes, and so be able to offer market-beating interest rates to lenders.

Until banks and building societies are able to provide similarly high-interest, low-fuss investment options, we welcome all government support that incentivises individuals to make peer-to-peer lending a part of a diversified (tax-free) investment portfolio.”

Vocal SME advocate Louise Beaumont, Head of Public Affairs, GLI Finance added;

Vocal SME advocate Louise Beaumont, Head of Public Affairs, GLI Finance added;

“The Government’s decision to officially introduce the Innovative Finance ISA, for loans arranged via peer-to-peer platforms, proves that alternative finance is now far more than a niche offering for tech-savvy investors – it’s becoming a mainstream option for savers looking for returns in a low-interest rate environment…we look forward to contributing to the consultation on whether to include equity-based crowdfunding in ISAs.”

Rhydian Lewis, CEO at RateSetter, added;

Rhydian Lewis, CEO at RateSetter, added;

“The Chancellor seems determined to unblock finance, allow innovation to flourish and crucially give savers and investors more control over their money. I see the Innovation Finance ISA as part of that new spirit. It will be an immediate boost for hundreds of thousands of everyday investors and has the potential to move the dial on the availability of small business and personal finance in this country.”

“The new ISA will offer investors a much needed middle ground between low yield cash and high risk investments – by including their RateSetter investment in an ISA, a higher-rate taxpayer could save around £350 in tax and a basic rate taxpayer around £175.”

“Today’s announcement provides a welcome boost for investor choice and will help reinvigorate the ISA market.”

The peer to peer lending platform trailblazer Zopa agreed with industry sentiment. Giles Andrews, Zopa CEO and co-founder said;

The peer to peer lending platform trailblazer Zopa agreed with industry sentiment. Giles Andrews, Zopa CEO and co-founder said;

“Today’s announcement confirming a third ISA category, the Innovative Finance ISA dedicated to peer-to-peer lending, is a game changer for millions of Brits who have suffered from poor returns since the financial crash. It signals that P2P lending has become a mainstream way for people to invest for their futures.

“We are pleased to see that the Chancellor is open to services like Zopa, allowing consumers to side-step the banks for higher returns. With cash ISA rates from banks at rock bottom, this new IFISA will, I believe, provide reliable, predictable and low risk tax free returns that will beat most other asset classes. We expect huge demand for this new type of ISA and see P2P lending through Zopa becoming one of UK’s most popular ways to grow your money.”

The P2PFA in the UK welcomed the Chancellors statement confirming inclusion of P2P assets in ISAs, but cautioned about adding equity to the Innovate Finance ISA. Christine Farnish, Chair of the P2PFA said;

The P2PFA in the UK welcomed the Chancellors statement confirming inclusion of P2P assets in ISAs, but cautioned about adding equity to the Innovate Finance ISA. Christine Farnish, Chair of the P2PFA said;

“We are absolutely delighted by today’s decision. The creation of the Innovative Finance ISA will encourage more people to benefit from the fair deal that P2P lenders offer without getting confused between stocks and shares, P2P lending or cash savings. P2P lending differs significantly from both equity investments and from bank deposits. We urge caution not to rush including riskier forms of crowdfunding as part of this new ISA.

“It is a good day for investors and our sector.”

Karen Kerrigan, Legal and Financial Director at Seedrs and UKCFA Board Member, saw the potential growth for the equity crowdfunding sector and approved of joining P2P and equity into a single ISA wrapper;

Karen Kerrigan, Legal and Financial Director at Seedrs and UKCFA Board Member, saw the potential growth for the equity crowdfunding sector and approved of joining P2P and equity into a single ISA wrapper;

“It is encouraging that the UK Government is supporting individual choice to invest in non-traditional financial products, by introducing the Innovate Finance ISA. We look forward to participating in the consultation of whether equity crowdfunding will be eligible for inclusion in this ISA alongside its peer-to-peer cousins.”