Causes and Lessons to be learned from more Developed Markets

In this three-part series, we examine whether “conservative” Canadian business culture is having a negative effect on equity crowdfunding taking hold in Canada. In Part I of this series we took a snapshot of equity crowdfunding so far in Canada, the funds actually raised to date, and talked to some of Canada’s leading platforms and experts to find out if they believed culture has had an impact.

In Part II of this series, we drill down on some of the perceived and actual causes for the underdevelopment of the market in Canada and the lessons to be learned from other more developed markets.

Part I in the series investigated the market metrics and traction so far in Canada: Read it here. Part III will take a specific look at the Real Estate sector.

In Techcrunch recently, Tim Ryan the country manager in Canada of the platform Tilt said: “The dollar value of Tilt campaigns are higher in the US,” than in Canada. He went on to say that in his opinion “Canadians culturally are quite a bit more utilitarian, more conservative, more practical in some ways [than Americans]” which he points to as being the main reason why initial interactions with Tilt by Canadian users have been less robust than Tilt’s experience with American users of the platform. He believes as Canadians get used to Tilt, the amounts raised in campaigns will increase and more people will become involved.

In Techcrunch recently, Tim Ryan the country manager in Canada of the platform Tilt said: “The dollar value of Tilt campaigns are higher in the US,” than in Canada. He went on to say that in his opinion “Canadians culturally are quite a bit more utilitarian, more conservative, more practical in some ways [than Americans]” which he points to as being the main reason why initial interactions with Tilt by Canadian users have been less robust than Tilt’s experience with American users of the platform. He believes as Canadians get used to Tilt, the amounts raised in campaigns will increase and more people will become involved.

We concluded in Part I that culture was not the primary cause of the underdeveloped Canadian market. Let’s dig deeper on some key questions to shed further light.

Are legal structures in Canada holding back equity crowdfunding?

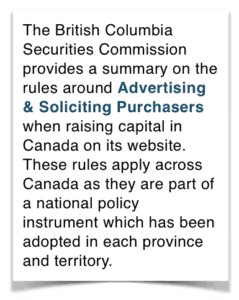

Canadian securities laws, unlike the securities laws in the United States (US), have allowed issuers to advertise they are raising capital and are looking for investors since 2003. In 2005, National Policy 45-106 – Prospectus and Registration Exemptions harmonized the majority of the capital raising rules across Canada, including the ability to advertise when using certain exemptions. Online equity crowdfunding platforms did not emerge in Canada until 2007, when the predecessor to Optimize Capital Markets was formed.

Canadian securities laws, unlike the securities laws in the United States (US), have allowed issuers to advertise they are raising capital and are looking for investors since 2003. In 2005, National Policy 45-106 – Prospectus and Registration Exemptions harmonized the majority of the capital raising rules across Canada, including the ability to advertise when using certain exemptions. Online equity crowdfunding platforms did not emerge in Canada until 2007, when the predecessor to Optimize Capital Markets was formed.

Conkin launched platform Fundfindr in 2008 to facilitate venture funding but wound it up after a couple years determining it was too early for online investments from the crowd in Canada. Over the last several years ECN Capital (www.ecncap.com) had also sought to provide online investment for private companies prior to a recent pivot.

It took until 2014 with the launch of SeedUps for another equity platform to launch, despite issuers and Canadian registered dealers being able to advertise and solicit investors under the accredited investor exemption, the minimum investment exemption and the offering memorandum exemption in Canada.

In the spring of 2014, six Canadian provinces adopted the start-up crowdfunding exemption. It was based on a similar exemption adopted a year early by Saskatchewan. No equity crowdfunding platforms were ever launched under the Saskatchewan crowdfunding exemption. Three start-up crowdfunding exemption platforms are now operational in Canada and a number of others are expected to emerge by year-end. As of last week, the first crowdfunding campaign under the start-up crowdfunding exemption reached its minimum closing requirement. Guusto Gifts is on track to be the first company in Canada to complete an offering under the start-up crowdfunding exemption.

In the spring of 2014, six Canadian provinces adopted the start-up crowdfunding exemption. It was based on a similar exemption adopted a year early by Saskatchewan. No equity crowdfunding platforms were ever launched under the Saskatchewan crowdfunding exemption. Three start-up crowdfunding exemption platforms are now operational in Canada and a number of others are expected to emerge by year-end. As of last week, the first crowdfunding campaign under the start-up crowdfunding exemption reached its minimum closing requirement. Guusto Gifts is on track to be the first company in Canada to complete an offering under the start-up crowdfunding exemption.

