“This year couldn’t be more different,” Toby Austin, CEO & Co-Founder of Beauhurst

The above quote pretty much sums things up. According to the numbers tallied by Beauhurst, 2017 was a gangbuster year for investment into UK high growth firms. Austin adds that;

“It’s good to see that the UK’s image as a powerhouse of Fintech innovation is increasingly justified by the data, with remarkable levels of investment into firms as diverse as challenger banks and cryptocurrency platforms.”

Hard to top that.

This report comes at a critical time as Brexit fears linger and the UK government is negotiating the European divorce terms. The UK has embraced the concept of creating an innovation driven economy. Programs such as the EIS and SEIS act as market driven subsidies for early stage firms. Fintech has emerged as a sector of excellence due to the UK’s leading spot as a financial center. So will the good times continue? Time will tell.

[clickToTweet tweet=”‘It’s good to see that the UK’s image as a powerhouse of #Fintech innovation is increasingly justified by the data, with remarkable levels of investment into firms as diverse as challenger banks and #cryptocurrency platforms.'” quote=”‘It’s good to see that the UK’s image as a powerhouse of #Fintech innovation is increasingly justified by the data, with remarkable levels of investment into firms as diverse as challenger banks and #cryptocurrency platforms.'”]

As for 2017, Beauhurst says deal numbers have returned to their 2015 peak with investment into venture stage firms increasing nicely. Megadeals are up as foreign investors are willing and able to pump money into promising growth stage firms. In 2017, the UK experienced more £50 million plus deals than ever before. Fintech, according to Beauhurst, experienced its best year ever surpassing £1 billion in funding thus echoing the sentiment shared by the Innovate Finance report.

Some interesting bullets points:

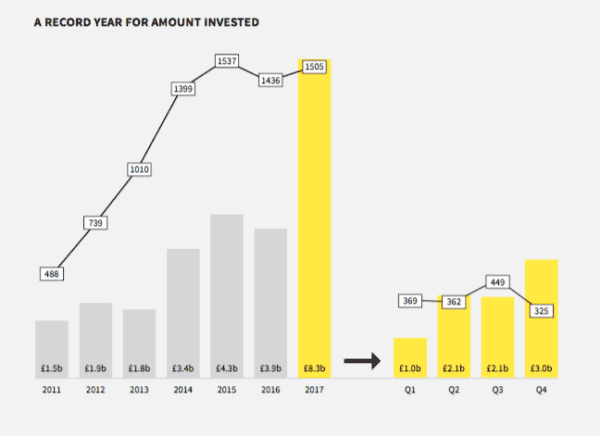

- 2017 saw the most cash ever invested more than double 2016 at £8.27 billion

- 25% of the mega-deals (£50M +) go to the darling Fintech sector

- 23 or the 29 megadeals captured foreign investment

- Challenger banks came into their own for the rst time last year, securing 19 raises and over £500m in funding.

- Average investment size hit £6.8 million

- Seed, Venture and Growth stage investments are moved higher with Growth stage capturing the bulk of the investment

And how do the investment crowdfunding platforms fit in this story? These online investment platforms have become super relevant to the UK economy and rank second in the number deals just after PE/VC money. Other nations are hopefully paying attention.