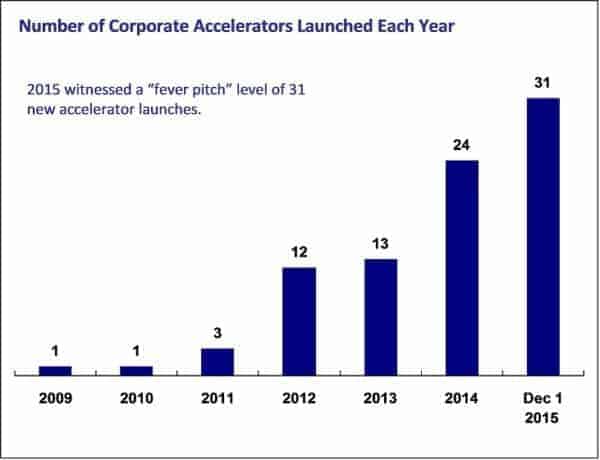

A recent report published by Future Asia Ventures highlights the growing commitment from established corporations in funding startup accelerator programs to foster a culture of innovation. According to the report, in 2015 31 new corporate accelerators were launched bringing the worldwide total to 85. Interestingly Europe leads the charge with 40 and the Americas list only 27. Asia-Pacific boasts 18 but of this number 10 were launched in 2015. Of course Fintech is a hot sector right now as all forms of finance are moving online.

Falguni Desai, Managing Director of Future Asia Ventures, states;

“Digital disruption from startups has sparked the corporate accelerator trend. Competitive pressure and the threat of innovative business models is pushing large corporations to engage with startups like never before. In 2015, an unprecedented 31 corporate accelerator programs were launched, bringing the total to 85. I expect to see this trend continue for the next few years.”

The research calls the number of new accelerator programs at a “fever pitch” level.

The authors believe that Kuala Lumpur in Malaysia is “poised to become a key hub city for startups as government support and private funding continue to increase”. Other Asian cities mentioned are Hong Kong, Singapore and Bangalore.

The authors believe that Kuala Lumpur in Malaysia is “poised to become a key hub city for startups as government support and private funding continue to increase”. Other Asian cities mentioned are Hong Kong, Singapore and Bangalore.

The report states that Malaysia currently has 85 plus venture capital firms and over 750 startups. That is a solid number for a fairly small country. Malaysia was also the first country in the region to craft a regulatory regime to facilitate equity crowdfunding. Peer to peer lending rules will follow in 2016. Asia in general is said to have the potential to make a meaningful impact in Fintech by improving financial access and financial inclusion for certain populations. Unbanked and under-served populations are creating demand for efficient and tech-enabled lending and payment tools.

If you are interested in reading the report it is available for download here. You just have to hand over your name and email first.