It was only in the fall of 2013, that the federal securities laws in the US were amended under Title II of the Jobs Act to allow advertising when selling to accredited investors (often referred to as Title II equity crowdfunding or Rule 506(c) equity crowdfunding). Dozens of accredited investor equity platforms opened their doors in the US soon after the after this securities rule change. According to statistics gathered by Crowdnetic approximately 5,878 companies have raised over US $765 million in capital using advertising when soliciting accredited investors since the rule was adopted.

It was only in the fall of 2013, that the federal securities laws in the US were amended under Title II of the Jobs Act to allow advertising when selling to accredited investors (often referred to as Title II equity crowdfunding or Rule 506(c) equity crowdfunding). Dozens of accredited investor equity platforms opened their doors in the US soon after the after this securities rule change. According to statistics gathered by Crowdnetic approximately 5,878 companies have raised over US $765 million in capital using advertising when soliciting accredited investors since the rule was adopted.

Individual accredited investor platforms in the US have also reported on the successful capital raising results of entrepreneurs on their platforms. Entrepreneurs have raised over:

- US $115 million on EquityNet in the last 12 months;

- US $204 million on Fundable since 2012;

- US $125 million on CircleUp since 2012;

- US$222 million on Crowdfunder since 2013.

Dozens of niche crowdfunding platforms like WeFunder, a platform aimed at startup companies, which has helped 89 startups raise over US $13 million, are also scattered throughout the US. The exact amount of equity raised on these platforms is not known as Rule 506(c) is available online and offline.

The US has not yet adopted a federal level crowdfunding specific securities exemption. Over 20 states have adopted an intrastate equity crowdfunding exemption. The adoption of intrastate crowdfunding exemptions is a relatively recent phenomenon. Last year about this time only 5 states had adopted an intrastate crowdfunding exemption. The impact these exemptions may have on individual state economies is yet to be determined. Certain states like Texas have really embraced intrastate equity crowdfunding. The Texas rule became effective in late November of 2014. There are now eight registered intrastate crowdfunding portals in Texas.

The US has not yet adopted a federal level crowdfunding specific securities exemption. Over 20 states have adopted an intrastate equity crowdfunding exemption. The adoption of intrastate crowdfunding exemptions is a relatively recent phenomenon. Last year about this time only 5 states had adopted an intrastate crowdfunding exemption. The impact these exemptions may have on individual state economies is yet to be determined. Certain states like Texas have really embraced intrastate equity crowdfunding. The Texas rule became effective in late November of 2014. There are now eight registered intrastate crowdfunding portals in Texas.

The contrast between the take-off rates of equity crowdfunding in Canada versus the US is striking. Canada’s regulatory system and securities laws, however, are not a real factor in why such a large difference exists between the two countries response to equity crowdfunding.

Is anything holding back Canadian investors from participating in equity crowdfunding?

Canada historically and the western provinces in particular, have been known for raising venture capital far in excess to what its population base would suggest. BC-based companies have accounted for about 60% of worldwide financing activity in mineral exploration. Canadian investors account for about 15% of the worldwide financing activity in oil & gas exploration. Both of these sectors are considered high-risk investment sectors. Start-up companies in other industries such as technology and biotechnology have had less traction in attracting venture capital investment in similar demographic proportions.

Sandi Gilbert, Founder & CEO for SeedsUps Canada, commented that Canadian investor reluctance may have less to do with anything holding back Canadian investors per se but more to do with the relative newness of the concept in Canada. It was her view that the biggest hurdle at this time was getting companies investor ready and through their due diligence process. She believes that more deals will bring a broader investor interest.

Sandi Gilbert, Founder & CEO for SeedsUps Canada, commented that Canadian investor reluctance may have less to do with anything holding back Canadian investors per se but more to do with the relative newness of the concept in Canada. It was her view that the biggest hurdle at this time was getting companies investor ready and through their due diligence process. She believes that more deals will bring a broader investor interest.

“The Canadian public” she said “isn’t even aware that they can invest in deals online. So getting the word out is important.”

“Entrepreneurship is not celebrated in Canada the way it is in other countries especially the US where there is an ecosystem that supports (it),” stated Marcus News, Founder & Chief Entrepreneur from InvestX. He points to a number of other actors impacting Canadian investors’ willingness to participate in equity crowdfunding. These factors include historical reliance on national banking institutions for investment guidance, a public company venture capital markets in Canada being down 75% from its peak in 2011 causing risk capital investment fatigue and a need for education, success stories and media attention on equity crowdfunding.

Craig Asano, Founder & Executive Director of the National Crowdfunding Association of Canada (NCFA Canada), believes factors such as investment alternatives, investor and issuer risk profiles and the regulatory environment all play a role in determining the level of Canadian investor participation in equity crowdfunding.

Craig Asano, Founder & Executive Director of the National Crowdfunding Association of Canada (NCFA Canada), believes factors such as investment alternatives, investor and issuer risk profiles and the regulatory environment all play a role in determining the level of Canadian investor participation in equity crowdfunding.

Is there anything about the structure of the Canadian private equity finance market impacting equity crowdfunding? Although not directly addressed by any of the platform operators in our discussions, it became clear to us in these discussions, that the structure of Canadian private equity finance markets has had a significant impact on the development of equity crowdfunding. Only registered dealers or those who have an exemption from registration can operate a funding platform in Canada.

Over the last fifteen years, the securities regulators in Canada have increased the burden on registered dealers and their brokers. These burdens include more stringent oversight in what investments a firm allows its clients to invest in or trade. The result has been the closure of dozens of boutique dealers across Canada, and a move to a management portfolio model that emphasizes funds and senior equity investments, and discourages investment in early stage and risk investments at any level. Regulatory suitability obligations have resulted in a no-risk investment tolerance.

Exempt market dealers, have also experienced similar regulatory pressure, and tend to sell three exempt market products only: real estate investment securities; investment fund units, and mortgage investment corporation securities. These three categories represent over 95% of the private placement securities these dealers sell. All of these securities have a quarterly or bi-yearly coupon or dividend and, if things go well, are expected to pay-out within five to seven years.

Exempt market dealers and registered dealers also have no interest in sharing their investor list online and risk losing their commission or future investment pool. Their relationships to these investors are how they make money.

Arguably these same conditions exist elsewhere and have not impeded the development of a more robust equity crowdfunding environment to date. The question is what is different in those jurisdictions and what lessons can we learn and apply from those jurisdictions here in Canada.

Global Lessons to Apply

Equity crowdfunding is not a North America only phenomenon. In 2014, the European alternative finance market (equity crowdfunding and peer to peer lending), excluding the United Kingdom (UK), provided €201m worth of early-stage, growth and working capital financing to European start-ups and SMEs. This is approximately 7% of the €2,957 million total transaction volume of the online European alternative finance market in 2014. The amount raised in individual countries in the European alternative finance market in 2014 was as follows: €2,337m was raised in the alternative finance market in the UK, €154m in France, €140m in Germany, €107m in Sweden, €78m in the Netherlands and €62m in Spain.

Equity crowdfunding is not a North America only phenomenon. In 2014, the European alternative finance market (equity crowdfunding and peer to peer lending), excluding the United Kingdom (UK), provided €201m worth of early-stage, growth and working capital financing to European start-ups and SMEs. This is approximately 7% of the €2,957 million total transaction volume of the online European alternative finance market in 2014. The amount raised in individual countries in the European alternative finance market in 2014 was as follows: €2,337m was raised in the alternative finance market in the UK, €154m in France, €140m in Germany, €107m in Sweden, €78m in the Netherlands and €62m in Spain.

In Australia, the platform ASSOB has raised over $143M for Australian ventures since 2005.

Forty-six companies on Israel based Our Crowd have raised over $60M in just 16 months. Since 2010 FundedByMe, a crowdfunding platform out of Sweden, has helped 500 companies from 25 countries raise over $ 17,700,000 (€12,011,853) and built a network of more than 53,000 investors from 70 countries.

In the Netherlands, equity crowdfunding from unaccredited investors has been legal since 2010. Peter-Paul Van Hoeken, Founder & CEO of Frontfundr, tells a story about the maturation of crowdfunding in The Netherlands. He was taking a taxi ride and the subject came up on what he did. When equity crowdfunding was mentioned, the taxi driver disclosed he had invested in more than one company via a crowdfunding platform. The taxi driver is a good icon for crowdfunding gone mainstream in an economy.

What is true when you examine the development of equity crowdfunding in all of these jurisdictions outside of North America is that it took two years before equity crowdfunding started to have an impact. In the UK equity crowdfunding legislation was adopted in 2011. This legislation was modified in 2014. In 2014, 30% of equity funding in the UK came from equity crowdfunding. In 2015, that number is projected to be around 50%. Similar patterns can be seen in each jurisdiction in Europe. Year over year growth in the alternative finance market as a whole is up over 100% in each jurisdiction and in some instances up over 200% in growth over the prior year.

What is true when you examine the development of equity crowdfunding in all of these jurisdictions outside of North America is that it took two years before equity crowdfunding started to have an impact. In the UK equity crowdfunding legislation was adopted in 2011. This legislation was modified in 2014. In 2014, 30% of equity funding in the UK came from equity crowdfunding. In 2015, that number is projected to be around 50%. Similar patterns can be seen in each jurisdiction in Europe. Year over year growth in the alternative finance market as a whole is up over 100% in each jurisdiction and in some instances up over 200% in growth over the prior year.

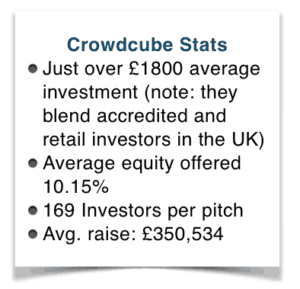

The growth of equity crowdfunding in the Europe can be further illustrated by looking at the development of CrowdCube in the UK. Entrepreneurs on Crowdcube have successfully raised over £100,000,000 for 290 businesses since Crowdcube launched in 2011. Darren Westlake, Founder & CEO of Crowdcube, speaking at Wired Money 2015, noted that the first equity crowdfunding campaign on its platform raised £75,000 and took five months to raise that amount of money. In February 2015, a company named Just Park raised £3.7 million in five weeks On Crowdcube. Westlake noted that the deals, investors, and time frame have all matured since 2013. Companies and raises are larger, the time frame to close significantly shorter, and the types of investors participating on the platform far more diversified.

Why is the equity crowdfunding market in Canada raising less capital than the UK/Australia/US/Europe?

Sandi Gilbert, Founder & CEO from SeedsUps Canada, pointed out that the UK has had the benefit of two tax incentive programs that effectively de-risk investment into venture deals. These tax incentives provide investors with up to 30% credit on their equity investment in the form of EIS (Enterprise Investment Scheme) or SEIS (Seed Enterprise Investment Scheme). EIS Relief can be claimed on investments up to £1,000,000 in one tax year giving a maximum tax reduction in any one year of £300,000, provided the investor has sufficient Income Tax liability to cover it. For SEIS it’s even more generous with relief of 50% on investments up to £100,000 per tax year in qualifying shares. Investors may also be eligible for Capital Gains Tax (CGT) relief when they sell, give away, exchange or otherwise dispose of their securities.

Sandi Gilbert, Founder & CEO from SeedsUps Canada, pointed out that the UK has had the benefit of two tax incentive programs that effectively de-risk investment into venture deals. These tax incentives provide investors with up to 30% credit on their equity investment in the form of EIS (Enterprise Investment Scheme) or SEIS (Seed Enterprise Investment Scheme). EIS Relief can be claimed on investments up to £1,000,000 in one tax year giving a maximum tax reduction in any one year of £300,000, provided the investor has sufficient Income Tax liability to cover it. For SEIS it’s even more generous with relief of 50% on investments up to £100,000 per tax year in qualifying shares. Investors may also be eligible for Capital Gains Tax (CGT) relief when they sell, give away, exchange or otherwise dispose of their securities.

Canada has similar tax credit programs to those that exist in the UK. Companies raising capital and their investors, however, may not be familiar with these programs. Two such programs are the Small Business Venture Capital Act in British Columbia (BC) and the New Brunswick Small Business Investor Tax Credit Act.

The Small Business Venture Capital Act (SBVCA) in BC provides tax credits to BC residents investing in BC Eligible Business Corporations. The SBVCA provides investors with a tax credit of up to 30% of the value of their investment, up to an annual maximum tax credit of $60,000.

The New Brunswick Small Business Investor Tax Credit Act (SBITC) provides a 50% (for investments made after April 1, 2015) non-refundable personal income tax credit of up to $125,000 per year (for investments of up to $250,000 per individual investor) to eligible individual investors who invest in eligible small businesses in the province. For a corporation and trust eligible investor, the SBTIC provides a 15% non-refundable corporate income tax credit of up to $75,000 per year (for investments of up to $500,000).

Closing Comments

Despite the fact equity crowdfunding has been available under the securities laws in Canada since 2003, equity crowdfunding is a relatively new concept in Canada. It will take some time for equity crowdfunding to develop in Canada based on the experience elsewhere. Daryl Hatton, Founder & CEO of FundRazr echoed the need for education, stating: “Investors are unaware of the option to invest in this class. Investors who are aware of equity crowdfunding are wary of it given low levels of knowledge about this market and our general conservative nature.“

Despite the fact equity crowdfunding has been available under the securities laws in Canada since 2003, equity crowdfunding is a relatively new concept in Canada. It will take some time for equity crowdfunding to develop in Canada based on the experience elsewhere. Daryl Hatton, Founder & CEO of FundRazr echoed the need for education, stating: “Investors are unaware of the option to invest in this class. Investors who are aware of equity crowdfunding are wary of it given low levels of knowledge about this market and our general conservative nature.“

Adoption of accredited investor equity crowdfunding in the US appears to be have been rapid and significant on first glance. Over $765 million in capital has been committed through Rule 506(c) accredited investor offerings. This number, however, represents less than 1% of the total amount raised under the traditional Rule 506(b) accredited investor exemption that does not allow advertising.

What do you think? Is equity crowdfunding in Canada poised to explode? We welcome comments from prospective investors or other on this subject.

In Part III we focus in on the Real Estate sector and take a snapshot of the equity crowdfunding story so far in Canada. In Part I of the Series we looked at whether culture was the cause of the underdevelopment of equity crowdfunding in Canada.

Alixe Cormick, is President/Founder, Venture Law Corporation in Vancouver, BC. Alixe concentrates her legal practice in the areas of initial public offerings, follow-on offerings, reverse takeovers, capital pool corporations, qualifying transactions, mergers & acquisitions, secondary listings and exempt market financings.Alixe has assisted over 150 companies listing on stock exchanges and trading boards in North America. Alixe has registered four broker dealers in Canada and has acted as outside legal counsel to three Canadian mutual funds. Alixe is also an active angel investor. Alixe has been a speaker at several conferences in Canada discussing the legal aspects of crowdfunding.

Alixe Cormick, is President/Founder, Venture Law Corporation in Vancouver, BC. Alixe concentrates her legal practice in the areas of initial public offerings, follow-on offerings, reverse takeovers, capital pool corporations, qualifying transactions, mergers & acquisitions, secondary listings and exempt market financings.Alixe has assisted over 150 companies listing on stock exchanges and trading boards in North America. Alixe has registered four broker dealers in Canada and has acted as outside legal counsel to three Canadian mutual funds. Alixe is also an active angel investor. Alixe has been a speaker at several conferences in Canada discussing the legal aspects of crowdfunding.

Bret Conkin is the Founder of CrowdfundSuite, a CrowdInvesting and Crowdfunding Consultancy. CrowdfundSuite provides platform development and other expert services to help organizations profit from the new Crowd Economy. Bret is an Ambassador to the National Crowdfunding Association of Canada and a former executive with FundRazr. He has founded and collaborated on multiple tech start-ups including Canada’s first Crowdfunding platform Fundfindr launched in 2008.

Bret Conkin is the Founder of CrowdfundSuite, a CrowdInvesting and Crowdfunding Consultancy. CrowdfundSuite provides platform development and other expert services to help organizations profit from the new Crowd Economy. Bret is an Ambassador to the National Crowdfunding Association of Canada and a former executive with FundRazr. He has founded and collaborated on multiple tech start-ups including Canada’s first Crowdfunding platform Fundfindr launched in 2008.

Are you in Western Canada and interested to find out more? VanFUNDING 2015 Crowdfunding Conference to be held Sept. 29, 2015 in Vancouver.